The Intelsat–SES merger is a milestone for the satcom industry

SES announced, in May 2024, that it will acquire Intelsat for USD3.1 billion in cash after years of discussions. The transaction is expected to be completed in 2H 2025, subject to regulatory compliance, and will result in the formation of a strong, multi-orbit satellite communications (satcom) operator.

Satcom operators are facing strong competition from non-geostationary (GEO) players. Industry consolidation is considered to be an important counter strategy, especially for the incumbent players. Indeed, Viasat has already merged with Inmarsat, and Eutelsat has merged with OneWeb.

The formation of the new Intelsat–SES combination is considered to mark the start of a new chapter in the evolution of the satcom industry. In this article, we discuss what industry stakeholders should expect from the merger. We consider if the combined entity can offer greater value to existing Intelsat and SES customers and partners, while also countering the competition from non-GEO players.

Competition from non-GEO players is the key driver of the rearrangement of the satcom ecosystem

Non-GEO players are at the centre of the current satcom industry transformation. Their main value proposition is higher bandwidths and lower prices than their GEO counterparts.

Starlink and OneWeb have both completed their phase 1 constellations. Starlink has been at the forefront of deploying non-GEO services across more than 50 countries worldwide, and has been successful in capturing significant market share, especially in the consumer broadband market. As a result, the size of the subscriber bases of GEO incumbents such as Hughes, Viasat and NBN have declined significantly.

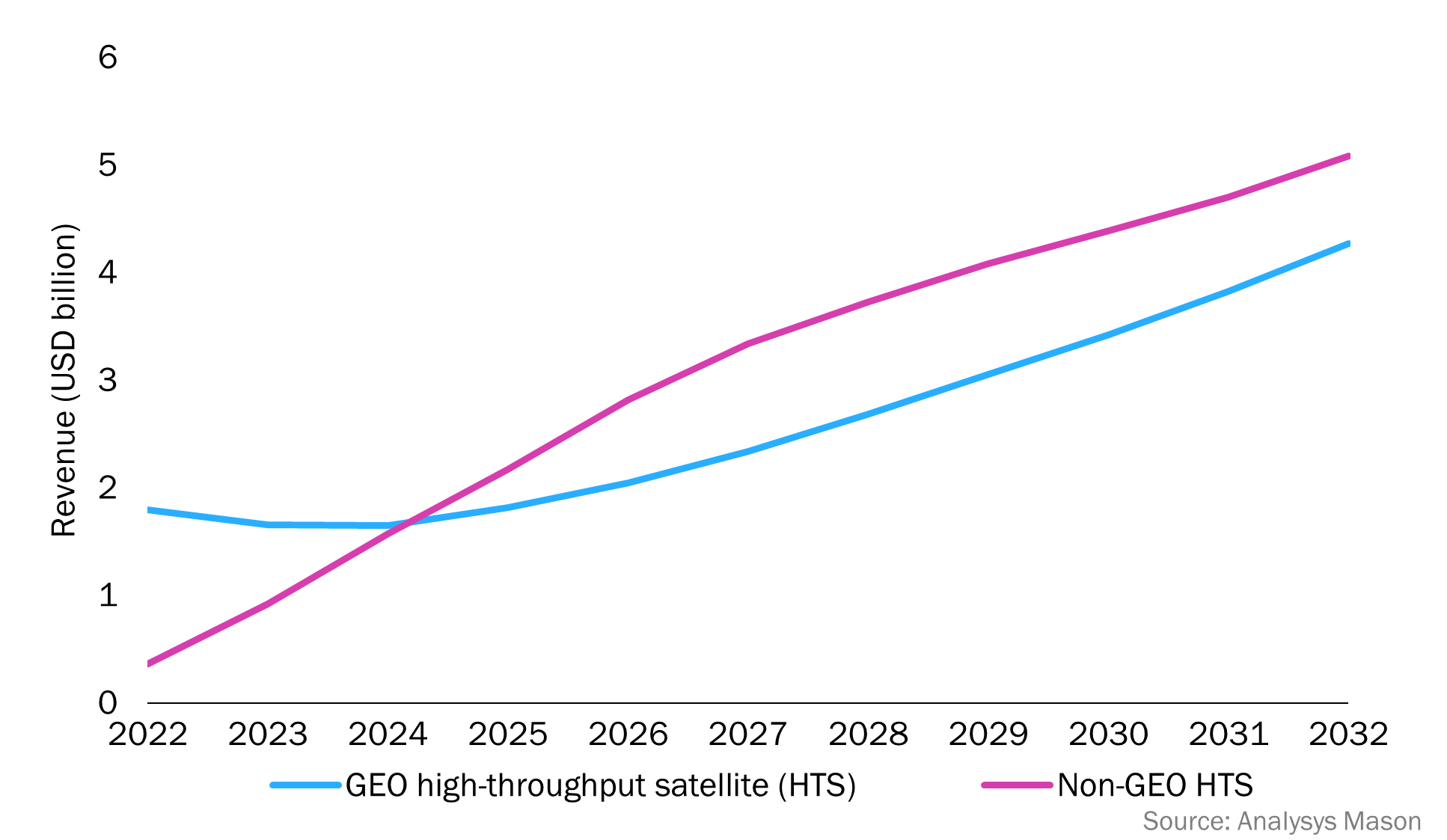

Most of the revenue from satellite-based consumer broadband services in North America will soon come from non-GEO players, largely due to Starlink’s success (Figure 1). Branding, affordability and increased bandwidth per site have been the main drivers of this success, and Starlink is now looking to have a similar impact on other market sectors such as mobility and enterprise.

Figure 1: Satellite-based consumer broadband service revenue, by type, North America, 2022–2032

This is creating immense pressure for the other satellite operators, especially in terms of pricing and service offerings, and this pressure will get more intense as Telesat’s Lightspeed and Amazon’s Kuiper release more non-GEO capacity into the market. Amazon’s Kuiper may even be a bigger threat than Starlink due to its access to AWS and Amazon (retail) customers.

The entrance of new players with stronger value propositions, brand value and access to capital will result in an evolution of the satcom ecosystem. The current trend is for incumbent operators to ‘consolidate to compete’. However, this will only be successful if the two firms in each merger have appropriate synergies in terms of factors such as capabilities, customer bases, assets and geographies.

The proposed merger between Intelsat and SES represents a compelling strategic alignment

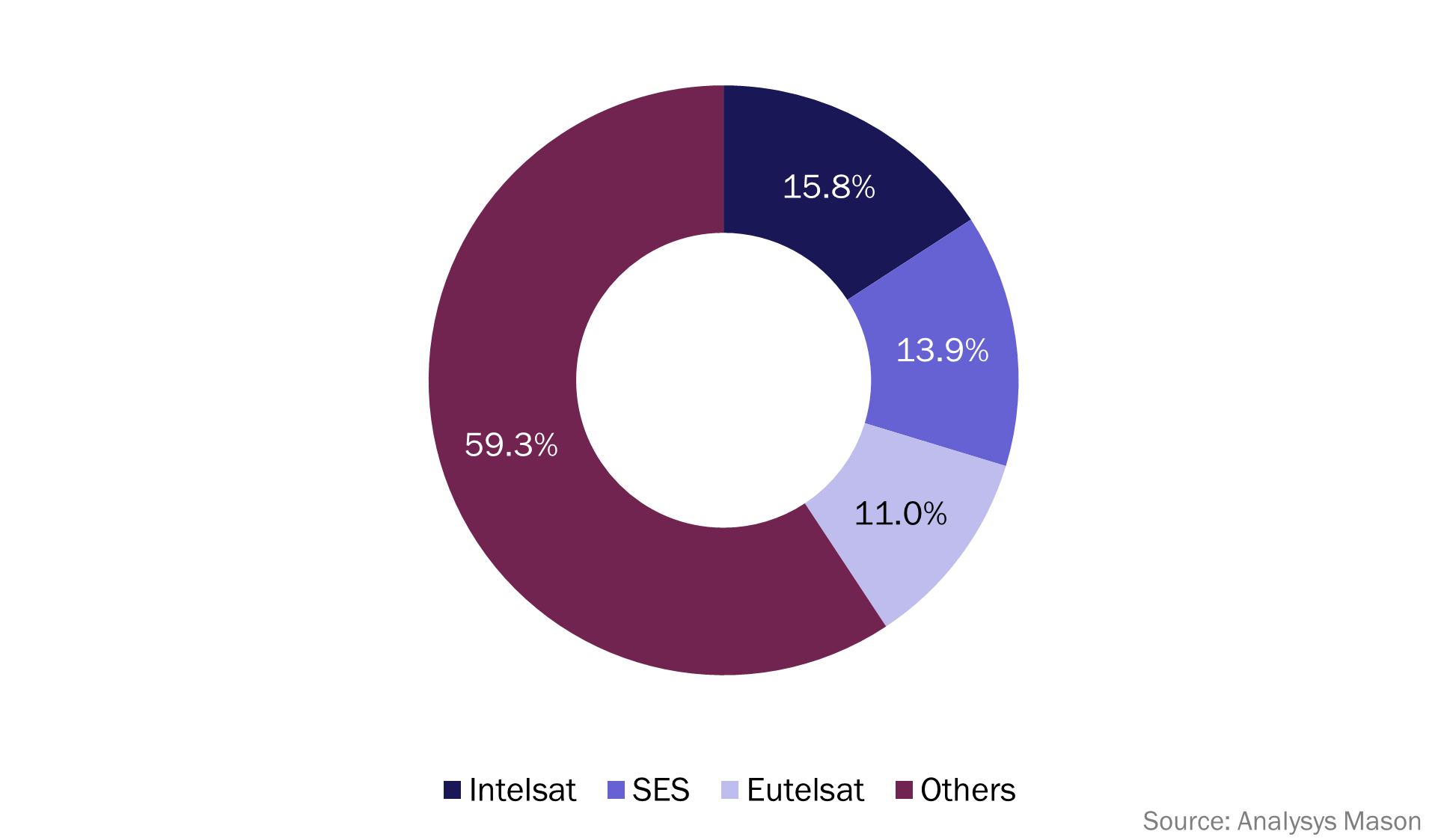

The merged Intelsat–SES entity will be one of the largest satcom players in the market. It will have a combined fleet of 100 GEO and 26 medium-Earth orbit (MEO) satellites, as well as a footprint across a wide range of frequency bands. The integrated firm will hold a share of approximately 30% of the widebeam leased capacity market, thereby making it the clear industry leader (Figure 2). Its future strategy for capacity supply is likely to include software-defined high-throughput satellites and integrated Intelsat–SES non-GEO constellations.

Figure 2: Breakdown of the leased C-, Ku- and Ka-band transponder market in terms of the number of units, worldwide, 2022

Our expectations for the combined Intelsat–SES entity in the coming years, split by application, are as follows.

- Video. The combined entity will control most of the US satcom video market. This may raise some questions during the regulatory approval process. One counterargument is that the video market is in decline and the merger will allow the firm to optimise its space and ground assets so that competitive value can be created for network customers.

- Enterprise very-small-aperture terminal (VSAT). Both the companies have software-defined and integrated cloud capabilities. The use of multi-orbit solutions to generate high-margin revenue will be the major value proposition in the enterprise VSAT segment. The combined customer base and market know-how will create barriers for players such as Starlink in this area.

- Backhaul and trunking. Both Intelsat and SES have been advocating for the inclusion of satellite in 5G architecture. The backhaul and trunking segment is growing because telecoms operators are expanding and upgrading their networks. The combined entity will be able to use its integrated supply across GEO and MEO to offer a flexible and scalable solution to customers.

- Mobility. Intelsat and SES have complementary capabilities in the mobility segment. Intelsat’s vertically integrated aviation division connects around 3000 aircrafts, while SES’s maritime division has service agreements with major cruise line operators. The combined firm will therefore have extended mobility capabilities and an expanded customer base.

- Government. Both Intelsat and SES are trusted players for delivering secure and reliable connectivity for government and military applications. These applications have a growing need for high bandwidths and low latency. The combined entity will be able to use its multi-orbit capabilities for sustained revenue growth.

The proposed merger between Intelsat and SES will make use of synergies in various satcom applications. It is especially important because of the upcoming competition from non-GEO players in the networks market. However, securing regulatory approval and navigating acquisition conditions will be pivotal. The acquisition will most certainly result in a strong market position and growth prospects for the combined entity.

Article (PDF)

DownloadAuthor