The number of smartphone shipments is stagnating, but there are still opportunities for operators

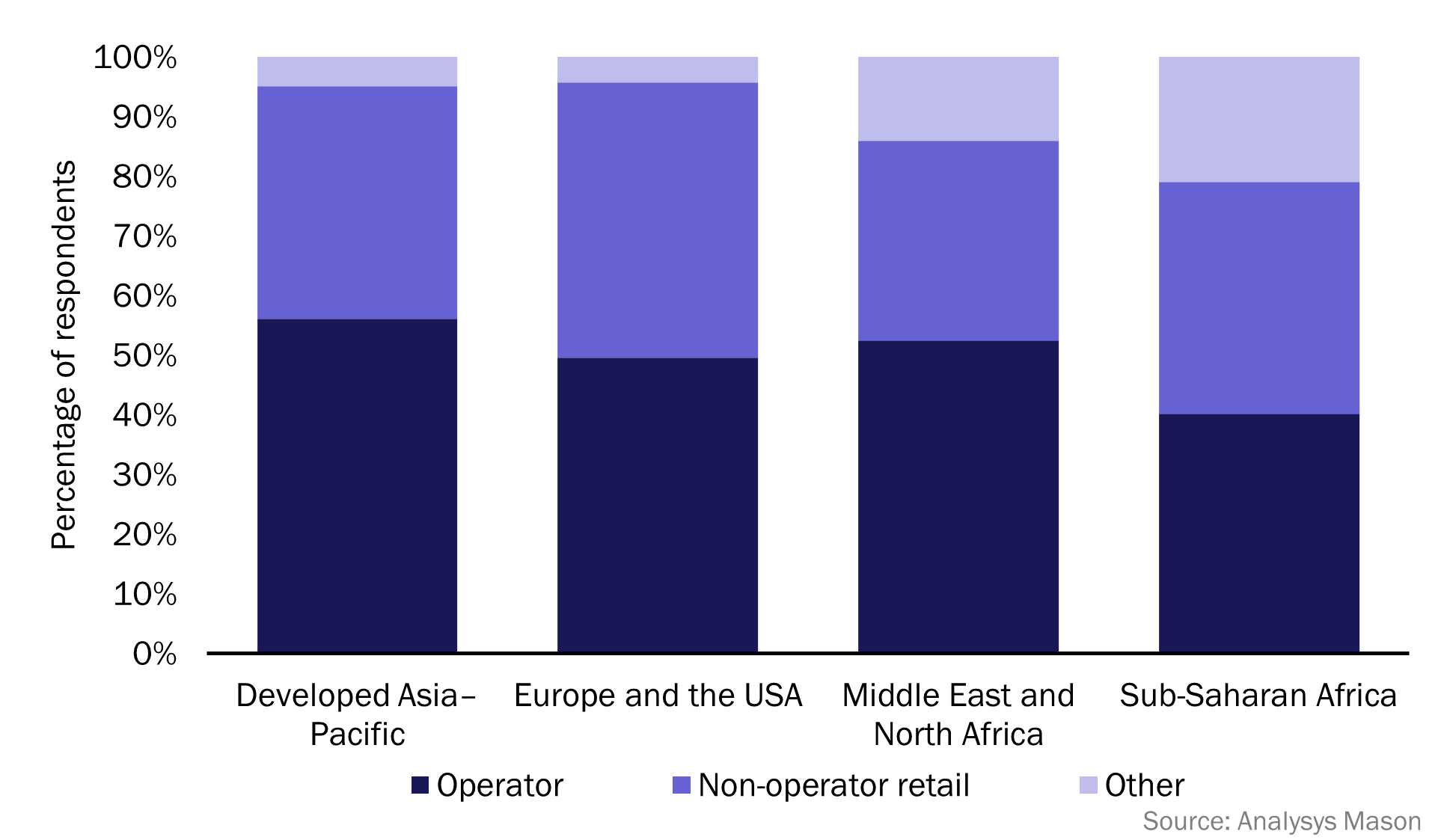

Operators are an important distribution channel for mobile handsets in many countries (Figure 1) because they bundle handsets into their mobile data plans to differentiate their offerings and manage churn. In this article, we use the results of Analysys Mason’s consumer survey to highlight trends in the mobile handset market and related opportunities for operators. We conclude that operators should consider new approaches to handset bundling in light of recent trends in the smartphone market.

Figure 1: Handset purchases by distribution channel, worldwide, 2021

The number of handset shipments in developed markets will plateau in the long term

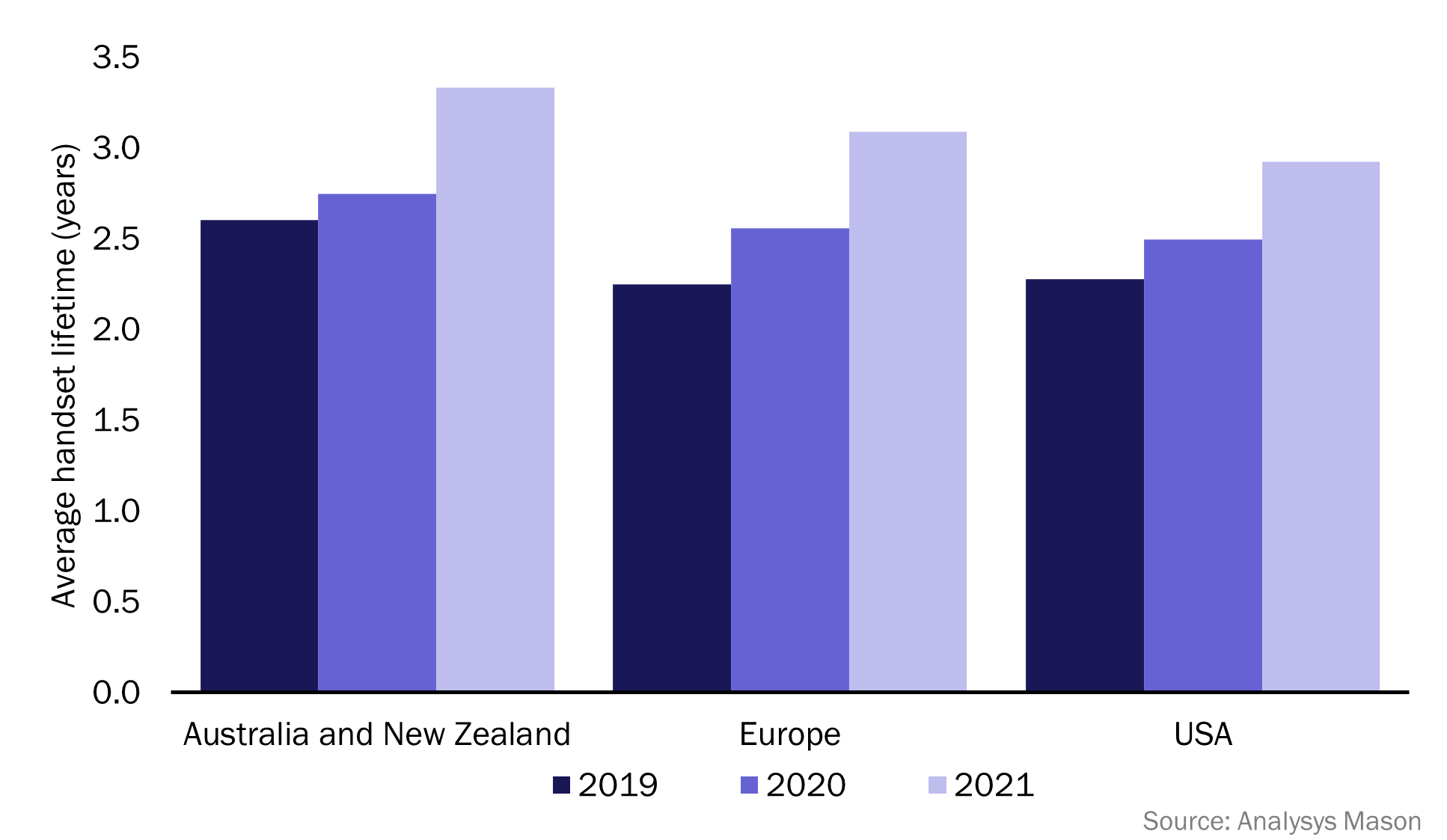

Figure 2 shows the average handset lifetime among respondents to Analysys Mason’s consumer survey. We calculated these figures by adding the reported handset age for each respondent to the time until they plan to replace their device. Handset lifetimes are increasing in all of the regions shown in Figure 2. This is probably because recent innovations in handset technology have not led to radically different features that would incentivise consumers to upgrade their existing handsets. Moreover, global chipset shortages have caused smartphone prices to rise, which may have led consumers to delay replacing their mobile phones.

Figure 2: Average handset lifetime by region, 2019–20211

Analysys Mason expects that longer handset lifetimes will lead to a decrease in the year-on-year growth in the number of handset shipments. The penetration of mobile handsets is so high in developed markets that most purchases are made to replace existing handsets. Indeed, 99%, 97% and 98% of respondents in Europe, developed Asia–Pacific and the USA, respectively, reported owning a smartphone in 2021. We predict that growth in the total volume of handset shipments in these countries will fall as consumers upgrade their handsets less frequently.

There are still opportunities for operators to make better use of their handset distribution capabilities

The popularity of operator handset bundling has declined in recent years. Operators make small, sometimes negative, margins on bundled devices due to the subsidies that these bundles include. Moreover, low growth in smartphone sales and competition from consumer credit options, such as Klarna, have reduced the extent to which operators view handset bundling as a way of differentiating their mobile plans. Indeed, the proportion of survey respondents that reported receiving their mobile handset through their mobile contract fell between 2019 and 2021 in all European countries surveyed, other than France and Germany.1

Operators are increasingly pursuing other strategies to differentiate their offerings and reduce churn. For example, many operators bundle fixed and mobile services together into fixed–mobile convergence (FMC) plans and apply discounts on these plans to differentiate their offerings. However, FMC bundling is less feasible for MNOs that do not have their own fixed infrastructure. These operators could consider the following ways to adapt their handset bundling strategies to better manage churn.

- MNOs could adapt their offerings to accommodate consumers’ preferences for longer handset lifetimes. They could increase the minimum duration of postpaid mobile contracts that include bundled handsets to increase the stickiness of mobile contracts and help to reduce churn. For example, AT&T, Vodafone (Spain) and O2 (UK) all offer long-term contracts (minimum of 3 years) that include the iPhone 12. Survey respondents whose handsets were bundled into their mobile data contracts tend to have shorter average handset lifetimes than those who acquired their handsets through third parties. This suggests that consumers with bundled handsets replace their phones more frequently than they would do otherwise, most likely because they replace their handset at the end of the contract.

MNOs could also offer services alongside their mobile contracts to target consumers that plan to retain their handsets for a long time. For example, Orange Poland offers handset repair services through its Orange Smart Care scheme, thereby encouraging consumers to maintain their existing handsets rather than replacing them when they break.

- Operators could expand their handset distribution activities into countries with low smartphone penetration, such as those in sub-Saharan Africa (SSA). Analysys Mason expects that the smartphone share of mobile connections in SSA will grow rapidly from 45.9% in 2020 to 72% in 2026.2 Affordability is major barrier to smartphone penetration in SSA because many consumers are unable to meet the high upfront costs. Indeed, consumers who can afford to purchase smartphones tend to own low-cost models. For example, survey respondents in Nigeria and Kenya are more likely to own handsets from low-cost Chinese brands than respondents in Europe and the USA. As such, operators can facilitate growth in the take-up of smartphones in SSA by improving affordability. Some operators have already done so, including Orange, that launched the Sanza Touch with an upfront cost of USD32.3 Many African MNOs also offer smartphone financing plans that allow consumers to pay in instalments. Examples include Safaricom’s Lipa Mdogo Mdogo plan in Kenya and MTN’s Pay Mpola Mpola in Uganda.

Growth in the smartphone market is stalling, but operators still have a role to play

There are still opportunities for MNOs to make use of their role as a key handset distribution channel, despite the poor outlook for handset shipments in developed countries. These operators can adapt their offerings to target consumers who wish to maintain their handsets for long periods of time and can facilitate increased smartphone adoption in markets where affordability is a barrier to further penetration.4

1 Here, Europe refers to the seven European countries surveyed in 2019, 2020 and 2021 (France, Germany, Italy, Poland, Spain, Turkey and the UK).

2 For more information, see Analysys Mason’s Sub-Sahara Africa telecoms market: trends and forecasts.

3 Orange, Orange Sanza Touch. Available at: https://www.orange.com.lr/en/devices/orange-sanza-touch.html.

4 For more information, see Analysys Mason’s Mobile devices and distribution channels consumer survey reports.

Article (PDF)

Download