Mobile operators’ messaging needs to go beyond network quality and price to win SMEs’ business

Mobile operators face continued pressure in the micro, small and medium-sized enterprise (SME)1 market because the total spend on connectivity remains flat. Most SMEs cannot discern any meaningful difference between providers and many SMEs (particularly micro enterprises) are opting for consumer plans, so operators need to differentiate themselves and clearly explain why SMEs should subscribe to business plans. Operators that do not take any action risk competing simply on price, either with other operators or with their own consumer divisions. The issues discussed here are covered in more detail in Analysys Mason’s Operator strategies for differentiating mobile services for micro, small and medium-sized enterprises.

Many SMEs perceive no benefit in taking a business contract and will often opt for a comparable consumer version

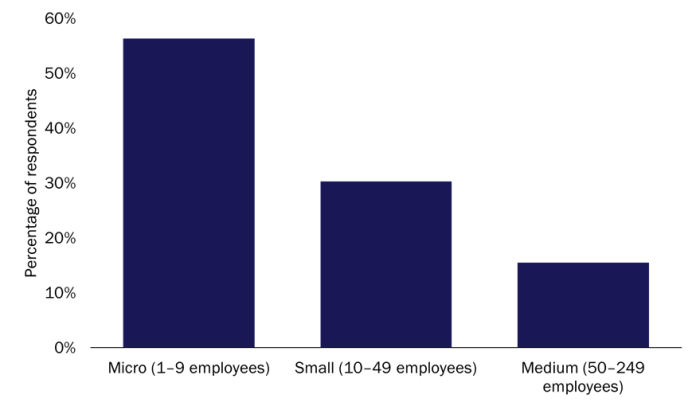

Many SMEs take residential or consumer mobile plans because they do not see the benefit of subscribing to business plans (Figure 1). Most mobile operators are experiencing this phenomenon. Indeed, Telefónica told us, “…especially for the smaller enterprises, the micro businesses, it is very difficult to make them buy an enterprise plan…it is easier for them, and many times cheaper, to buy a residential offer rather than a B2B [plan], because at first [glance] it’s cheaper and they don’t see, or it’s difficult to show them, the differential support they receive.”

Figure 1: Percentage of SMEs taking consumer mobile plans, by size of business, worldwide, 20192

Source: Analysys Mason, 2022

Many operators’ business units understand this issue and know how to use it to their advantage. For example, Vodafone said, “there is a good business opportunity to move customers from consumer plans to business plans because it creates higher ARPU, lower churn and higher NPS.”

SME spending on mobile voice, messaging and data services worldwide is expected to increase only slightly from USD70 billion in 2020 to USD78 billion by 2025 (2% CAGR). As such, telecoms operators’ business divisions need to develop strategies to expand their SME customer base and increase the average spend per customer in order to increase their market share of mobile data services revenue. Migrating SMEs from consumer plans to business plans is likely to key to achieving this goal.

Mobile operators that become ‘trusted partners’ will have the best chance of gaining SME customers and upselling fixed telecoms and IT services

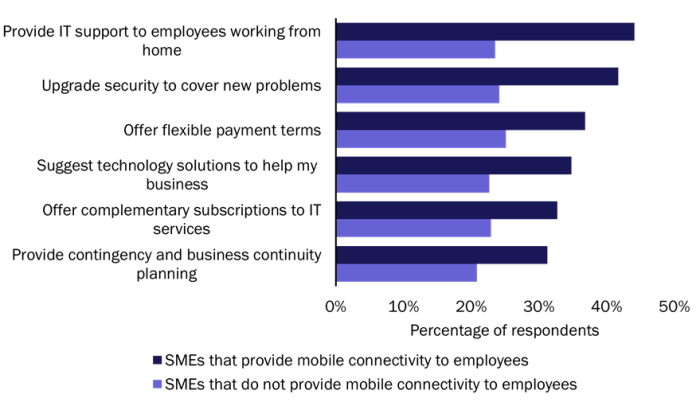

SMEs are looking for providers to help them in a wide variety of ways. SMEs that pay for their employees’ mobile contracts rank services such as supporting remote workers, upgrading security and offering business advice as even more important than those SMEs that do not pay for their employees’ mobile contracts (Figure 2).

Figure 2: Percentage of SMEs that rated various provider services as “most helpful”, Australia, Canada, UK and USA, 1Q 20213

Source: Analysys Mason, 2022

Furthermore, many SMEs (particularly micro businesses) do not have in-house IT staff or external technology professionals that are dedicated to managing their IT service and support. These SMEs therefore need their providers to help them on a day-to-day basis.

Many SMEs are also still struggling with the long-term, continuing effects of the COVID-19 crisis and the rise in remote working. Indeed, the respondents to our most recent ICT Tracker survey4 reported that increasing their reliance on channel partners for strategic help, beyond just IT support, will take on a greater urgency in the next 12 months.

Mobile operators are well-positioned to build upon their existing relationships with SME customers and many already include support services with their mobile offerings. For example, BT/EE provides a “strong service wrapper” with its mobile solutions, which includes free device health checks. KPN customers can opt for a package that combines IT and telecoms solutions but has a single point of contact for support. Telefónica’s Personal Assistant programme provides named contacts for SMEs’ support needs.

We believe that Telefónica is thinking about the right sort of issues (that is, better customer care), but designated, named account managers may not be necessary. SMEs typically just want their problems to be fixed quickly and are likely to be less concerned with who is doing the work. It will also be difficult and costly for operators to provide a named account manager for a large number of SME customers.

Operators that offer value-added services that address SMEs’ unmet requirements will be well-placed to capture a growing share of SME spending

Operators’ business divisions need to compete against both their peers and their own consumer units on more than just price. SMEs want a variety of services to be bundled with their mobile contracts to help support their business demands. As such, creating mobile plans that address SMEs’ unmet needs will position operators to capture a larger share of SME spending.

The attractiveness of various add-on services differs among SMEs. Mobile operators’ business units must therefore target specific firm sizes with value propositions that are most closely aligned with their unique business needs. For example, medium-sized businesses respond favourably to ongoing customer support, bundled mobile security and bundled business software, whereas micro businesses are more interested in service and support for their mobile devices. Business offerings that are comparable to consumer plans, but that come at a small price premium and provide business-class service/support are thus likely to resonate best with micro businesses.

We believe that operators will see an increased take-up of their business plans if they offer plans that are tailored to businesses’ needs. Indeed, Vodafone has reported success with its Prime Contact service and cyber security add-ons, as well as positive results in terms of revenue and Net Promoter Score (NPS) for its business-level insurance plans. Operators should ensure that they are not competing purely on price with their peers or their own consumer divisions. However, they must still be price-competitive and should include extra services that businesses value.

1 Note that we use the term ‘SME’ to refer to micro, small and medium-sized enterprises throughout this article.

2 Question: ”What type of mobile package do you purchase?” n = 2063.

3 Question: “Please rate the following services from IT, telecommunications or technology suppliers in terms of how helpful they would be to your business during the next 12 months?” n = 1435.

4 Analysys Mason surveyed 1049 micro, small and medium-sized businesses in Germany, Singapore, the UK and the USA between December 2021 and January 2022.

Article (PDF)

Download