IoT connectivity standard Matter helps operators to broaden smart home propositions and differentiate broadband

The number of devices that comply with Matter, a connectivity standard for IoT, has increased sharply since it was launched in September 2022. As the Matter ecosystem grows to include a broader range of devices, consumer take-up of IoT will increase as the integration and management of different devices becomes simpler.

Matter has received backing from major vendors such as Amazon, Apple and Google, which have already launched compliant devices. Operator interest is also high due to the potential synergies between Matter and operators’ existing smart-home and in-home connectivity initiatives. Indeed, Matter can create opportunities for operators to resell and bundle a wider range of IoT devices with lower upfront costs.

The Matter ecosystem is growing and operator and vendor interest has increased proportionally

Matter enables consumers to control IoT devices produced by different vendors by using the same touchpoints. At the time of writing, Matter supports consumer IoT devices related to home automation (for example, connected lightbulbs, dishwashers and speakers) and home security (including connected door locks and sensors). We refer to these two categories of IoT devices as ‘smart home’ services.

The Connectivity Standards Alliance, the industry body that is developing Matter, plans to add support for other devices such as cameras and electric vehicle charging points in the future.

Major manufacturers of consumer devices support Matter and have launched ‘hubs’ for managing and controlling the smart home devices that are compatible with Matter. Apple’s HomePod, Google’s Next Wi-Fi Pro router and Amazon’s eero Max 7 router all support Matter devices.

Analysys Mason’s research into operator smart home strategies shows that major operators are planning to integrate Matter into their existing smart home propositions. Matter has also received considerable attention at industry events, including the Wi-Fi World Congress (May 2023) where the Connectivity Standards Alliance delivered a presentation.

The increase in the number of Matter-compatible devices will increase the take-up of smart home services

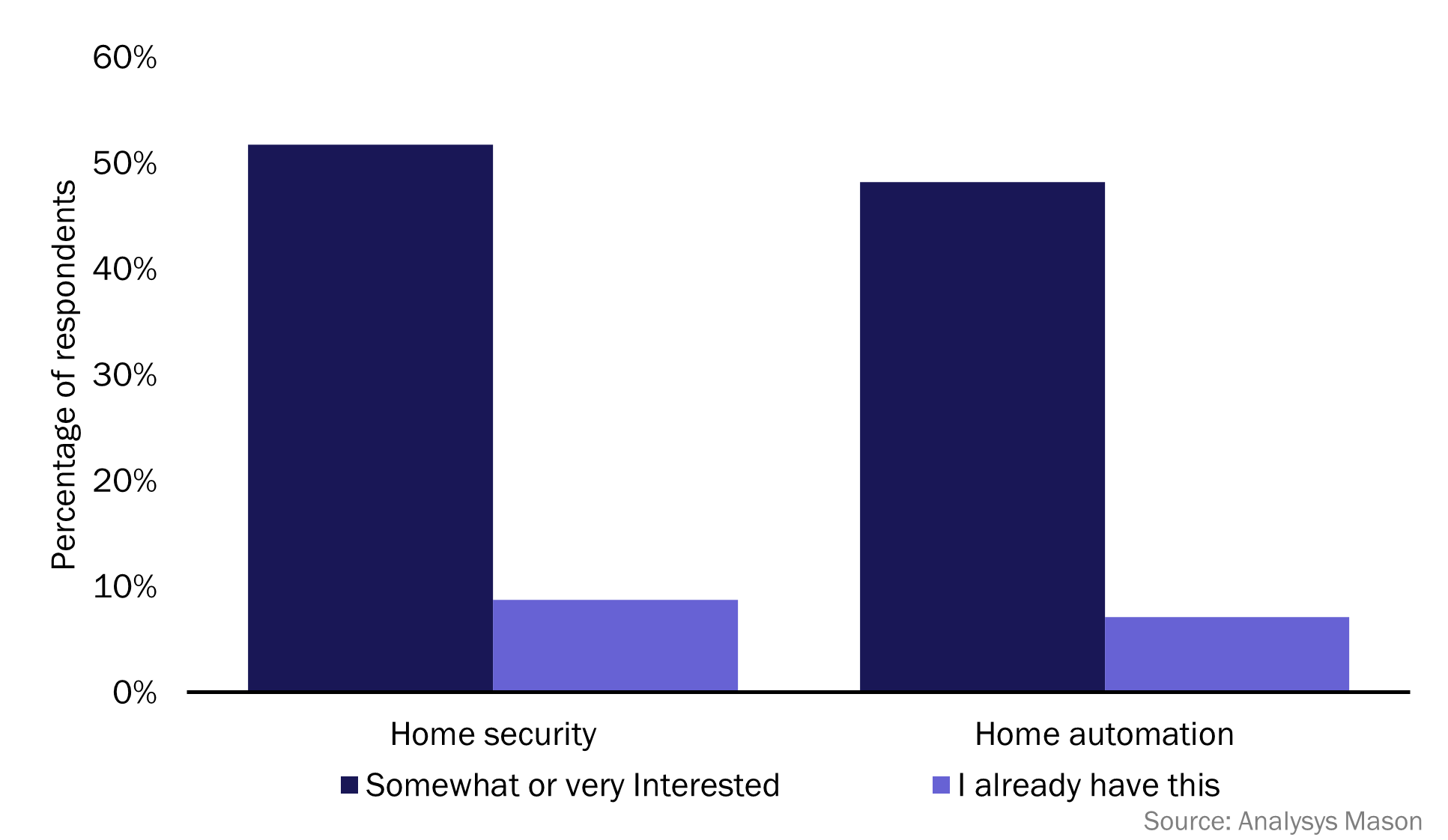

Data from Analysys Mason’s 2023 consumer survey shows that only a small percentage of consumers currently use smart home services (9% of respondents use home security services and 7% use home automation). However, consumer interest in these services is high. 52% and 48% of respondents reported being “somewhat interested” or “very interested” in home security home automation solutions, respectively.

Figure 1: Interest and take-up of home automation and home security services, worldwide, 20231

Matter can potentially address some of the factors that cause the disparity between take-up and interest in smart home services. Interoperability with smart speakers and mesh access points from vendors such as Apple and Google (which already have a higher take-up among survey respondents) means that consumers will face fewer obstacles when setting up their home automation services. Moreover, smart home services will become more accessible to consumers who are not necessarily ‘tech-savvy’ because the devices will be easier to use and understand due to common standards among device manufacturers

Matter will enable operators to access a wide ecosystem with low upfront costs

Operators’ smart home solutions depend upon their vendor partnerships. For example, Telkom South Africa provides its Smart Spaces offering through an agreement with Tuya. Orange developed its Maison Protegée home security solution with surveillance specialist Groupama. Currently, this means that either operators' customers are limited to the devices from vendors that their fixed broadband provider has an agreement with, or the operator provides little-to-no integration of services and simply acts as a reseller for third-party hardware.

Matter will change this. Operators that want to resell consumer IoT devices and integrate them into the control interfaces that they manage will have access to a broader range of devices. Similarly, consumers who already have devices from one operator will be able to integrate solutions from their provider into their existing smart home system, regardless of the brand of their device.

However, if Matter makes it easier for operators to enhance their smart home services, this could also present a challenge to operators that have already developed their own platforms for aggregating smart home services. When such developments create opportunities for other players to enter the market, those that are already ahead potentially have more to lose. For example, Deutsche Telekom has developed HomeOS, a suite of APIs that acts as a communication layer between its Wi-Fi CPE and third-party smart home devices. Customers can manage smart home devices through the same touchpoints that they use to manage their home Wi-Fi. This is a sophisticated solution that will eventually become easier to reproduce thanks to Matter.

Deutsche Telekom currently supports different devices to those supported by Matter. For example, Deutsche Telekom customers can manage connected cameras, whereas Matter cannot yet. However, as Matter adds a broader range of devices to its ecosystem, these developments could erode some of the competitive advantages that Deutsche Telekom has acquired by developing its own smart home aggregation capabilities.

Nonetheless, most operators stand to benefit from Matter because it will allow fixed broadband providers to integrate a broader range of smart home devices into their offerings. This broadens the opportunities that operators have to differentiate their existing connectivity services. Analysys Mason’s research into operator connected home strategies outlines how operators can take advantage of the synergies between wireline connectivity, Wi-Fi and smart home solutions to differentiate their offerings.

1 Question: “Would you be interested in any of the following connected home services?”; n = 15 425.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Article

Operators could maximise the capabilities of existing in-home equipment by offering Wi-Fi motion sensing