GenAI offers telecoms application vendors new revenue opportunities, but clarity on their role(s) is critical

Artificial Intelligence (AI), and generative AI (GenAI) specifically, are among the hottest topics of discussion in the telecoms industry. Despite the attention that the technology is receiving, communications service providers (CSPs) face challenges with its implementation. Telecoms application vendors can pursue new revenue opportunities by helping CSPs to tackle these challenges. To capitalise on the GenAI revenue opportunity, vendors must identify which role(s) they can play. Analysys Mason’s report The generative AI opportunity for telecoms application vendors explores the opportunities available to telecoms application vendors and explains how these opportunities can be captured.

Telecoms application vendors are uncertain about which roles to play in the GenAI market

CSPs are exploring different AI use cases by undertaking trials, proofs of concepts (PoCs) and commercial projects. The challenges that are emerging as part of these exercises (including issues with data preparation for use with GenAI models, the integration of GenAI with internal systems to drive the automation of tasks within these systems and compliance with regulatory, data security and privacy policies) represent opportunities for telecoms application vendors.

The GenAI ecosystem is complex and evolving quickly: GenAI involves several new capabilities, including foundation model (FM) development, which requires integration between internal systems and the FMs, and GenAI application management. As a result, many telecoms application vendors are still learning how best to implement GenAI capabilities and are trying to identify their role(s) in this market.

Nevertheless, telecoms application vendors that do not include GenAI in their solutions, or do so as a standalone solution, risk inviting negative brand perceptions and the reduced competitiveness of their offerings. Given the high levels of investment associated with GenAI, most CSPs are likely to adopt this technology through applications offered by their telecoms application vendors, rather than by building these capabilities themselves. As such, it is essential that telecoms application vendors quickly identify and establish their role(s) in this space.

Foundation models, applications and professional services present new revenue opportunities for telecoms application vendors

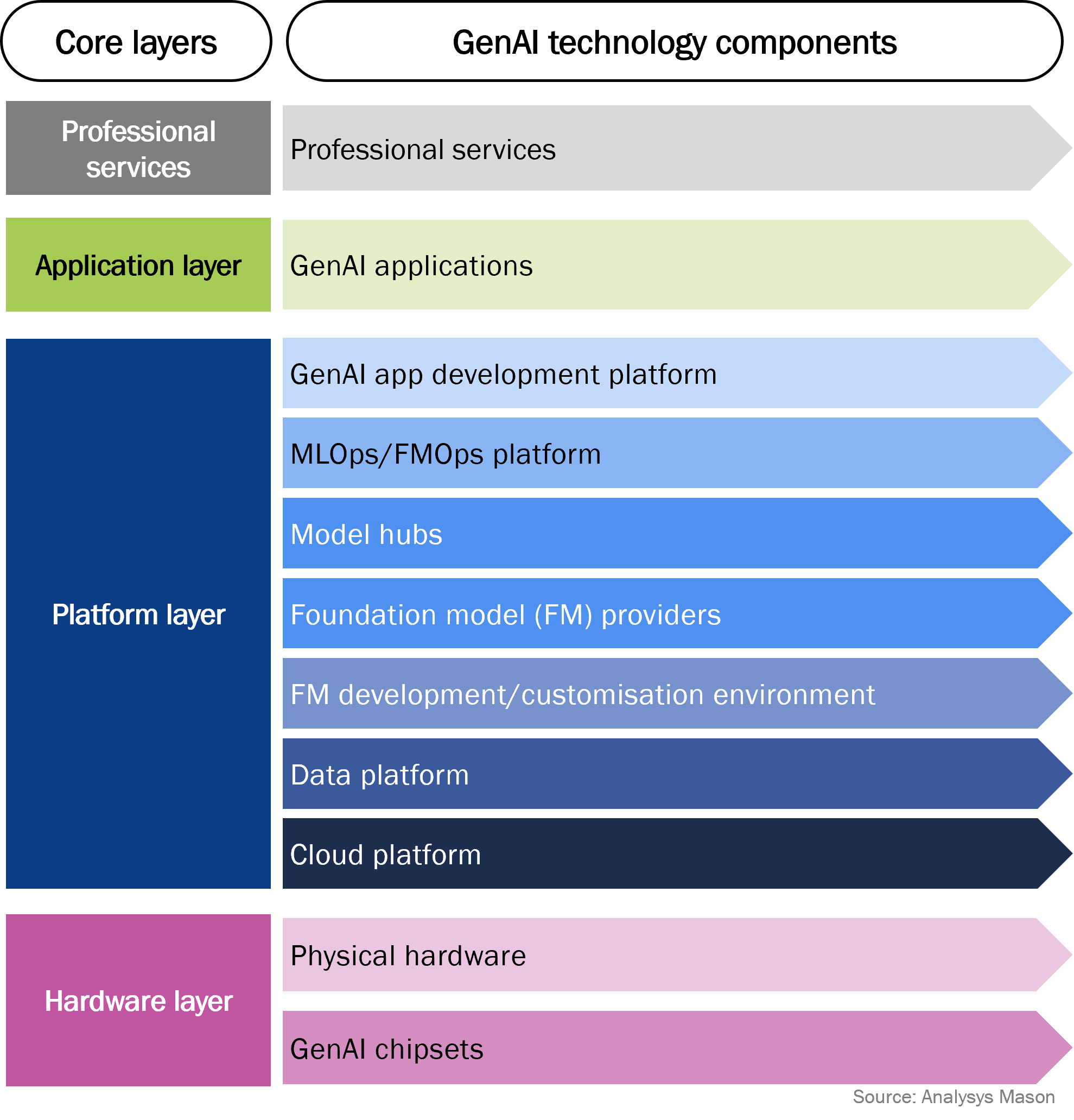

Analysys Mason has developed a GenAI value chain (see Figure 1) to help CSPs and telecoms application vendors address the complexity of GenAI. This value chain identifies the key layers involved in developing and deploying GenAI use cases, which makes it easier for telecoms application vendors to assess their current capabilities and to identify their role(s) in the GenAI market.

Figure 1: Analysys Mason’s GenAI value chain

Most telecoms application vendors will be active in the application development layers of this value chain. Vendors will enhance their existing products with GenAI capabilities such as knowledge search, question and answer, as well as text summarisation. We consider these use cases to have reached a mature enough stage for vendors to deploy within their applications. However, such use cases will create the need for non-differentiated opportunities.

Telecoms application vendors can differentiate their GenAI offerings in the FM provider layer. The telecoms industry has complex and unique requirements and will therefore need access to telecoms-specific FMs. While top-tier CSPs (such as SK Telecom, SoftBank, KT Corp and Viettel) have deep enough pockets to build their own telecoms-specific FMs, most CSPs will look to their vendor partners to provide FMs that they can customise. Customised/pre-trained FMs can be developed to address telco domains such as billing and network operations (for example, design, optimisation and automation). FMs also provide an avenue through which vendors can deliver unique solutions based on these customised/pre-trained models. However, vendors will need to consider the high costs associated with becoming FM providers (including training, deployment and management costs). Vendors that decide to invest in becoming FM providers can capitalise on new revenue opportunities by offering these models that appeal to CSPs and other telco vendors.

Telecoms application vendors have an opportunity to move up the GenAI value chain by delivering professional services to CSPs with gaps in their GenAI skills. More specifically, CSPs will require specialist services to maximise investment in GenAI in areas such as GenAI application development, FM selection, customisation, integration and lifecycle management, as well as data-related services such as data preparation and governance. Telecoms application vendors such as Amdocs1 and Netcracker2 are already positioning themselves to capture these opportunities.

Telecoms application vendors must overcome several challenges to succeed in the GenAI market

The adoption of GenAI presents telecoms application vendors with multiple revenue opportunities, but there are several challenges that they must address to realise them. These include the identification of the FM(s) that form the core of the GenAI-based applications developed by these vendors, as well as the platforms that will support the development and ongoing evolution of these applications. Further challenges include access to the right data sets and assuring the quality of these data sets.

Telecoms application vendors will need to ensure that their applications can support the full range of CSPs’ requirements and the requirements associated with an increasing number of FMs. CSPs that have an advanced understanding of GenAI do not want to be locked into using specific FMs. FM requirements will vary depending on how they fulfil the needs of use cases that they support (this will include avoiding bias and providing accurate responses). It is therefore important that telecoms applications vendors craft their applications in such a way that they support multiple FMs. However, this is not a trivial task, especially when the FMs are supporting more-advanced use cases such as the automation of application workflows. There is also the burden associated with regulating these FMs to ensure data security and privacy policies are not compromised.

To excel in this market, telecoms application vendors will need to select the right partners across the broader GenAI value chain to avoid vendor lock-in, decide how far into the value chain that they need to go to make the maximum impact and determine how to address critical concerns around data and privacy.

1 See Analysys Mason’s Amdocs accelerates generative AI deployment for CSPs, leading in the race to adopt generative AI solutions.

2 Netcracker also offers solutions that occur in other layers of the GenAI value chain including FM customisation, GenAI application and data platforms. For more information, see Analysys Mason’s Netcracker: generative AI solutions for communications service providers.

Article (PDF)

DownloadAuthor