Many operators can increase their revenue using FWA, even if it remains a niche technology

Conventional wisdom suggests that operators have few opportunities to grow revenue using fixed–wireless access (FWA). Indeed, Analysys Mason’s forecasts show that FWA will account for only 4% of fixed broadband connections worldwide in 2027.1 However, at the individual country level, there are some high-profile examples of operators that have rapidly expanded their presence in fixed broadband markets using FWA. For example, T-Mobile USA and Verizon reached 1.9 million and 4.8 million FWA customers, respectively, in 4Q 2023 after launching FWA services in 2021.2

Analysys Mason’s Fixed-wireless access strategies: six operator case studies and analysis, which is based on interviews with FWA providers, shows that operators have developed strategies for FWA that support their fibre-to-the-premises (FTTP) initiatives and can help them to target specific areas where FWA can be disruptive. The business case for FWA is strongly influenced by geographical factors. Operators therefore need to develop strategies with sufficient geographical granularity to benefit from the opportunities presented by FWA. Operators with long-term ambitions for FWA can also automate internal processes to market and sell FWA based on insights from their mobile networks.

FWA allows converged operators to increase their fixed broadband subscriber base to support their FTTP roll-outs

For many converged operators, FWA is a ‘stepping-stone’ technology for FTTP. FWA can be installed more quickly than FTTP, which allows operators to grow their customer base quickly while their FTTP footprint is growing. This is an important feature of Mobily’s strategy in Saudi Arabia, for example, where the economy is growing, as is the size of the population, which has led to a higher demand for fixed broadband than can be met by the roll-out of FTTP.

Customers will always receive a faster and more-reliable connection from FTTP compared to FWA. As a result, FWA customers are likely to churn once their homes have been passed by FTTP, and FWA tariffs are unlikely to be competitive in areas where FTTP coverage is high.

However, this allows operators to use FWA to their advantage: they can use it to reach new fixed broadband customers quickly, and then upgrade them to an FTTP connection when they have been passed. Vodafone UK, for example, has adopted an ‘FTTP beachhead’ strategy: Vodafone targets areas where it plans to roll out FTTP services in the future so that FWA customers can be migrated to FTTP once its roll-out is more advanced.

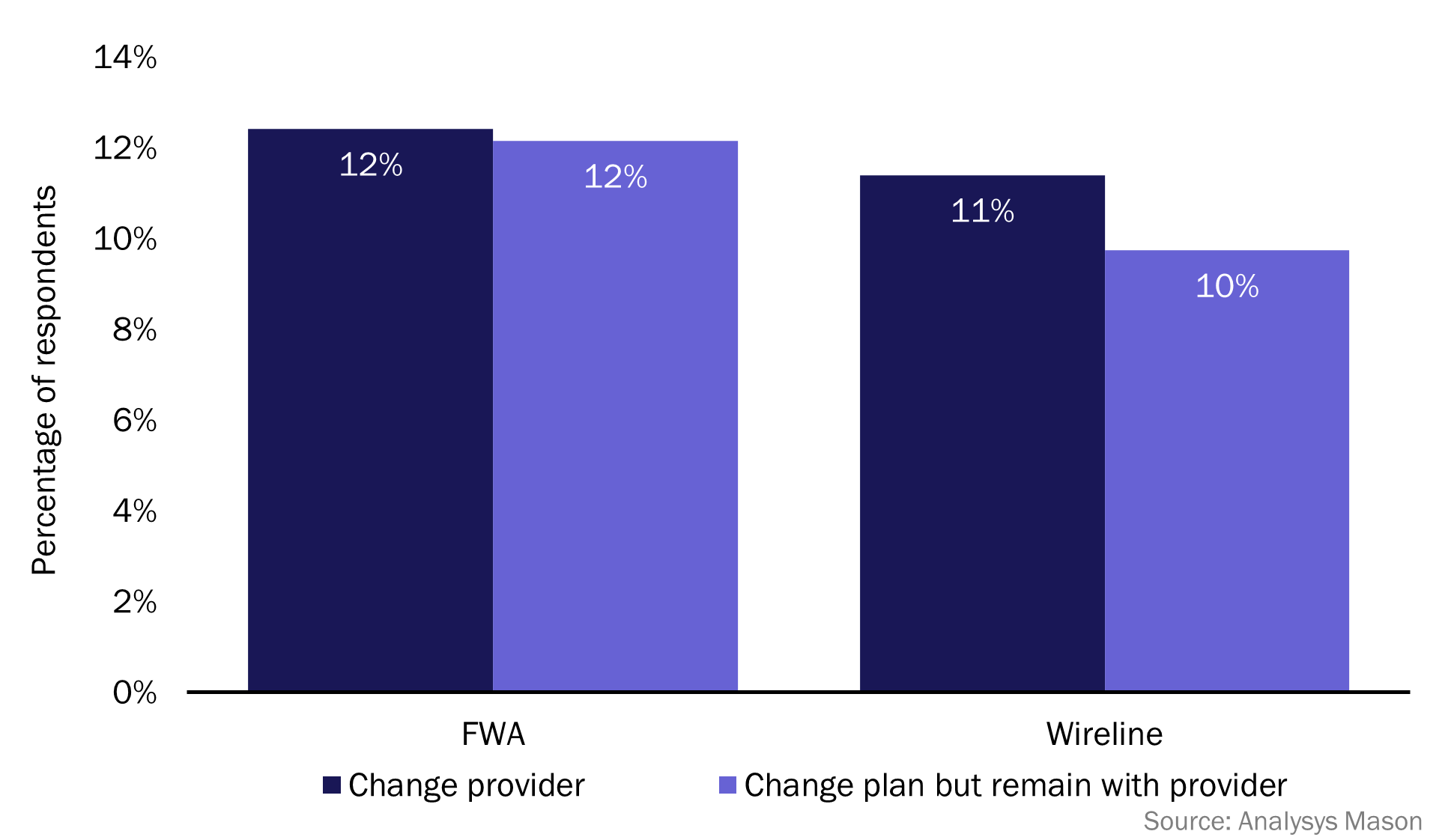

Data from Analysys Mason’s annual survey of 18 000 consumers suggests that this is a viable strategy. FWA respondents were more likely to report intending to change their plan while remaining with their existing provider than customers that took FWA over wireline technologies (for example, FTTP, DOCSIS or DSL).

Figure 1: Intention to change provider and change broadband plan, by access technology, across the survey panel, 20233

Operators need geographically granular strategies to target areas where FWA will be disruptive

During our interviews with operators about their FWA strategies, several operators cited that the average traffic volume for FWA customers was 10 to 20 times that of handset customers. This poses a problem for operators. FWA customers can reduce mobile handset customers’ quality of experience (QoE) if network performance is reduced by traffic from FWA. It can also lead to revenue cannibalisation if operators onboard a small number of FWA customers instead of a large number of handset customers.

One option is to invest in additional network capacity. However, the cost of expanding mobile network capacity for FWA services is often greater than simply purchasing access to wholesale FTTP networks. As a result, operators strategically target areas where there is spare capacity on their network, rather than investing in capacity specifically for FWA. T-Mobile USA, for example, forecasts traffic at individual base stations in order to plan the number of 5G FWA users that it can support at each location without hindering network performance. Operators that have historically been able to offer FWA services without geographical granularity, such as Mobily, will develop a more-granular approach to FWA as they approach maximum network capacity.

The scale and timeline of operators’ FWA plans will determine how much operators should invest in their internal processes for FWA

Operators can generate savings when marketing and selling FWA by improving the efficiency with which they gain insights from their networks. Operators that plan to maintain a long-term FWA subscriber base, rather than use it as a stepping stone to FTTP, will benefit the most from investing in this process specifically for FWA.

Telekom Slovenije, for example, has automated the process by which sales agents are informed about available services at customers’ addresses. Sales agents are automatically informed about the availability of 4G or 5G FWA versus FTTP services at customers’ addresses. This is the best approach for Telekom Slovenije, given that it expects to maintain 7% of its fixed broadband subscriber base on FWA in the long term.

However, we also interviewed operators that use manually updated excel spreadsheets, or held weekly meetings between network and sales teams, as an alternative to process automation. This can be the best choice for operators for whom the potential for FWA is not significant enough to justify further investments. Vodafone UK, for example, does not plan to maintain a large FWA subscriber base once FTTP roll-outs are complete, and has therefore not invested in automating retail processes for FWA.

This is part of a wider trend that we observe among operators that offer FWA services. There are multiple trade-offs that operators must consider when developing their FWA strategies. A strategy that works for one operator may be costly or inefficient for another. Operators need to be aware of best-practice approaches to FWA from around the world to determine which FWA strategies are best for their local market contexts. This way, operators can benefit from the opportunities presented by FWA in the specific contexts where it will be disruptive.

1 Source: Analysys Mason's DataHub.

2 T-Mobile USA reports data for ‘high-speed internet customers’, but it is unclear whether this includes FTTP customers. T-Mobile’s FTTP footprint is small, so most of these customers will use FWA.

3 Question: “Do you intend to make a change to your home broadband service within the next 6 months?” and “What kind of broadband service do you have?”, n = 14 546.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Article

Operators could maximise the capabilities of existing in-home equipment by offering Wi-Fi motion sensing