Analysys Mason’s research shows that business pay TV accounts for a sizeable share of overall pay-TV revenue

The number of business pay-TV connections and the related service revenue remain largely unreported by regulators and operators across Europe. However, research by Analysys Mason suggests that business pay TV forms a sizeable portion of overall pay-TV revenue in many European countries. Operators should therefore consider the opportunities that this service presents, both for growing enterprise revenue and for increasing customer loyalty.

Business pay-TV services are particularly significant in countries with a strong tourism sector and large football viewership

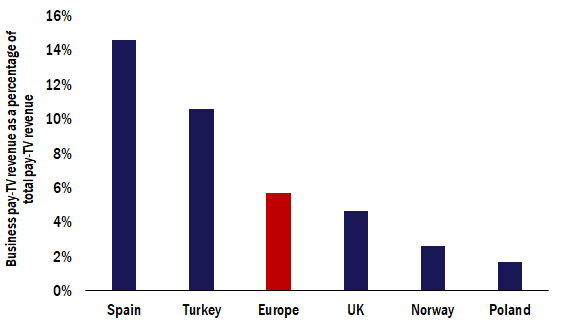

In those countries where cable TV providers do not dominate the market, business pay-TV services present a growth opportunity for operators that have not historically targeted this sector. For example, Russian operator Rostelecom reported that its business pay-TV revenue grew 70% year-on-year in 2017 compared with its overall pay-TV revenue growth of 16% for the same period. The market also has scale: we estimate that direct pay-TV revenue from businesses in Europe reached EUR2.26 billion in 2017, and that it accounted for nearly 6% of the region's overall pay-TV revenue. The proportion of pay-TV revenue derived from business services varies from country to country and is among the highest in Italy and Spain. Figure 1 shows a selection of countries to demonstrate this variation.

Figure 1: Business pay TV as a percentage of total pay-TV revenue, European average and selected countries, 2017

Source: Analysys Mason

Our research suggests that revenue from business pay TV is particularly significant in countries with a strong tourism industry and/or where it is common practice to publicly follow, or bet on, sporting events.

Operators can charge businesses more for pay-TV services than they do residential customers

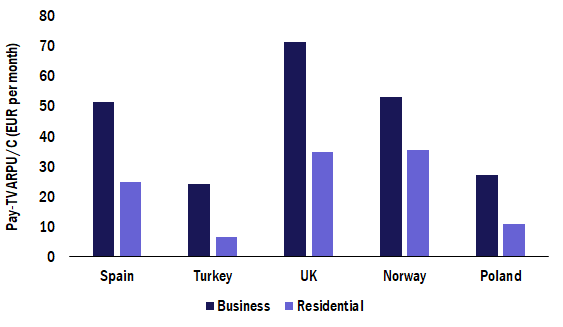

The premium charged to businesses that use pay-TV services is mainly dependent on the potential audience size and the content. Consequently, the average spend for business pay-TV services across Europe is significantly higher than for residential services. Figure 2 compares spending in these two sectors in selected European countries during 2017. Analysys Mason has examined the approaches taken by Movistar in Spain and Rostelcom in Russia to pricing business pay-TV services in order to highlight how operators address the market for different types of establishments.

Figure 2: Comparison of business and residential pay-TV ARPU/C for selected European countries, in EUR per month, 2017

Source: Analysys Mason

Movistar identifies three customer categories for its business pay-TV services: bars, betting shops and hotels.

- It offers a pay-TV football package to bars at a monthly price of EUR275, while the same service is offered to betting shops for EUR472. The operator applies further fees for each additional TV within an establishment's premises that displays the content, and the fees for betting shops are higher than those for bars.

- The operator's pricing for hotels depends on the number of bedrooms and on its location. A detailed price structure is agreed on a case-by-case basis.

Rostelecom segments its business pay-TV customers into the following groups: bars and restaurants, offices, and hotels.

- The operator's suggested pay-TV package for bars and restaurants is offered at RUB949 (EUR13.1) per month. The addition of a football package incurs a further cost of RUB3390 (EUR46.8), bringing the monthly total up to RUB4339 (EUR59.9).

- For offices, the basic pay-TV package costs RUB420 (EUR5.8) per month. The addition of the same football package costs a further RUB339 (EUR4.7), ten times less than in the previous case.

- Rostelecom's standard package for hotel rooms is offered for RUB199 (EUR2.8) per month and adding the same football package costs the same as it does for an office.

- For comparison, the standard residential package (which includes roughly double the number of channels as each of the standard business packages) is offered for a monthly fee of RUB320 (EUR4.4).

These two cases clearly demonstrate that the inclusion of football content represents the main driver of the premium charged for business pay-TV services.

Selling business pay-TV services can improve upsell and churn

Operators can bundle pay TV with other business services to improve customer loyalty and increase enterprise revenue. Such bundles often include one or more of the following: fixed broadband, the installation of Wi-Fi at the establishment, a landline, and several mobile voice and data contracts. Our previous research concluded that the addition of pay-TV services has a positive effect on residential telecoms services churn. For instance, we found that bundling pay TV with fixed broadband reduced the intention to churn by 37% in 2017 in Europe and the USA. Proximus in Belgium, for example, takes a bundling approach to selling business pay TV by including this service in all of its enterprise bundles. The operator's addition of 14 000 TV customers in the first quarter of 2018 was partially attributed to good traction for these bundles.

Although business pay-TV revenue is small in comparison with that of other telecoms enterprise services, pay-TV business solutions play an important role in serving the needs of many enterprises, particularly those operating in the hospitality sector. Operators should be alert to the opportunities presented by business pay TV and should consider using their bundling capabilities in this context to enhance customer satisfaction, sell more of these services, and consequently increase enterprise revenue.

1 Analysys Mason calculates its numbers for business pay-TV services (that is, those pay-TV services subscribed to by businesses/enterprises) and residential pay-TV services separately.

2 Rostelcom (March 2018), Financial and operational results for 4Q 2017 and FY 2017. Available at: www.rostelecom.ru/upload/protected/iblock/0a1/4Q2017%20Presentation%20for%20conf%20call_eng.pdf.

3 For more information, please see Analysys Mason’s Connected Consumer Survey 2017: TV and video in Europe and the USA.

Downloads

Article (PDF)Latest Publications

Tracker

Public cloud provider and CSP partnership tracker 1H 2024

Article

Operators cannot rely on price rises to boost revenue in 2024 but digital services could help

Article

Cyber-security services will account for almost 20% of operators’ incremental revenue from SMEs