FMC subscribers in Europe tend to be more satisfied with their broadband service than non-FMC subscribers

A significant number of operators across Europe offer consumers fixed–mobile convergence (FMC) plans. Operators need to be able to understand how their performance compares with that of their peers in terms of churn and the satisfaction metrics associated with FMC customers. Operators also need better insights about the likely demographic characteristics of FMC customers, which will help them to tailor their marketing. This article presents a summary of the findings from Analysys Mason’s recently published Connected Consumer Survey 2020: fixed–mobile bundling in Europe.

Our Connected Consumer Survey dataset allows us to investigate a range of different metrics

The results from our 2020 Connected Consumer Survey have enabled us to analyse FMC consumer trends and behaviours in each of the eight European countries included in our survey.1 Insights have been gained in the following areas.

- The take-up of FMC offers in each country

- The percentage of consumers taking fixed and mobile from the same operator

- The average age and spend of FMC consumers

- FMC penetration among families

- Pay-TV bundling rates of FMC consumers

- Customer service channel usage among FMC customers

- The take-up of value-added services among FMC consumers

- Average fixed broadband and mobile satisfaction among FMC customers

- Churn and Net Promoter Score (NPS) metrics among FMC subscribers.

Our survey shows that self-reported FMC penetration is increasing in almost every European country that we surveyed

We categorised a respondent as an FMC customer if they selected ‘mobile’ as one of the answers to the question ‘Are any of the following services included as part of a bundle or package from your home broadband provider?’

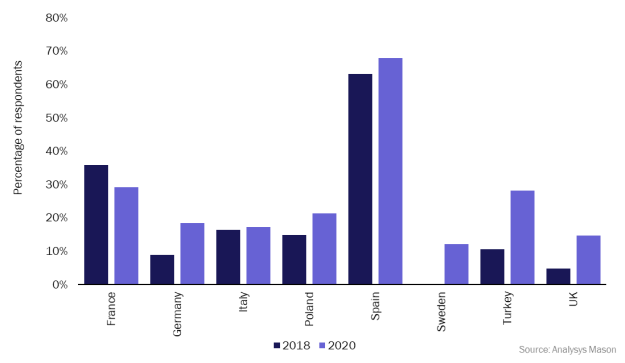

As shown in Figure 1, the level of self-reported FMC has increased in almost every European country surveyed between 2018 and 2020 (note that Sweden was not surveyed in 2018). FMC remains niche in countries such as Poland, Germany, Sweden, and the UK because FMC discounts have not been aggressive enough to spark mass-market take-up and market structures confine the ability of many operators in these countries to offer FMC.

Turkey has seen the most significant increase in FMC take-up, which has been driven by the launch of FMC offers by Vodafone, as well as the substantial discounting that Turkcell has offered on its broadband services for mobile customers. Broadband penetration and speeds continue to increase in Turkey and there is evidence that FMC discounts may be play a central role in influencing consumers’ broadband choices.

FMC penetration is highest in France and Spain, but market dynamics have differed over the past couple of years. In Spain, despite high penetration, the FMC share of fixed broadband customers continues to increase. This is driven by competition at the lower end of the market, from operators such as Euskatel and MÁSMÓVIL. Operators have continued to update their FMC portfolios and now include unlimited mobile data and more-flexible contract lengths. France is the only market in which FMC penetration is falling. This is because FMC offers consist of simple discounts with very little content/service differentiation. FMC offers from sub-brands such as Sosh have been discontinued.

Figure 1: Self-reported FMC share of total broadband subscribers, by country, 2018 and 2020

FMC customers return high broadband satisfaction scores but the impact of FMC on churn intention is unclear

FMC subscribers are, on average older, more likely to live with children, and have a higher average spend in most of the European countries that we surveyed. However, in countries where penetration is lower (such as Germany, Sweden and the UK), the average age of FMC customers is lower, which suggests that first adopters are more likely to be from a younger demographic, and also indicates that younger consumers are receptive to these offers.

There is a strong alignment between fixed and mobile service channel usage, which indicates that FMC offers are encouraging fixed customers (who more commonly rely on traditional means of contact) to migrate to channels more commonly used for mobile customer service. This suggests that operators are having some success in homogenising the fixed/mobile customer experience. It also indicates that FMC offers may provide customers with convenience and that there are potential cost savings achievable for converged operators.

Our results show that FMC SIMs are predominantly used as secondary SIMs in some countries (over 50% of FMC customers bundling mobile with broadband in the UK, Tukey and Sweden take their primary mobile SIM from a different operator to their broadband). This suggests that operators may wish to offer cheap SIMs as add-ons to broadband plans to capitalise on this demand. Customers are also more likely to bundle pay TV if they bundle mobile services with broadband, although the percentage of FMC customers bundling pay TV has fallen since our 2018 survey (falling by almost 50% in some countries), which shows that the cord-cutting phenomenon is prevalent among FMC customers, and that operators can be successful in offering FMC plans without the need for traditional pay-TV content. FMC customers also have higher self-reported take-up of fixed value-added services than non-FMC customers. Smart-home services have particularly strong traction among FMC customers, with self-reported smart-home service take-up of over 20% in several countries (including the UK, Turkey and Germany). Smart-home bundling in FMC plans is currently limited in most countries, but this suggests there may be a bundling opportunity.

Finally, we analysed the churn intention and satisfaction metrics of FMC customers across the surveyed countries. Broadband satisfaction was, on average, higher for FMC customers than non-FMC customers for metrics such as customer service, pricing and speeds. Overall mobile satisfaction is, conversely, generally more negative among FMC customers, which suggests a weakness that is not being addressed in operators’ FMC plans. This is particularly marked in countries where standalone mobile network operators (MNOs) still have a strong presence. However, in general, customer service satisfaction is higher for mobile FMC customers. When analysing broadband NPS trends at operator level, customers that take fixed and mobile from the same operator had higher NPSs in every statistically significant example. This suggests that customers perceive some benefit from converging fixed and mobile services.

However, there was no obvious evidence from our survey that FMC customers in Europe have a lower intention to churn (in broadband or mobile services). Indeed, the intention to churn for both services was only lower for subscribers in countries such as Spain and Italy. This suggests that the often-stated churn reduction effect of FMC is largely derived from the logistical complexities in switching operator when customers take multiple services from the same provider.

1 The countries included in the survey are France, Germany, Italy, Poland, Spain, Sweden, Turkey and the UK.

Article (PDF)

DownloadRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Forecast report

USA: fixed–mobile convergence forecast 2025–2030