Operator business revenue is declining in Europe, forcing operators to balance cost-cutting and investment

21 February 2020 | Research

Article | PDF (3 pages) | SME Services| Enterprise Services

Listen to or download the associated podcast

Our recently updated Western European business forecasts estimate that operator revenue from basic voice and data connectivity services will fall by 5% between 2019 and 2024.1 Operators face some challenging decisions and will need to balance cutting costs from traditional services while also investing in growth services such as ICT. Even where these trade-offs are managed well, operators' revenue may decline in real terms, and an increased focus on ICT is likely to result in lower margins.

This article outlines the scale of the challenge facing operators and highlights some of the strategies being adopted in response to market conditions.

ICT revenue is expected to increase its share of total operator business revenue to 20% by 2024

Revenue from ICT services (including security, data centres, and cloud services) accounted for around 15% of operator business services revenue in Western Europe in 2019. This share is expected to increase to 20% by 2024 as businesses transfer spend from traditional voice and connectivity services to new, often cloud-based, solutions.

Between 2019 and 2024, business revenue from fixed connectivity services is expected to decline by nearly 10%, driven primarily by declining voice revenue. Although demand for high-performance data connectivity is growing, competition and regulation will lead to falling prices in most countries. Providers of high-value dedicated connections are also facing pressure from FTTP services and from the ability of SD-WAN to deliver improved performance over existing links.

Within mobile markets, increased use of data and IoT connectivity services is expected to offset an ongoing decline in business use of legacy voice and messaging services, and we expect operators to maintain current levels of business mobile revenue in nominal terms in the period to 2024.

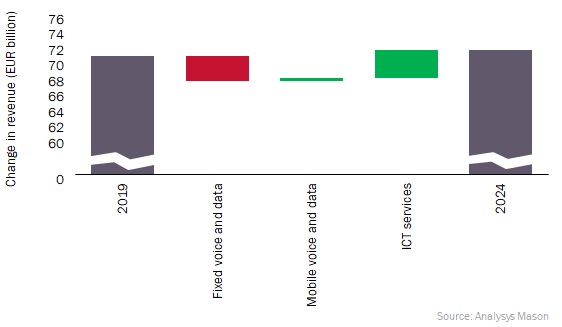

Overall, this results in a 6% decline in fixed and mobile voice and data markets. This is a decline that we believe can be offset by growth in ICT services, but it would only be enough to maintain revenue at roughly current levels, meaning a decline in real terms.

Figure 1: Change in operator business revenue in Western Europe, 2019–2024

Operators face the challenge of investing in new ICT capabilities while reducing costs in legacy businesses

Many operators are investing heavily in new ICT capabilities. Of the 24 acquisitions by European operators recorded in our Business-services-related M&A tracker in 2019, at least 20 related directly to delivering ICT services. Operators are also investing in new partnerships with ICT providers and in internal product development and recruitment of specialist staff.

However, operators are investing in ICT services at a time when they are cutting costs, with competitive pressure and the emergence of lower-cost technologies driving operators to streamline operations and reduce staffing. Declining revenue from legacy services must be matched by lower costs: a 6% fall in revenue in nominal terms cannot be countered with small tweaks to operational processes, something much more radical is required.

Incumbent operators are struggling the most. Their high market share in connectivity means that they are suffering most from revenue declines and have least opportunity to buck overall market trends by increasing market share. Many are seeking to re-deploy resources and re-train staff, but this is far from straightforward, especially as the average age of employees is typically much higher in incumbent operators than in their competitors.

The challenge facing operators is further compounded by the way that developments in the consumer market are shaping business expectations for services to be available on-demand, and for a customer experience that is hassle-free and with rapid response times. Pay-as-you-go pricing models also limit operators' ability to recoup investment in the short-term.

Operators must pay close attention to market trends and how those trends will influence their own particular strategy

Operators are responding to these challenging market conditions with a variety of strategies.

- Some, such as Orange and Telefónica, are pursuing investment in ICT services to protect business revenue and lay the building blocks for future growth. Their multi-national scale helps to make this strategy feasible, although it is not without great difficulty. New product developments and acquisitions need to be integrated with the broader business and with sales channels to deliver the full benefit from existing customer relationships and adjacencies with connectivity markets.

- Some operators are retaining a narrower focus on connectivity, with challenger operators looking to grow market share and others preferring to focus on cost-cutting and margin retention rather than investing in (often lower-margin) ICT services.

- Others are building partnerships to deliver ICT service capability with minimal investment themselves; the IBM–Vodafone partnership is a good example of this. Partnerships often enable operator investment patterns to mirror those of on-demand pricing models (opex-based and scaling with demand).

- Others are reselling basic ICT services, either as a means of increasing revenue or to increase customer engagement and reduce churn.

The difficulties with all of these approaches are illustrated by the way that some operators appear to have pivoted first one way and then the other. For example, KPN made several ICT-related acquisitions in 2017, but sold off three units in 2019 as part of its efforts to focus on a converged and simplified portfolio in the business market.

With limited resources, even large-scale operators must marshal their resources wisely. For those operators looking to ICT services to drive growth, there is still time for action: while businesses are rapidly adopting new services, many firms take a cautious approach and often prefer to adopt new services only when they are available from a trusted supplier such as their connectivity provider. Operators need to pay close attention to market trends, and the activities of not just their traditional competitors but also those of cloud providers, IT and security specialists, and managed service providers. This will enable them to identify and take best advantage of the growth opportunities that do present themselves.

1 See Analysys Mason's DataHub and individual country reports.

Downloads

Article (PDF)Authors