Should MNOs dabble into airline connectivity?

With the proliferation of smartphones, tablets, and other connected devices, passengers expect to stay connected and productive even when flying at 30,000 feet. As a result, airlines are recognizing the significance of providing reliable and high-speed connectivity to passengers, leading to a growing emphasis on inflight Wi-Fi services and the integration of technology solutions that cater to the connected traveler.

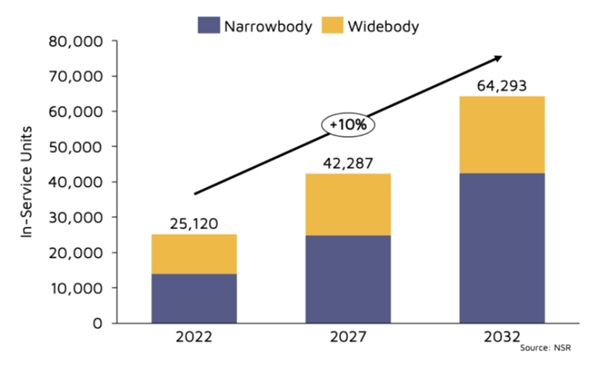

NSR’s Aeronautical Satcom Market’s report, 11th Edition estimates that the number of in-service units for commercial passenger aircrafts will grow at a CAGR of 10% to over 64,000 units by 2032. As airtime costs have reduced, mobile network operators (MNOs) have become swayed by the proposition of taking their offers to the sky. Inmarsat works with mobile network operators and sponsors to make Wi-Fi free and help generate a positive ROI for all parties. Inmarsat is also pioneering a new Wi-Fi roaming technology; Passpoint which gives passengers seamless roaming access on board, similar to what they’d experience through regular terrestrial roaming services.

What are the stakes?

MNOs can expand their service offerings and tap into a lucrative revenue stream, capitalizing on the growing demand for uninterrupted connectivity during flights. Additionally, providing IFC allows MNOs to strengthen their customer relationships and enhance brand loyalty, as passengers increasingly expect seamless connectivity throughout their travel experience. In an age where brand differentiation, passenger experience and subsequently, their loyalty, matter more than ever, the benefits of offering free Wi-Fi are compelling.

Several MNOs have made attempts at entering the IFC market, but the most recent is T-Mobile, partnering with US mainline carrier Delta Airlines (has also partnered with Alaskan, American, and United airlines) to provide free in-Flight Wi-Fi. But whether the attractive addressable IFC market is just enough to create a pathway for MNOs to compete and thrive remains a valid question.

Barriers MNOs may face

One of the key questions lots of customers ask is, “Why can’t IFC be like broadband at home?”. Airlines and sponsors usually want passengers to have access to the airline portal, accessible through the on- board Wi-Fi network so that every passenger can see airline branding and available services. Starlink’s connection model is “portal-less”, and as Starlink continues to sign more airlines in the future, questions as to why passengers need a captive portal in the first place will begin to rise.

In 2022 T-Mobile and SpaceX entered a partnership to develop direct satellite-to-smartphone connectivity for improved mobile network coverage and resilience. This will create opportunities for satcom and telecom industries and can eventually be adopted in Aeronautical markets as part of the campaign for “portal-less” connectivity.

Suggestions for airlines and MNOs

Airlines should leverage their loyalty programs and build experiences that appeal to them by partnering with MNOs to figure out new ways to pivot their onboard experience to meet passenger expectations. Various models and options are available when designing a loyalty program and airlines should consider local specificities, their customer base’s preferences, and their own objectives.

Service Providers should upgrade their network infrastructure to increase network capacity and bandwidth by deploying advanced antenna systems to accommodate the growing demand for data-intensive applications and services. If you want to have high engagement, you must have enough bandwidth in the right spots to support it, because if you drive high demand and you run out of bandwidth and that’s not going to look great.

The bottom line

The provision of free Wi-Fi connectivity is a significant consideration for airlines, but partnering with MNOs can ensure reliability and sustainability. A collaborative approach between airlines and operators can help overcome technical challenges and provide seamless access to passengers, enhancing their travel experience.

Passengers want to do the same in the sky as they do on ground. Airline connectivity could be a place to look at for MNOs looking to find, keep and retain value for customers.

Article (PDF)

DownloadAuthor