SES and Starlink have established an unusual partnership but it could be the first of many of its kind

Cruise ships have a growing need for high-speed, reliable internet connectivity to meet the expectations of passengers and stakeholders. SpaceX’s Starlink and SES have partnered to offer a managed service to cruise operators called SES Cruise mPOWERED + Starlink, which provides high-speed, reliable internet service to cruise ships, regardless of whether they are clustered in port or far out at sea. It is the first time that cruise operators have been able to use a managed service to offer low-latency and high throughput connectivity services, in what seems to be an unlikely scenario.

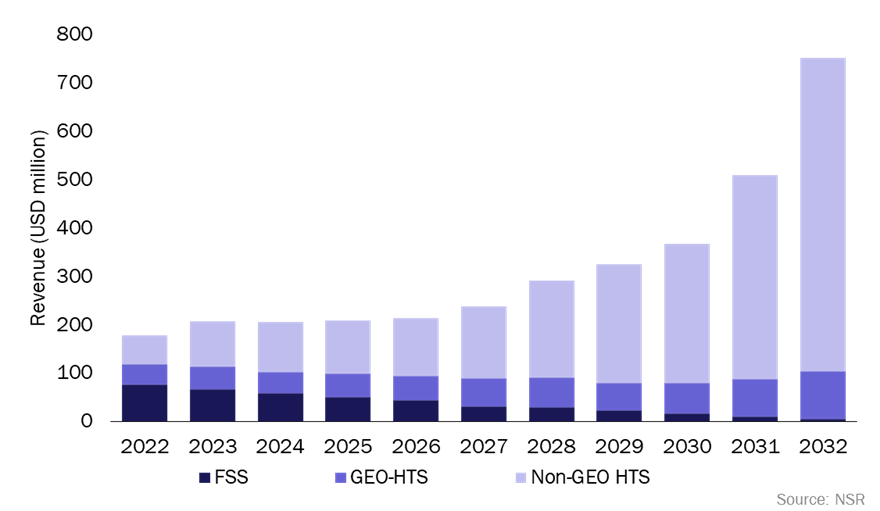

SES is bringing a new multi-orbit hybrid connectivity solution to the cruise industry, integrating SpaceX’s Starlink connectivity into its offering. The integrated low-Earth orbit (LEO) and medium-Earth orbit (MEO) satellite network has no caps on connectivity bandwidth or capacity, removing consumption-based data plans. SES and Starlink appear to be poised to deliver the lowest combined latency on the market, as well as boundless geographical reach. According to NSR’s report on maritime connectivity, the cumulative capacity revenue opportunity for the passenger segment will be about USD3.5 billion from 2022 to 2032, growing at a CAGR of 15% (Figure 1). Operators are on a quest to deliver a unique guest and crew experience by expanding capacity and reach while maximising bandwidth availability.

Figure 1: Passenger capacity revenue, worldwide, 2022–2032

Why do Starlink and SES want to co-operate?

Starlink originally focused on the consumer market, but it quickly delved into other verticals including enterprise, mobility, aero and more; it entered the cruise market at the beginning last year through a deal with Royal Caribbean Cruises. This is not the first time Starlink has worked with an integrator, but it is the first time a major operator has delivered that managed service. Starlink has previously collaborated with other industry players, such as Marlink and Speedcast, and has also signed a reseller agreement with Anuvu.

An integrated LEO + MEO satellite service is a game changer, and Starlink realises this. The agreement between SES and Starlink materialised in response to growing customer demand. Cruise lines are seeking a comprehensive solution encompassing both forward and return capabilities for specific passenger applications and ship operations, and this managed solution will create an entirely new standard for ship connectivity worldwide.

Starlink is limited on upload capability when compared to parabolic systems and could use the network optimisation that the O3b satellite constellation provides. Starlink satellites provide low-latency connectivity, which is ideal for real-time applications while SES’s O3b mPOWER offers higher throughput and extended coverage. LEO connectivity caters to low-latency requirements for passenger applications, such as streaming and real-time communication, while MEO connectivity supports operational needs with high throughput and broader coverage. The combination ensures that passenger and operational demands are effectively met.

MEO satellites, with their higher orbital altitude, contribute to reduced handovers, compared to LEO satellites. The stability offered by MEO satellites, combined with the low-latency benefits of LEO satellites, results in more stable and consistent connectivity for cruise ships, reducing disruptions during transitions between satellite footprints. SES Cruise mPOWERED + Starlink is positioned to offer the industry’s best latency, extensive geographical coverage and unlimited data plans with advanced traffic optimisation for maximum uptime and security. That is the plan, at least.

While SES O3b mPOWER offers higher throughput, Starlink offers global coverage, hence the need for both entities to combine their strengths to deliver industry-best connectivity per ship and low-latency for seamless, high-performance onboard internet experience worldwide, with no service data consumption limitations.

Is this replicable in other markets?

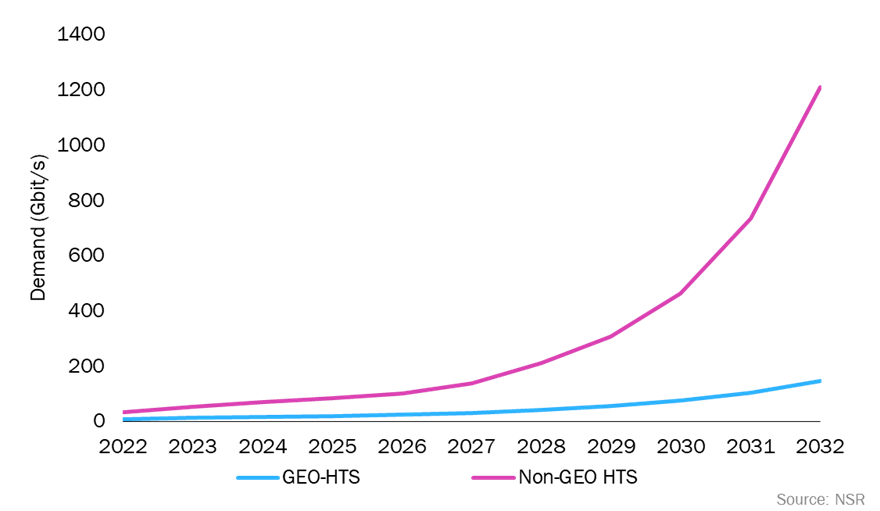

According to NSR’s Maritime connectivity (11th edition) report, demand for fixed-satellite service (FSS) capacity will slowly decrease in the maritime market at a rate of 2.3% during the 2022–2032 forecast period. Non-GEO high-throughput satellite (HTS) services will experience the largest growth in demand (43.4% and a net growth of 910Gbit/s) (Figure 2). Passenger vessels are early adopters of non-GEO HTS services as are leisure vessels. Non-GEO HTS operations for vessels have good business potential; the combination of SES as a MEO operator and Starlink as a LEO operator will give these companies a competitive advantage compared to other players. That is the value proposition and the selling point.

Figure 2: Passenger capacity demand, worldwide, 2022–2032

There is not much competition in the LEO satellite market currently, but Amazon Kuiper might change this; its mature ground infrastructure for cloud operations may be favourable for vessels. AWS already offers a wide range of cloud-based services, including data storage, analytics and machine learning, which can be used to enhance the onboard experience for crew members and passengers. To effectively compete with Starlink in the maritime segment, Kuiper will need to use its existing mature ground infrastructure and the customer base of AWS’s OTT platform and marketplace to provide seamless connectivity to its maritime customers.

Some of the biggest developments in the satellite industry over the past year appear to be pointing to a multi-orbit and highly competitive future:

- the merger between Eutelsat and OneWeb

- Viasat’s acquisition of Inmarsat

- Intelsat’s continuing collaboration with OneWeb and its plans for a MEO constellation

- SES’s planned service launch for the O3b mPOWER constellation.

These developments could improve worldwide connectivity, reduce latency and smooth transitions, meeting the requirements of dynamic mobility applications such as those required for airline in-flight connectivity, or maritime and land-based mobility.

Bottom line

The integration of LEO and MEO capabilities for cruise operators in the maritime industry represents a transformative advancement in connectivity. SES’s expertise and existing infrastructure in maritime connectivity would complement Starlink’s capabilities to enhance service quality and reliability. Eventually, a sizeable chunk of the maritime industry will be multi-orbit-focused as connectivity becomes more and more commoditised.

Customers want the best of both worlds (LEO and MEO). Starlink has yet to prove itself in the maritime space, but it has partnered with an established operator that has strong credentials and expertise thereby accelerating Starlink’s market opportunities and SES is responding to its customers’ requests for LEO options. For the moment, it appears to be a win–win proposition for both entities, but we will let the marketplace be the judge of that.

It will be interesting to see whether this will be a long-standing partnership, or whether the companies will go their own way when technical capabilities on each side have been developed in-house. It is also possible that other partners will get involved. Whatever happens, we are witnessing the beginning of a dynamic future for the maritime industry in which ecosystem development will be characterised by constant change and innovation – not just on the technical front but on the go-to-market aspects as well.

Article (PDF)

DownloadAuthor

Shagun Sachdeva

Senior Analyst, expert in space mobilityRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Tracker

ESG standards and goals: space organisations 2025

Forecast report

Aeronautical satellite communications: trends and forecasts 2024–2034