Operators have options beyond the usual discounting approach for promoting fixed–mobile bundles

14 September 2023 | Research

Article | PDF (3 pages) | Fixed–Mobile Convergence

Converged operators have historically managed to build a large fixed–mobile convergence (FMC) customer base by promoting FMC plans with significant discounts. However, this strategy has disadvantages for operators; it reduces margins and revenue potential.

Operators could benefit from increasing the proportion of FMC accounts among their customer base: these are high-spending customers and churn less than customers who buy fixed and mobile services separately.

However, most operators that are pursuing (or want to pursue) an FMC strategy face a common challenge: how can they gain (or retain) FMC customers without offering large monetary discounts?

Operators like Virgin Media O2 (VMO2) in the UK, Telenet in Belgium and Telefónica in Spain have developed a value-oriented FMC proposition to encourage customers to buy FMC plans: to keep monetary discounts at a minimum, they are offering exclusive features and services only to FMC customers.

Operators that promote FMC bundles with discounts have gained customers, but the strategy has disadvantages

Large monetary discounts have driven the adoption of FMC bundles. Operators in the Netherlands, Portugal and Spain built large bases of FMC customers quickly by upselling mobile tariffs with big discounts (of up to 50%) to fixed customers.

However, this strategy is ‘value-destructive’ in the following ways.

- It ignites price wars among operators; as in the ‘prisoner’s dilemma’ situation, if one operator introduces large discounts, all competitors will follow.

- It reduces the benefits of offering FMC bundles. FMC is an optimal strategy to retain customers. However, if an operator pushes FMC bundles with discounts that are too large, it will not maximise revenue.

- It does not allow operators to differentiate their retail proposition: operators can easily replicate the discounts applied by competitors.

- It does not allow operators to pursue a price discrimination strategy. Operators might be offering services with big discounts to customers who would buy the same services at a full price.

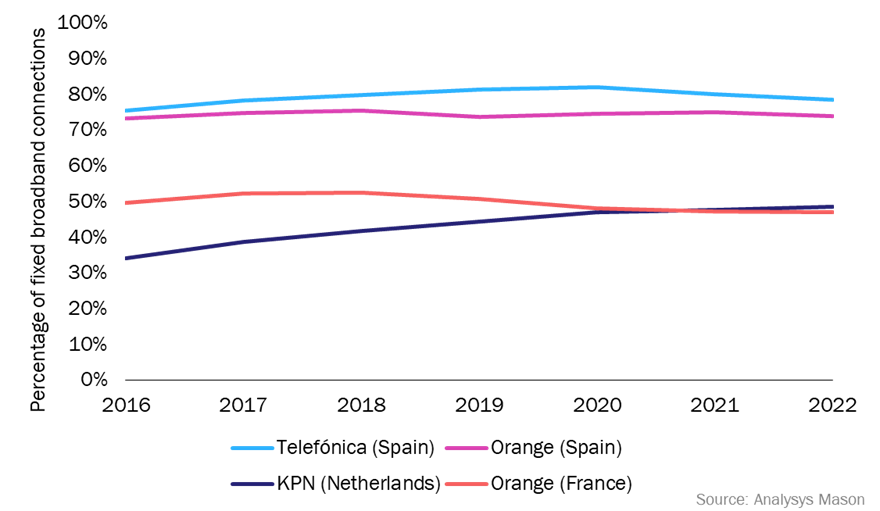

Some operators in mature FMC markets are experiencing a decline or a significant slowdown in the fixed broadband penetration of FMC accounts, after having reduced the monetary benefits included in FMC bundles (Figure 1). Other operators that own fixed and mobile networks are delaying the launch of FMC bundles because they are wary of revenue cannibalisation (for example, operators in Norway).

Figure 1: Percentage of fixed broadband connections that are part of an FMC package, selected European countries, 2016–2022

Some operators are offering unique and exclusive benefits to FMC customers to move on from the traditional discounting approach

Several operators are trying to move away from the traditional discounting approach for offering FMC services. They have started to develop value-based FMC propositions, using benefits that are not explicitly financial.

We have developed a non-comprehensive list of examples of these benefits and have placed them in one of three broad categories (Figure 2).

Figure 2: Examples of non-monetary benefits that some operators grant to customers who buy mobile and fixed services in a bundle

| Additional services at no extra cost | Exclusive services and features reserved for FMC customers | Flexible and customisable bundles |

|

|

|

Source: Analysys Mason

- Additional services at no extra cost. In the UK, VMO2 launched Volt, a premium FMC proposition in October 2021, 5 months after the Virgin Media–O2 merger. VMO2’s FMC customers are offered the following benefits: a broadband speed boost (up to 1Gbit/s), double mobile data, Wi-Fi guarantee at no extra cost (with up to three Wi-Fi pods). Over 1.5 million of VMO2’s customers had bought one of the Volt bundles as of 2Q 2023.

- Exclusive services and features reserved for FMC customers. Telenet (Belgium) restricts the range of standalone services to encourage the take-up of FMC plans. Unlimited mobile data plans are available only as part of an FMC bundle (the maximum monthly data allowance included in standalone tariffs is 5GB). Until early 2023, only FMC customers could buy fixed plans with a download speed of up to 1Gbit/s. Telenet’s FMC customer base increased by over 20% from 2Q 2021 to 2Q 2023, despite only offering a limited discount (below 5%).

- Flexible and customisable bundles. Telefónica (Spain) revamped its FMC proposition in May 2022 and replaced Fusión, its historical FMC bundles, with miMovistar, a more flexible proposition. FMC customers can personalise their bundle and adapt it to their needs. They initially choose a basic package with mobile and fibre services and can add TV content and a wide range of value-added services (such as finance, energy, gaming, health and home security services) at any time during the contract. Existing Fusión customers can switch to miMovistar at no extra cost. At the end of 1Q 2023, 30% of Telefónica’s FMC customers in Spain had selected one of the new miMovistar bundles.

To limit discounts, operators must provide FMC customers with clear benefits compared to standalone tariffs

Operators’ FMC bundles must include some benefits to encourage customers to buy mobile and fixed services in a bundle. The price discount that is granted to FMC customers will probably continue to be a key incentive for customers (and in some situations operators do not have other options – for example, in markets with challenger operators).

However, the price discount can become less relevant, if operators develop FMC propositions that offer clear benefits compared to standalone tariffs.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Forecast report

USA: fixed–mobile convergence forecast 2025–2030