Challenger operators are growing business revenue faster than incumbents, but the gap is narrowing

Business revenue accounts for nearly a quarter of operators’ total revenue (based on results from over 50 operators detailed in our Business revenue tracker). Operators’ business revenue has increased, on average, by 5% a year between 2019 and 2022. Typically, business revenue is growing no faster than consumer revenue, and high inflation rates mean that for most operators it is falling in real terms.

Longer-term prospects for business revenue are more promising. Revenue declines from legacy services are reaching their lowest point and services that promise revenue growth, including cloud and security, and small-business offers, are driving future growth. The trends outlined in this article are explored in more detail in Analysys Mason’s Operator business revenue: trends and analysis report.

Business revenue growth rates for incumbents are catching up with those of challengers

On average, business revenue accounts for 23% of total revenue for operators in our sample (consumer revenue accounts for much of the rest). This proportion has been stable for the past 3 years.

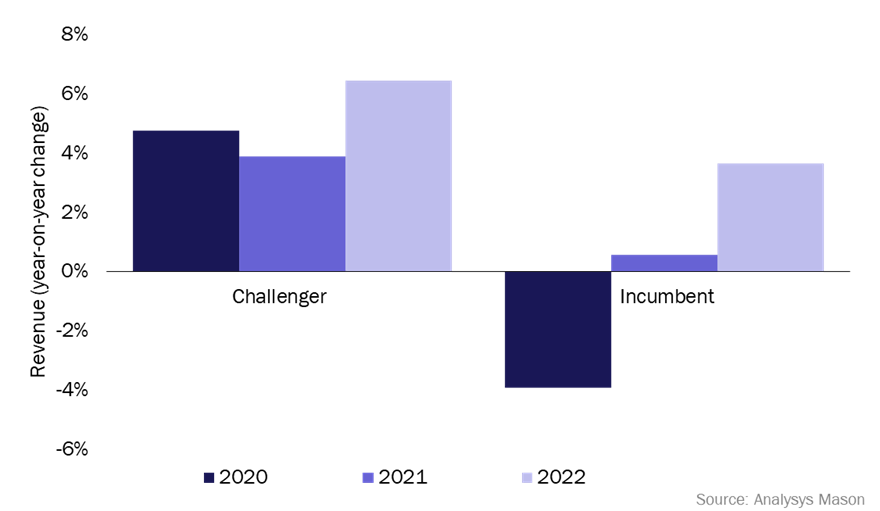

Challenger operators often outpace incumbents in terms of business revenue growth rates, because challengers benefit from market share gains, while incumbents struggle to migrate customers from legacy connectivity services. Reporting shows that challengers’ business revenue continued to outpace that of incumbents in 2022, but incumbents are gaining ground (Figure 1). Declines in revenue from legacy services are bottoming out and some incumbents report a return to growth for B2B revenue.

Figure 1: Average year-on-year change in business revenue by type of operator, worldwide, 2020–2022

Not all incumbents are experiencing an upturn in business revenue growth. For example, Verizon’s year-on-year business revenue was flat 2021–2022 largely because a decline in revenue from legacy services offset the growth it experienced in the small and medium-sized enterprise (SME) market. Similarly, TDC’s business customer base returned to growth in 2022, after years of decline, but increases in revenue were offset by declines from legacy services.

However, as revenue from legacy services bottoms out in the near future, operators are expected to benefit from investment in new networks and services. For example, Verizon is developing an Intelligent Edge Network to generate opportunities in the business market in a cost-efficient manner. KPN has already benefited from completing its migration of SME customers from legacy services.

Inflation rates are high, reaching a record 9.2% in Europe during 2022, and these have contributed to recent revenue growth. In the consumer segment, price rises have been widespread, although some challenger operators have avoided them in order to increase their market share. In the business segment, price increases have often been more constrained, partly due to longer contract periods and volume discounts for large enterprises and public sector clients. High inflation rates have also driven customers to migrate to lower-priced rate plans; Deutsche Telekom reports that this has contributed to a decline in its overall revenue (including business and consumer).

ICT services play an increasingly important role in driving revenue growth

ICT is a promising area for business revenue growth, especially because business customers are seeking ways to cut costs and streamline operations, which is leading to a growing demand for digitalisation.

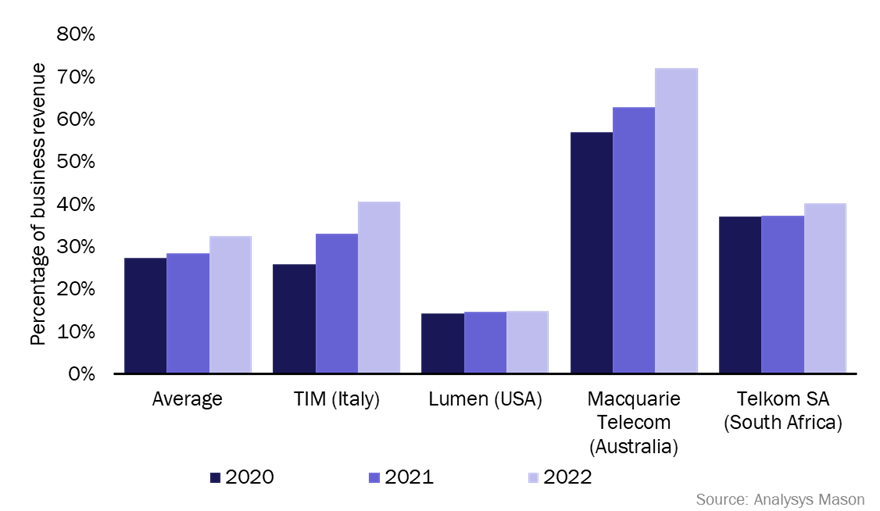

ICT revenue growth has outstripped that of overall business revenue growth in each of the last 3 years. On average, ICT services accounted for 33% of operators’ revenue in 2022, up from 27% in 2020.1 However, this is not the case for all operators; Lumen Technologies is focusing on connectivity (which usually has much higher margins) and ICT revenue accounted for only 15% of its revenue in each of the last 3 years (Figure 2).

Figure 2: ICT revenue as a percentage of business revenue, selected operators, worldwide, 2020–2022

TIM Enterprise reported an especially large increase in revenue from ICT services; it has the fastest-growing ICT share of business revenue in our sample, increasing from 26% in 2020 to 41% by 2022. The strong ICT performance more than offset its slight reduction in revenue from fixed business lines, and led to business revenue growth that exceeded the rest of the market. TIM expects that customers will increasingly demand more-complete ICT solutions and has invested in its ICT offerings and made strategic acquisitions during this period.

Growing demand for ICT services has also created new business opportunities for challenger operators. For example, DNA Finland’s business revenue growth increased from 1.4% to 3.0% in 2021 and 2022 respectively. Although inflation is impacting consumers’ purchasing power, DNA reported that business customers are increasingly demanding ICT services because they want to improve operational efficiency.

Operators are also having some success in the SME market

Several operators report particular success in the SME market. For example, revenue from SMEs accounted for 41% of Verizon’s total business revenue in 2022, up from 38% in the previous year.

Operators can tap into the SME market by offering product and service propositions that specifically cater to SME requirements and support their digital transformation needs. For example, KPN’s revenue from SMEs accounted for 33% of its total business revenue in 2022. It has different offers according to business size and provides a customisable portfolio of value-added services. Recognising the importance of SMEs, KPN prioritised these customers in the migration from legacy services in 2020; this segment was the first to return to revenue growth after several years of decline. Similarly, BT has been improving the customer experience and introducing simpler, and more transparent, pricing policies across SME products and services since 2020. For BT, growth in the SME and SoHo business markets has helped to offset revenue declines from legacy services.

Overall, we are optimistic about prospects for the operator business revenue growth. The beneficial impact of inflation on revenue (in nominal terms) will fade, but so will the worst of the revenue declines from legacy services. Revenue from ICT services has grown persistently over the last 5 years and if it continues at present rates, it could account for over half of operator business revenue by 2030.

1 Based on 17 operators that report ICT business revenue.

Article (PDF)

DownloadAuthor