Operators should capitalise on their strong cloud revenue growth rates with further investment

Listen to or download the associated podcast

Hyperscaler cloud units and SaaS providers’ revenue growth rates fell in 2022, although absolute growth rates remain high. Meanwhile, operators that reported cloud service revenue growth saw their rates increase in 2022 but these rates of growth were lower than those of hyperscaler cloud units and SaaS providers. This is positive news for operators but they should continue to invest in acquiring cloud specialists and capitalise on their expertise in connectivity if they wish to continue increasing revenue growth.

The base data in this article is taken from Analysys Mason’s Cloud service provider’s revenue tracker.

Hyperscaler cloud units and SaaS providers had high revenue growth rates in 2022, but these rates were lower than previous years

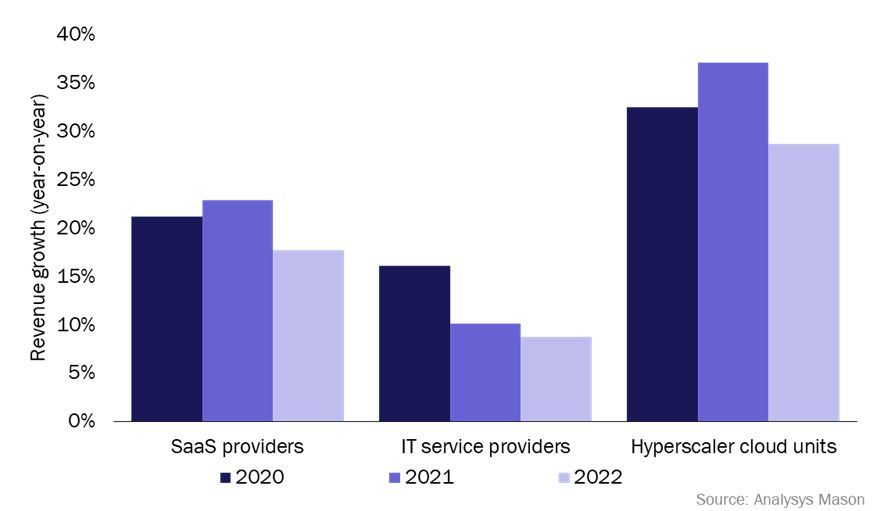

The hyperscalers’ cloud units (AWS, Azure and GCP), and to a lesser extent SaaS providers (such as Dropbox, Salesforce and others), have had impressive rates of revenue growth in 2020 and 2021; in the region of 30–40% for hyperscalers and 20–25% for SaaS providers. These companies have benefited from increasing demand for cloud solutions.

IT service providers, such as HPE and IBM, have had more modest revenue growth rates, even in their cloud services segments. However, growth rates for SaaS providers and hyperscaler cloud units followed the trend of IT service providers’ revenue growth and declined in 2022 (Figure 1).

Figure 1: Revenue growth rates, by type of service provider, worldwide, 2020–2022

Growth rates for hyperscaler cloud units and SaaS providers were still high in 2022, but lower than previous years. This can be at least partly attributed to the worsening economic climate in much of the world in 2022 and unfavourable exchange rates to the USD. This has led to some companies reducing their IT spend, by delaying the migration of workloads to the cloud or the adoption of SaaS solutions. Increased discussion about the cost of hyperscalers IaaS/PaaS solutions and whether in-house servers are more cost effective may also have had some impact on hyperscalers’ revenue growth.

Growth rates for hyperscaler cloud units and SaaS providers were still high in 2022, but lower than previous years. This can be at least partly attributed to the worsening economic climate in much of the world in 2022 and unfavourable exchange rates to the USD. This has led to some companies reducing their IT spend, by delaying the migration of workloads to the cloud or the adoption of SaaS solutions. Increased discussion about the cost of hyperscalers IaaS/PaaS solutions and whether in-house servers are more cost effective may also have had some impact on hyperscalers’ revenue growth.

Revenue growth from IT service providers has also declined in recent years, but revenue from their cloud services segments have been growing at a faster rate than that from their business overall. Indeed, HPE’s Compute segment and VMware’s Subscription and SaaS segment grew by 6.4 and 7.4 percentage points more than their total revenue, respectively.

The trend of cloud revenue growth outpacing total revenue growth is not unique to IT service providers; operators that disclose cloud revenue have reported similar. This is unsurprising as most operators have seen little or no growth in total business revenue in recent years. Hence, many operators have invested, internally and externally, in IT services, particularly cloud and cyber security, to deliver future revenue growth.

Operators’ cloud revenue growth trend has performed better than the market, but they are still lagging overall

Operator cloud portfolios typically include private cloud, managed public cloud and SaaS. Many operators (including those not otherwise active in cloud services) also offer enhanced connectivity solution such as dedicated cloud on-ramps, secure cloud access and access to edge compute services.

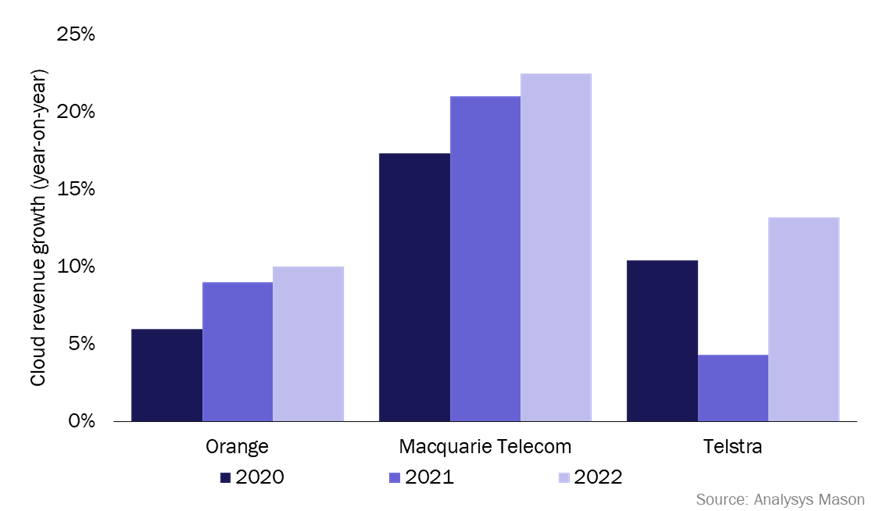

Very few operators consistently report their revenue or revenue growth from cloud services. Three operators that do (Orange, Macquarie Telecom and Telstra) all had their cloud revenue growth rate increase in 2022 (Figure 2). Orange and Macquarie have consistently increased their cloud revenue growth each year since 2020 and Telstra cloud revenue growth increased in 2022, after a dip in 2021.

Figure 2: Revenue growth rates of cloud services, selected operators, worldwide, 2020–2022

Other operators provided various details on their cloud services units in 2022 and the information was generally positive. For example, SK Telecom’s cloud revenue increased substantially in 2022, growing by almost 100% from 2021. Vodafone reported growth of over 50% year-on-year in cloud professional and managed services and it also mentioned positive results in cloud services in Spain, Italy and Turkey. Vodacom’s revenue growth has been strong as a result of its investment in hundreds of AWS ‘Certified Cloud specialists’ in South Africa.

Much of operators’ cloud revenue growth can be attributed to increased demand for public cloud services. This is the case for Vodafone, Vodacom and Macquarie Telecom, which stated in its December 2022 interim report “Cloud applications revenue increased by 15.6% … from growth in demand for partner cloud products including AWS and Microsoft”.1 Operators still had lower revenue growth in cloud services that that of the hyperscalers but it is a positive sing that operators’ have increased their cloud revenue growth while hyperscalers have not.

Operators that have invested in cloud services appear to be succeeding

Operators that have invested in cloud services capabilities are doing well, seeing consistent revenue growth and in some cases increasing their revenue growth each year. But they are still lagging behind the overall market in terms of growth rates and achieving the growth rates of specialist cloud services providers is probably not achievable for most operators.

To help grow their cloud revenue, operators should look beyond simple reselling of SaaS or cloud compute services, which tend to be low-margin services. Investment in professional services teams and other cloud specialists is crucial to this. Many operators are seeing the share of existing public cloud customers that take hybrid public/private cloud services or multi-cloud services increase. If operators invest in delivering services in these areas, they can help to secure future revenue growth. Sovereign cloud services are most likely not delivering meaningful revenue growth for operators yet, but they have potential to do so in the future.

Cloud services are a key area operators should look at to increase their business revenue, but it is not one they should focus on exclusively. While Orange Business has posted impressive cloud services revenue growth in recent years, its cyber-security revenue growth has been consistently higher, roughly 4 percentage points each year since 2020. Operators should also look to develop converged solutions that bring together their strength in connectivity with cloud and security capabilities.

1 Telstra Corporation (17 February 2022), Telstra Corporation Limited - Financial results for the half-year ended 31 December 2021.

Article (PDF)

DownloadAuthor