Flat-panel antennas may prove to be a game-changer for multi-orbit networking

The need to provide reliable coverage, mitigate signal interference and accommodate diverse bandwidth, latency and reliability requirements for a growing number of connected devices and applications across multiple regions is at its peak. Multi-orbit networks offer unparalleled global coverage, low latency, and high throughput, thereby making them ideal for a wide range of applications, including maritime, aviation, remote sensing and IoT.

Flat-panel antennas (FPAs) offer significant advantages over traditional parabolic antennas in terms of form factor, agility across orbits and frequency bands and the ability to handle complex engineering challenges. They are particularly suited for use in multi-orbit/band networks due to their ability to maintain reliable communication across various orbits and bands. However, their adoption and effectiveness can be influenced by factors such as cost, performance trade-offs and the specific requirements of the network.

The market for FPAs is growing

Multi-orbit/band networks are emerging as a promising way in which to meet the rising need for robust and versatile communication solutions that can provide reliable coverage across multiple regions, including remote areas. These capabilities are typically achieved by implementing advanced signal processing algorithms, beamforming techniques and sophisticated antenna array designs that enable antennas to dynamically adjust their beam direction and characteristics to track multiple satellites simultaneously or support multiple beams in different frequency bands. Flat-panel antennas (FPA) are a crucial hardware component to enable these capabilities.

The development of the non-geostationary (GEO) high-throughput satellite (HTS) system market is driving advancements in FPA technology towards more compact, affordable and user-friendly designs. The enterprise and consumer broadband markets are predominantly influenced by the demand for connectivity based on low-Earth orbit (LEO) systems. Military organisations are also embracing FPA technology for its versatility and ability to provide reliable communications in various environments, including for remote and mobile operations; as evidenced by Intelsat’s partnership with Starlink to develop an antenna for the US military.

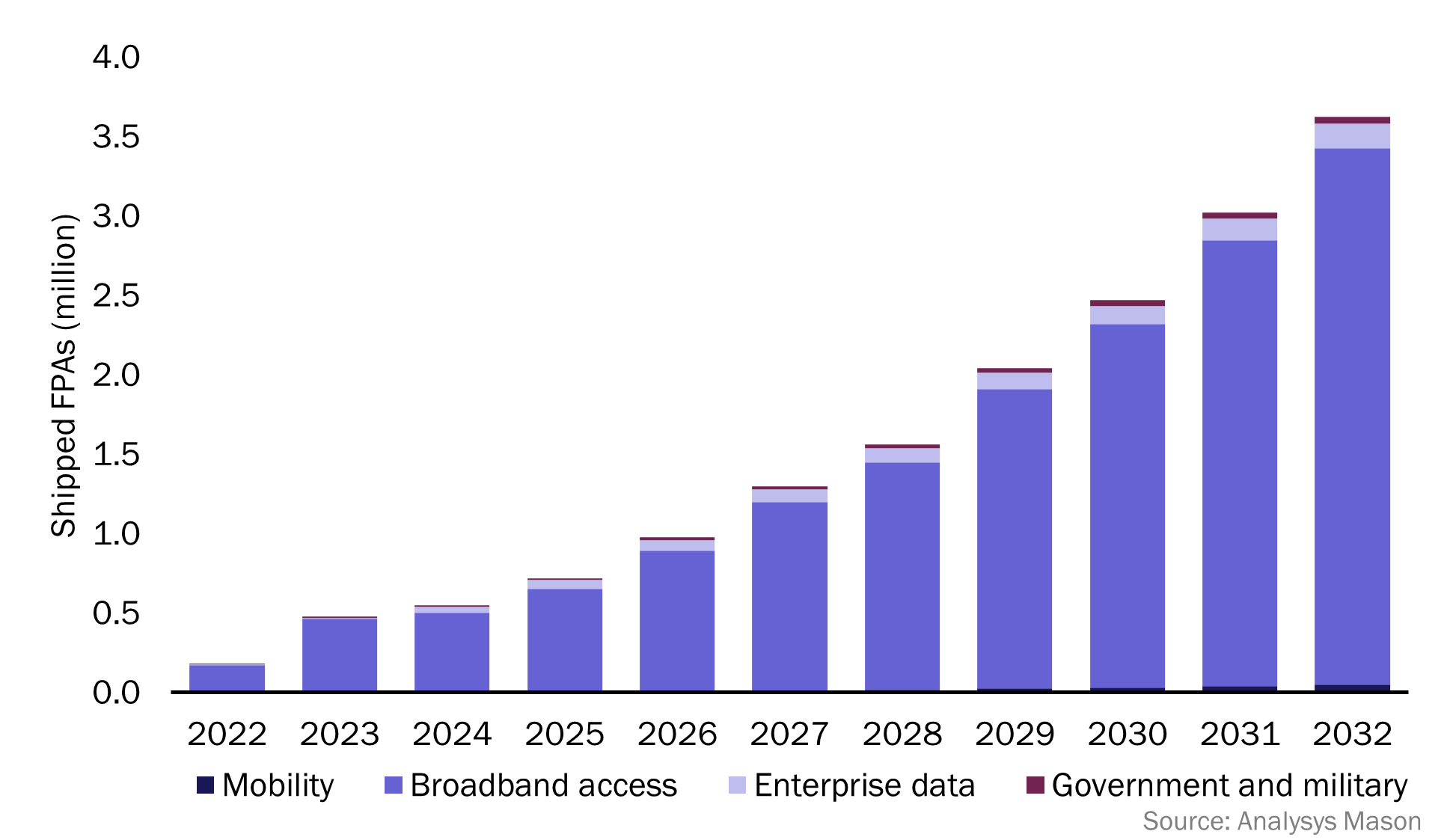

Analysys Mason’s Flat panel satellite antenna, 8th edition forecasts that a total of 16.9 million FPAs will be shipped worldwide between 2022 and 2023 (Figure 1). The vast majority are intended for consumer broadband applications. However, production costs decrease as production rates increase, so FPAs are likely to extend into high-value markets, such as the mobility and government/military markets, thereby expanding the revenue opportunities for FPA manufacturers.

Figure 1: Number of shipped FPAs by market, worldwide, 2022–2032

FPA manufacturers must choose between full-duplex and half-duplex operation and should ensure hitless handovers

The choice between full-duplex and half-duplex operation has a significant impact on FPA manufacturers’ product design, functionality and market positioning. Full-duplex FPAs use more advanced technology and are more complex, while half-duplex FPAs are simpler and lower-cost, thereby potentially making them more accessible. However, only full-duplex FPAs unlock the potential for simultaneous transmission and reception, which can be advantageous in specific scenarios such as high-bandwidth data exchange and real-time communication.

Manufacturers that opt for full-duplex FPAs need to focus on overcoming signal interference and achieving effective isolation between transmitted and received signals, while manufacturers that choose half-duplex designs will need to prioritise efficient mechanisms for switching between transmit and receive modes to ensure minimal signal loss and to maximise data throughput.

Antenna manufacturers that are considering operating in a multi-dimensional network must also ensure that their products can perform hitless handovers. Hitless handovers guarantee uninterrupted data transmission during transitions between different satellite beams or coverage areas. This is crucial for maintaining continuous connectivity for critical applications such as voice communications, video streaming and real-time data transmission, where even brief interruptions or packet losses can result in degraded service quality or service disruption.

Manufacturers must adapt their product offerings with the evolving FPA landscape

FPA manufacturers should focus on compatibility with various network infrastructures by designing antennas that can seamlessly integrate with both existing network infrastructure and emerging technologies such as AI-powered beam management. Equipment manufacturers should collaborate with network operators to design FPAs that are tailored to specific applications, such as high-frequency communication, multi-beam connectivity and integration with emerging technologies such as Li-Fi and mmWave.

Manufacturers should focus on developing scalable FPA designs that can support multiple orbits and frequency bands, thereby allowing for efficient spectrum utilisation and network optimisation. This is likely to make the FPAs power-hungry, but manufacturers can employ economies of scale to optimise costing and performance trade-offs.

FPA manufacturers must have a ‘Starlink strategy’, as is the case in almost every satellite communications market. Manufacturers must develop a robust strategy that addresses adaptability, competitive pricing and product differentiation. They can achieve this by integrating compatibility with Starlink’s constellation into their designs, forming partnerships with Starlink or other LEO satellite providers or focusing on niche markets with unique features that appeal to customers seeking alternatives to Starlink. Key features could include multi-satellite compatibility and seamless switching between LEO and GEO satellites.

Article (PDF)

DownloadAuthor

Luke Wyles

Analyst, expert in space and satelliteRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Tracker

ESG standards and goals: space organisations 2025

Forecast report

Aeronautical satellite communications: trends and forecasts 2024–2034