Salesforce’s acquisition of Vlocity may shake up the market for CSP customer engagement systems

Salesforce announced on 25 February 2020 that it is acquiring Vlocity for USD1.33 billion (the deal is expected to close in the second quarter of fiscal year 2021). Vlocity, which was founded in 2014, is a privately held company based in San Francisco with about 1000 employees. Vlocity offers industry-specific digital customer engagement solutions on top of the Salesforce platform in verticals such as communications, media and entertainment, energy and utilities, insurance, health and government. Vlocity has raised a total of USD163 million in capital, which includes their latest round of fundraising from March 2019. During this round, Vlocity was valued at around USD1 billion. Salesforce is the largest investor in Vlocity. Other investors include Accenture and multiple venture capital firms.

Vlocity's subscription-based software uses a SaaS delivery model, which is CSPs' preferred approach to delivery

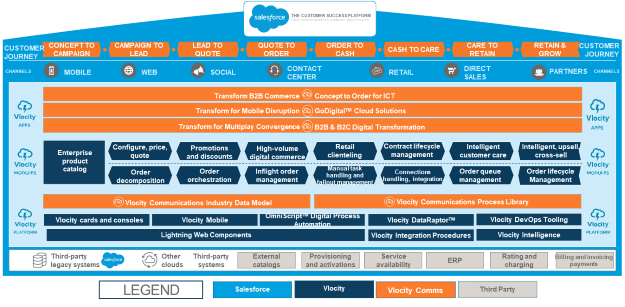

Salesforce is a software vendor that offers cloud-based customer relationship management (CRM) solutions to multiple industry verticals, including communications, finance, insurance, healthcare and the public sector. It was one of first companies to offer subscription-based software in the software-as-a-service (SaaS) delivery model, which is increasingly becoming the go-to delivery model for communications service providers (CSPs) as well. The company has a wide ecosystem of partners that have developed their solutions to work with the Salesforce platform. Vlocity is one such partner, which developed its solutions and platform to work natively and exclusively on the Salesforce platform. Vlocity's business model is to provide industry-specific digital engagement solutions for Salesforce customers. Vlocity derives around 60% of its revenue from the telecommunications vertical (see Figure 1).

Figure 1: Industry solutions map for Salesforce and Vlocity

Source: Vlocity, 2020

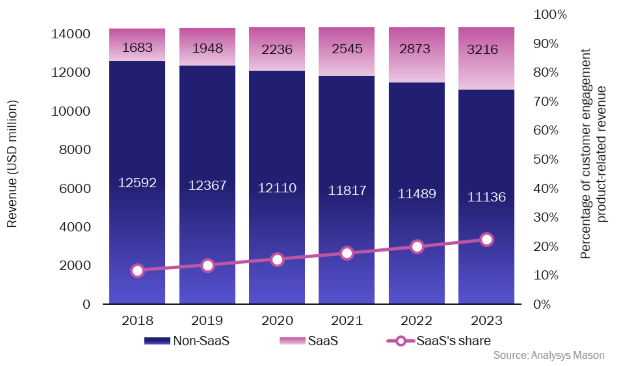

The SaaS component of CSP spending will almost double from USD1.7 billion in 2018 to USD3.2 billion in 2023

Salesforce's CRM solutions have grown in popularity within the telecommunications sector over the past decade because customer experience has increasingly become a strategic priority for CSPs. Salesforce's popularity among CSPs has been aided by its strong track record in other industry verticals, as well as its cloud-based deployment approach, which is considered to be faster and cheaper than traditional deployment models. Today, Salesforce is the dominant CRM vendor in telecommunications and is the leading vendor by revenue (according to Analysys Mason's report Customer engagement: worldwide forecast 2019–2023), accounting for the majority of CSP spend on SaaS-based solutions in this segment.

Vlocity's value proposition is to build industry-specific customer experiences on the Salesforce platform. The company built its business in the telecommunications sector first by providing the last-mile translation of the horizontal Salesforce system to telecoms-specific applications and services. Over time, Vlocity has applied this strategy to other verticals. This has proven to be a very popular approach, primarily enabled by the growing ubiquity of Salesforce, which Vlocity claims propelled it from USD0 to USD100 million in annual revenue in under 5 years.1

The acquisition price suggests an enterprise multiple approximately in the range of 7–8, which is high considering the high exposure to the telecoms business, where revenue multiples for telecoms-focused BSS companies are typically between 1 and 2. However, Vlocity's revenue has been increasing by approximately 100% year-on-year.1 This success is mirrored in the SaaS component of CSP spending worldwide, which is expected to accelerate in popularity, almost doubling from USD1.7 billion in 2018 to USD3.2 billion in 2023 (see Figure 2).

Figure 2: SaaS in customer engagement revenue by delivery type, worldwide, 2018–2023

The acquisition will have a wide and varied impact on the telecoms industry

The acquisition will affect various entities within the telecoms industry in different ways.

- Salesforce. Salesforce's strategy so far has been to offer horizontal, SaaS-based CRM solutions to multiple industries. This approach has encouraged its large number of ecosystem partners to provide industry-specific enhancements, which are pre-integrated with Salesforce platform. Salesforce's acquisition of Vlocity is a sign of Saleforce's growing ambition to verticalise its business, enabling the company to provide highly specialised, industry-specific support for several key verticals. This will account for at least 20% in additional revenue and may be as high as 100% in some cases, depending on the industry and function types. This acquisition could mark the beginning of Salesforce's attempt to extend its footprint within telecoms and it may even trigger further acquisitions if the company wants to improve its coverage for key industry-specific functions.

- Ecosystem partners. The acquisition weakens the position of some partners of the Salesforce ecosystem such as Cloud Sense, which used to compete with Vlocity. Nokia, another Salesforce partners, is unlikely to be affected by the acquisition in the short to medium term because this partnership, for now, focuses primarily on CSP customers that are common to both Nokia and Salesforce. For other Salesforce ecosystem vendors that are not yet directly impacted, the acquisition raises important questions regarding the future of their engagements with Salesforce.

- CSPs. This acquisition is a net positive for CSPs. Almost all CSPs that have invested in a Salesforce platform have had to buy an industry-specific solution from Vlocity or other vendors. They will now only need to engage directly with Salesforce, which will make it easier to procure, deploy and manage solutions. CSPs that have already deployed an industry-specific solution from another vendor may be incentivised to choose Vlocity in the long term.

- Other competitors. Other vendors within the telecoms customer engagement space (for example, Amdocs and Oracle) may consider the acquisition of Vlocity to be a negative development. Although both Amdocs and Oracle have a large base of well-entrenched Tier-1 customers, their growth in the telecoms segment is not comparable with that of Salesforce, and this gap will only increase with the Vlocity acquisition. However, there are some telecoms-specific functions (such as product catalogue, activation and discovery and management of network assets) where Salesforce and Vlocity's capabilities together are perceived to be equal to or lower than those of their competitors.

CSPs are cumulatively expected to spend over USD45 billion between 2019 and 2023 on customer engagement solutions. This acquisition clearly positions Salesforce for a significantly larger percentage of this spend than would otherwise have been possible for Salesforce on its own; this is because a larger number of CSPs are likely to find the combined package attractive. The acquisition therefore has the potential to dramatically change the market for telecoms-focused customer engagement systems.

1 Vlocity (1 October 2019), Reaching $100 Million in Revenue in Less Than 5 Years. Available at: https://vlocity.com/newsroom/reaching-100-million-in-revenue-in-less-than-5-years.

Downloads

Article (PDF)Latest Publications

GenAI will help communications service providers to upgrade CPQ systems for B2B services

Article

CSPs will need to invest in next-generation CPQ systems to compete effectively

Article

CPQ systems: worldwide forecast 2023–2028