The towerco market in Saudi Arabia is emerging and may disrupt the regional status quo

MNOs in Saudi Arabia have been contemplating the creation of a towerco for years

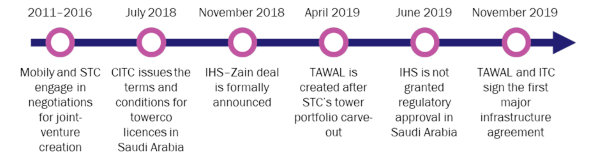

The three MNOs in Saudi Arabia (STC, Mobily and Zain) have been considering the sale or carve-out of their tower assets for the past few years. STC was the first to take the initiative at the end of 2019 (Figure 1), following a lengthy series of developments and changes in the strategies of all three MNOs. It carved out the majority of its tower portfolio (more than 14 000 towers) and established TAWAL, the first mobile passive infrastructure player in the country and one of the largest national towercos in the world.

Integrated Telecommunications Company (ITC) was the first operator in Saudi Arabia to sign up for co-location space, and did so on more than 150 existing sites in November 2019 (Figure 1). This will help ITC to expand its portfolio more quickly than would otherwise have been possible, thus giving concrete proof of the benefits that towercos can bring to mobile markets in the Middle East.

Figure 1: Major milestones in the creation of the first towerco in Saudi Arabia

Source: Analysys Mason, 2020

The demand for data and connectivity will trigger a new cycle of large investments from operators

Mobile data traffic is expected to grow steadily in the next few years, especially with the adoption of 5G. MNOs in Saudi Arabia have already launched 5G services, and offer generous data packages and unlimited plans. In parallel, the national regulatory authority (CITC) and the Ministry of Communications and Information Technology are joining efforts to make the country 5G-ready, and have imposed a roadmap of targets for 5G speed and coverage, with the first milestone set for the end of 2020.

The total traffic on Saudi Arabian mobile networks is expected to grow by 21% by 2024. Operators will have to increase their number of sites (including small cells and DAS), particularly in congested areas, in order to cater for the growing demand for data and service availability. An additional 2000 points of presence will still be needed, despite the increase in spectrum efficiency due to the deployment of new technologies such as 5G, massive MIMO and beam-forming techniques.

Operators must invest in both active equipment and passive infrastructure

Operators will need to upgrade their existing networks in order to offer 5G services. To comply with the conditions of the recently awarded 3.5GHz spectrum licences, operators will have to cover 35% of the population of the 5 largest cities in the country by September 2020, and 50% of the population of the 18 largest cities by 2025.

No new sites will be needed for operators to meet these obligations, but rather existing sites will have to be quickly upgraded. These upgrades will require a significant amount of capex for new active equipment such as radios and massive MIMO antennae, but they will also call for significant investments in the existing passive infrastructure in order to accommodate this equipment, which will require additional space and power. Many of the existing towers will have to be strengthened, modified or substituted, and the vast majority will require power system upgrades.

Operators may partner with towercos to quickly expand and upgrade their networks

As discussed earlier, operators will need to invest in both upgrading their existing sites and expanding their networks by adding new sites when upgrading their networks to 5G. Both aspects will put additional pressure on operators’ cash flows. However, there is an opportunity for towercos to ease this financial burden and ensure a faster implementation of operators’ expansion plans.

Can towercos help with the upgrade of operators’ existing sites? The benefits to operators in this case are not as straightforward as those in the case of newly built sites, and a more attentive cost–benefit analysis would be needed. However, operators might find it beneficial in the specific cases when an existing site cannot support upgrades and needs to be relocated, or when most of the site equipment needs to be substituted.

There are also opportunities for towercos to support network operators in building new coverage in a series of ambitious mega projects including Neom (a 26 500km2 mega city), King Abdullah Financial District (a massive complex composed of nearly 60 towers in the city of Riyadh), King Abdullah Economic District (a newly built city on the west coast near Jeddah) and the Red Sea touristic project. These will all give towercos an opportunity to provide greenfield, state-of-the-art infrastructure.

Establishing operations in Saudi Arabia would give any towerco the critical mass to operate subsidiaries in other smaller countries in the region, without incurring excessive overhead costs.

About Analysys Mason’s tower experience

Analysys Mason is a leading commercial and technical advisor with an exclusive focus on telecoms, media and technology (TMT). It has supported over 350 transaction support assignments worldwide during the last 5 years, more than 100 of which were tower-related assignments, such as supporting STC with the carve-out of its tower portfolio and the subsequent creation of TAWAL, the first towerco in Saudi Arabia. Analysys Mason has a 360-degree view of the towerco industry and an in-depth knowledge of the commercial, technological, operational and regulatory aspects of the business. This unique positioning makes Analysys Mason the ideal partner for towercos.

Downloads

Article (PDF)Authors