Six mobile security vendors are highly rated by partners, but there is no single clear favourite

Listen to or download the associated podcast

Telecoms operators are looking to expand their mobile security offerings; many are planning to add mobile threat defence (MTD) and mobile application management (MAM) solutions to their portfolios in the next 12 months. Check Point, Microsoft, MobileIron/Ivanti, VMware and Zimperium are best-placed to help operators to achieve this, according to the results of our survey.1 Other mobile security vendors will need to increase operators’ awareness of their brands and solutions to compete more effectively.

We surveyed 27 operators in 3Q 2021 about their mobile security offerings and suppliers

Respondents to our survey included some of the world’s largest telecoms operators as well as small challengers that are only present in one market. The survey was carried out worldwide; we received input from operators in North America, the Middle East, Asia–Pacific, Africa and Europe. These operators either already offer mobile security solutions or are planning to launch them in the next 12 months.

We asked respondents for their opinions on mobile security vendors and for suggestions on how these companies could become more attractive partners for operators and support their sales processes more effectively. We also asked about the operators’ current and planned mobile security offerings for business customers. All of the survey results are captured in our report, Mobile security solutions: survey of telecoms operators.

We asked our panel to rate mobile security vendors in terms of pricing and product quality, as well as overall impression. Check Point, Microsoft, MobileIron/Ivanti, VMware and Zimperium received the highest ratings for overall impression from our panel (Figure 1). It should be noted that the overall impression score refers just to the mobile security business for vendors that have a wider focus than mobile security.

Figure 1: Scores given to mobile security vendors by operators for overall impression, 3Q 2021

| Rating | Average score for overall impression (on a scale of 1–5)2 | Vendors3 |

|---|---|---|

| Highest-rated | Greater than or equal to 4.0 | Check Point, Microsoft, MobileIron/Ivanti, VMware, Zimperium |

| Above average | Greater than or equal to 3.5, but less than 4.0 | Lookout, Symantec |

| Average | Greater than or equal to 3.0, but less than 3.5 | Better Mobile Security, Citrix, IBM, Kaspersky, Pradeo, Sophos, SOTI, Wandera |

| Below average | Greater than or equal to 2.5, but less than 3.0 | BlackBerry, Cyan, ESET, PSafe |

Source: Analysys Mason, 2021

We also asked the operators whether any vendor’s mobile security solutions are particularly well-suited to small and medium-sized businesses (SMBs). Microsoft and VMware were each mentioned four times, and a wide range of other vendors were mentioned once or twice. Operators do not have a clear favourite when it comes to MTD and mobile device management (MDM) solutions for SMBs.

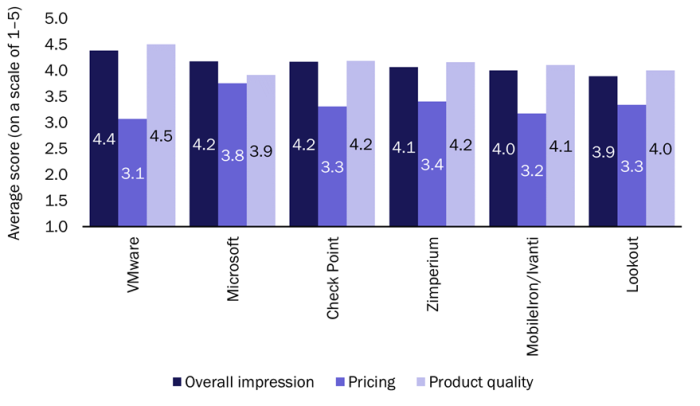

VMware’s score for product quality stood out, as did Microsoft’s score for pricing

Figure 2 shows the average scores for overall impression, pricing and product quality for the six leading vendors from Figure 1. These six vendors are a mix of MDM- and MTD-focused players, and some have portfolios spanning multiple other areas of security. The mobile security offerings of these vendors often overlap but are nonetheless different, so the scores reflect a range of factors. We did not ask operators to compare individual product lines from the vendors. Some caution is therefore advised when interpreting the results.

Figure 2: Scores given to the highest-rated mobile security vendors by operators for overall impression, pricing and product quality, 3Q 2021

Source: Analysys Mason, 2021

VMware received the highest average scores for overall impression and product quality in our survey. Its pricing score was only slightly lower than the average score for pricing among all of the vendors in the survey. This indicates that operators think that its mobile security solutions are expensive, but perhaps worth it.

Microsoft’s average score for pricing was higher than any other vendor’s. It was also the only vendor in the survey that scored above 3.5 for both pricing and product quality. Microsoft consistently received good scores across the board.

Check Point, Zimperium, MobileIron/Ivanti and Lookout received similar scores. They scored significantly higher than the average for overall impression and product quality, and slightly higher than the average for pricing.

We also asked operators to tell us which vendors’ mobile security solutions they currently sell to business customers. Microsoft and MobileIron/Ivanti were the only two vendors to be named as suppliers by more than half of our panel: 16 of the 27 operators surveyed offer Microsoft’s mobile security solutions and 15 offer those from MobileIron/Ivanti.

The mean number of mobile security vendors per operator in our survey is 3.7. Operators that partner with multiple vendors usually work with one MTD-focused vendor and between one and three MDM-focused vendors. This implies that vendors should focus more on conveying how the addition of their solutions to an operator’s portfolio will drive revenue/profit, rather than on why their solutions are better than their competitors’. For example, a vendor should show how its product is well-suited to a certain niche of businesses (micro businesses or firms in specific industries, for instance) or a particular use case.

The leading six vendors are well-placed to do more business with operators; others have work to do

Check Point, Lookout, Microsoft, MobileIron/Ivanti, VMware and Zimperium are well-placed to support operators in realising their mobile security plans. Other suppliers have work to do. Some of the well-known vendors failed to generate strong opinions (either positive or negative) from our operator panel, and need to do more to highlight their mobile security capabilities. The relatively low average scores received by some of the vendors whose primary focus is not on mobile security and/or that are small in scale may reflect operators’ limited awareness of their mobile security solutions and capabilities, rather than poor quality.

1 For more information, see Analysys Mason’s Mobile security solutions: survey of telecoms operators.

2 Question: “Thinking only about the listed vendors’ mobile security businesses, please score them on the following: overall impression; pricing; product quality.”; n = 27. Note that each vendor has less than 27 responses; respondents did not enter a score if they did not have an impression of the vendor. Scores were given on a scale of 1–5, where 1 was the worst/among the worst, 3 was average and 5 was market leading/among the leaders.

3 Shown in alphabetical order.

Article (PDF)

DownloadRelated items

Report

Network firewall and intrusion detection/prevention appliances: market overview

Report

Network firewall and intrusion detection/prevention appliances: vendors and products

Report

Unified threat management appliances: vendors and products