What services are mobility customers buying today, and which service providers are dominating the market?

Starlink’s entry into the satellite mobility market has begun reshaping the purchasing behaviour of service providers and mobility customers, and this impact is expected to persist in the present and future.

The satellite mobility market is continually evolving, driven by technological advancements and shifting consumer preferences. The future of this market holds promising opportunities, but the competitive dynamics are also leading to heightened market risks by introducing uncertainties regarding market demand, pricing dynamics and technology adoption rates. The demand for seamless, on-the-move connectivity, now a strategic necessity for mobility consumers, is fostering innovation, efficiency and collaboration across diverse sectors. In the midst of all the current market activity, how can satellite service providers make their offerings stand out among the many offerings available for end users in mobility markets, and how can satellite service providers meet the increasing customer expectations for fast, reliable and affordable connectivity? More importantly, how can incumbents remain pertinent in this fast-changing, competitive landscape?

Historically, communication for mobility use cases has been limited to basic services such as operational reports and safety-related weather updates. Basic voice calls were also a part of these use cases but were hindered by limited bandwidth availability. However, recently, the landscape has evolved significantly. Mobility use cases now include high-speed internet access to airline and maritime crew members and passengers of subscribed carriers through satellite services. Land-mobile connectivity has expanded beyond government and emergency applications, encompassing a broader spectrum of commercial uses like mobile banking and financial services. This advancement has enabled businesses and individuals to prosper in previously underserved remote areas.

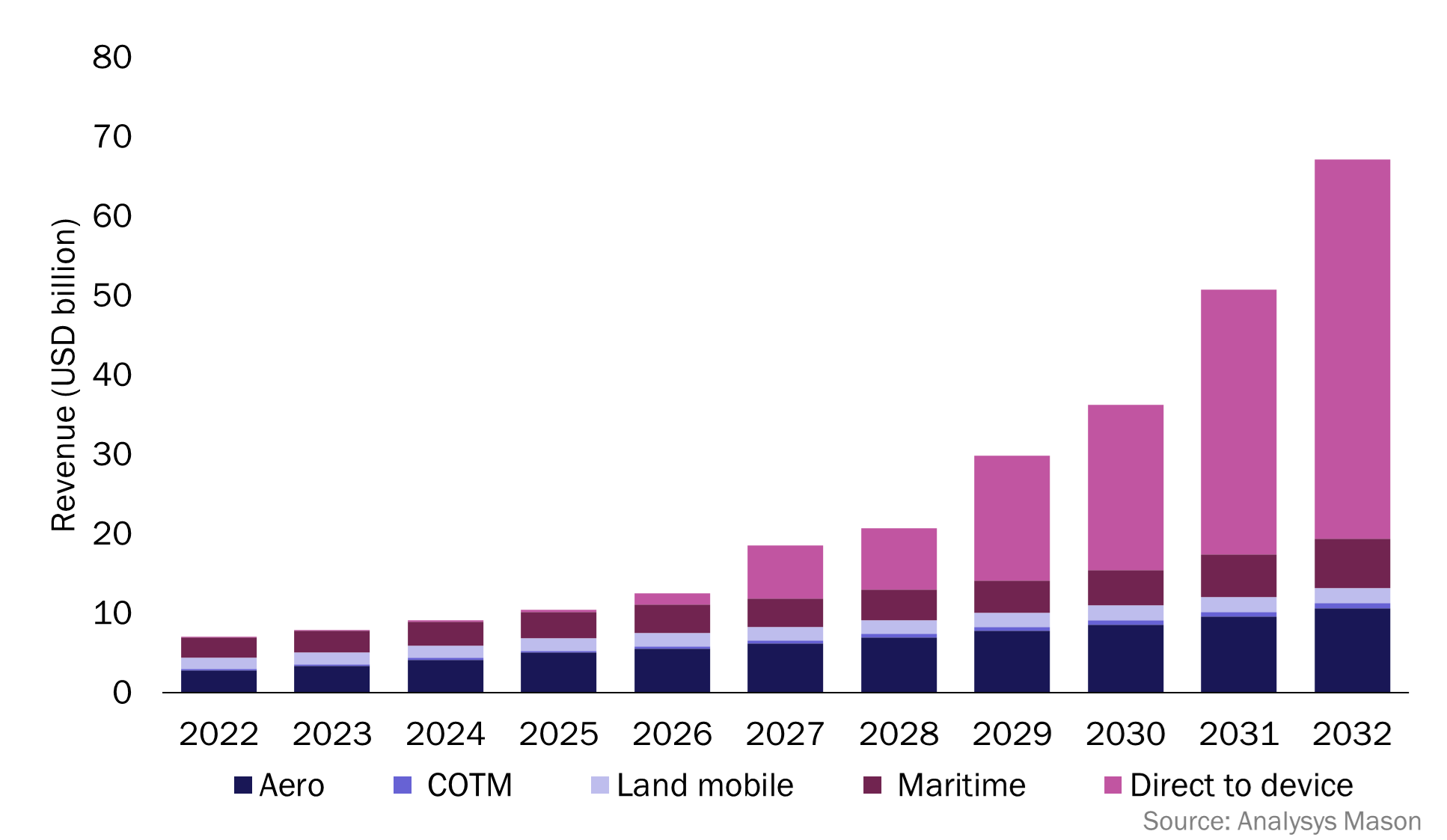

According to NSR’s recent report, Global space economy report, 4th edition, the commercial mobility segment will generate over USD270 billion from 2022 to 2032, growing at a CAGR of 25%. Today’s satellite mobility landscape is no longer limited to basic voice and data services, as it encompasses a diverse range of solutions catered to a multitude of industries and applications.

Figure 1: Commercial mobility revenue by segment, worldwide, 2022–20321

Beyond voice and data: new market segments are emerging

In the satellite connectivity segment, multi-orbit capability/services are presenting a paradigm shift, offering enhanced flexibility, reduced latency and expanded coverage for satellite-based services. Cruise lines are now leveraging hybrid low-Earth orbit (LEO)/middle-Earth orbit (MEO)/geostationary orbit (GEO) packages for high-speed internet at sea, and aeronautical companies are exploring latency-sensitive LEO options for in-flight connectivity, exemplified by Qatar and Hawaiian airlines. The mPOWERED SES and Starlink connectivity offering sets a challenge for traditional GEO satellite operators. A number of GEO operators will need to adapt and innovate in the face of high-speed LEO competition.

Beyond terrestrial coverage, satellite mobility offers a plethora of specialised solutions catering to specific industries. An example of this is the EchoStar collaboration with The Things Industries. This collaboration represents a service that offers satellite connectivity to EchoStar and The Things Industries customers by allowing them to connect IoT devices via satellite for real-time, two-way communications using a dual-transport, generic node. Maritime VSAT systems provide vessels at sea with high-bandwidth internet access. Aviation communication systems enable seamless voice and data exchange for aircraft. National governments and defence forces leverage secure and reliable satellite communication for operations ranging from border security to disaster relief.

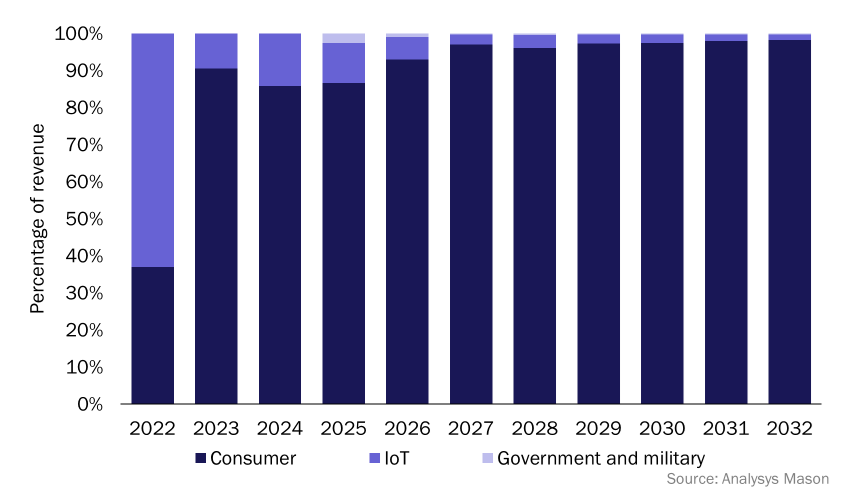

Direct-to-device (D2D) services are enabling end users to access connectivity for their smartphones through satellites. Satellite D2D will significantly influence consumer behaviour in the coming years by shifting communication habits and democratising connectivity. It will expand mobile services, increase user engagement and unlock new revenue opportunities. The focus of D2D in 2024 is on emergency alerts and basic messaging, with industry leaders such as AST, Iridium, Lynk, Starlink and ViaSat/Inmarsat, being among the first companies to offer satellite D2D services.

Figure 2: Satellite D2D service revenue by segment, worldwide, 2022–2032

Addressing the LEO threat and recommendations for GEO operators and service providers

Over the last few years, a pack of new 3GPP-standardised LEO operators have entered the market, and are eager to take a share of the market traditionally dominated by well-established GEO satellite operators. LEO service providers and operators are now offering customers lower latency, higher bandwidth and flexibility, all of which are services that have plagued GEO operators in the past. Due to their high altitude and fixed position above the Earth, GEO satellites inherently introduce latency in signal transmission, which can be problematic for applications requiring real-time interaction, such as online gaming or video conferencing. While facing significant competition from LEO solutions, GEO satellites still hold value due to their unique strengths and niche applications. For example, legacy operators like Eutelsat, Intelsat and SES still have extensive coverage worldwide, high-power satellites and established track records in media and government services.

In response to the competitive threat posed by LEO operators, several consolidations have emerged among GEO players, including the Eutelsat-OneWeb merger, Viasat’s acquisition of Inmarsat and a few more partnerships that will happen in the near to midterm future. Adapting their offerings, forging strategic partnerships and focusing on their differentiating qualities will be crucial for GEO operators to navigate the changing landscape of satellite mobility and remain relevant in the future.

GEO players can leverage their existing advantages, adapt their strategies and invest in technological advancements to stay competitive in this evolving market. In terms of existing infrastructure and mature technology, GEO players already have the advantage but should focus on improving competition by offering combined services, which could either be multi-orbit or multi-band capacities.

GEO operators should invest in micro GEO satellites and software-defined payloads that will allow these new GEO satellites to provide broadband services at lower costs than LEO systems. With this capability, GEO service providers can focus on low-latency applications and improve the flexibility of their services.

Cost-performance optimisation is also a necessary factor to consider for both GEO and non-GEO service providers. GEO service providers should focus on optimising their business strategies by providing targeted service offerings and prioritising customer satisfaction.

Bottom line

The satellite mobility market has evolved from a niche market to a rapidly expanding sector with the potential to transform various industries. Service providers can cater to the growing customer demand by enhancing ground infrastructure and using efficient data compression techniques to boost network performance. Despite the high costs, operators and service providers can consider innovative pricing models, partnerships and cost-sharing strategies.

While LEO constellations present a formidable competitive threat to GEO operators with their low latency, wide coverage and potential cost benefits, the competition is ongoing and GEO operators still have opportunities to succeed. By embracing advanced technologies like beamforming and exploring partnerships or hybrid solutions, GEO players can adapt and compete in the dynamic satellite mobility market. While technological advancements and innovation are crucial, partnerships, alliances and market access strategies are equally, if not more, important to keep in step with new entrants and market disruptors.

1 Comms on the move (COTM).

2 Due to their high altitude and fixed position above the Earth, GEO satellites automatically introduce latency in signal transmission, which can be problematic for applications requiring real-time interaction, such as online gaming or video conferencing.

Article (PDF)

DownloadAuthor