Automated assurance: worldwide market shares 2019

11 August 2020 | Research

Market share report | PPTX and PDF (44 slides); Excel | Automated Assurance

This report provides market share data for communications service provider (CSP) spending on telecoms-specific automated assurance (AA) software systems and related services for 2019. It provides details of how the spending varied by delivery model, service type, vendor and region. The report also includes profiles of the leading vendors in the market.

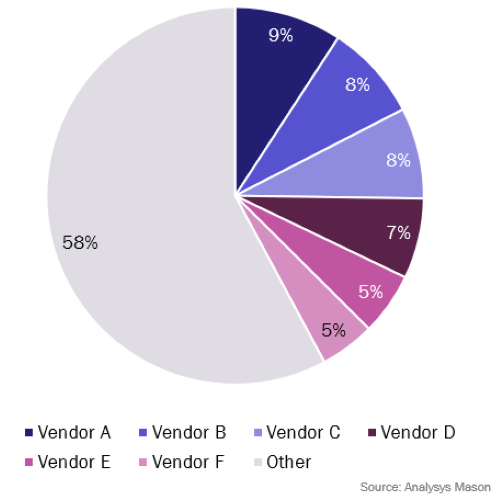

Automated assurance total revenue by vendor, worldwide, 2019

Key questions answered in the automated assurance market share report

- What was the overall size of the market (automated assurance software systems for the telecoms industry) and what drove this spending among CSPs?

- How did the spending vary across different sub-segments of automated assurance market?

- Who are the major vendors and what is their share of revenue in automated assurance systems market?

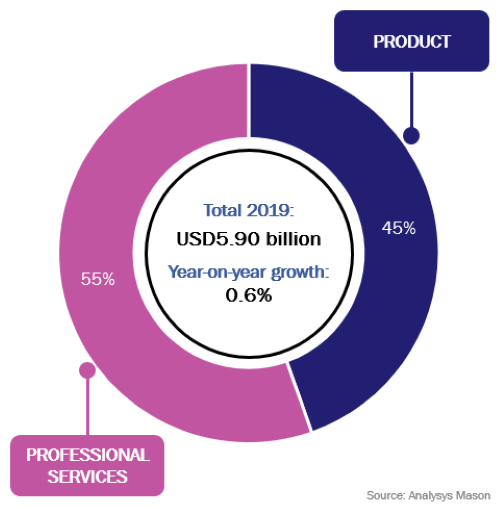

- What are the different drivers and growth rates of CSP spending on products and professional services?

Automated assurance total revenue by type, worldwide, 2019

Who should read this report

- Vendor strategy teams that need to understand where growth is slowing and where it is increasing across different sub-segment categories.

- Product management teams responsible for feature functionality and geographical focus, and product marketing teams responsible for market share growth.

- Market intelligence teams at vendors that want to understand how their competitors compare with each other.

- CSPs that are planning digital transformation journeys and want to ensure that their current vendors are staying up to date.

This report provides:

- detailed market share data for the automated assurance software systems market overall, as well as four sub-segments:

- probe systems

- service management

- intelligent performance and fault management

- workforce automation

- an Excel data spreadsheet of revenue and share for the top-six vendors in this segment, split by type and by region

- detailed profiles of 24 vendors in this market, and summaries of selected new players.

Company coverage

|

|

|

|

|

Related items

Article

Telecoms leaders attending DTW2024-Ignite called for simplification in telecoms operations

Article

Customer experience models can help streamline the decision-making process in telecoms operations

Strategy report

Optimising network assurance using customer experience insights