Low margins on connected car services are forcing operators to innovate

Theoretically, the connected car market offers a large and valuable opportunity for mobile network operators. Every year, tens of millions of new cars are equipped with embedded mobile connections and by 2030 more than a billion cars will have been shipped or subsequently equipped with one or more mobile data connections.

Despite the theoretical potential of the connected car market, most mobile operators have yet to do much more than provide basic (and often low value per gigabyte) data connectivity services to original equipment manufacturers (OEMs), and they have struggled to generate significant revenue.

Softbank’s acquisition of a majority stake in Cubic Telecom in December 2023 for EUR473 million shows that operators are continuing to want to develop the connected car market opportunity. Cubic has developed a platform that can support delivery of connected car services across multiple countries, and which already manages over 17 million vehicle connections.

Other operators that share Softbank’s ambitions in the connected car market need to find ways to increase the value and range of the services they provide to car OEMs, car owners and other potential investors in the industry.

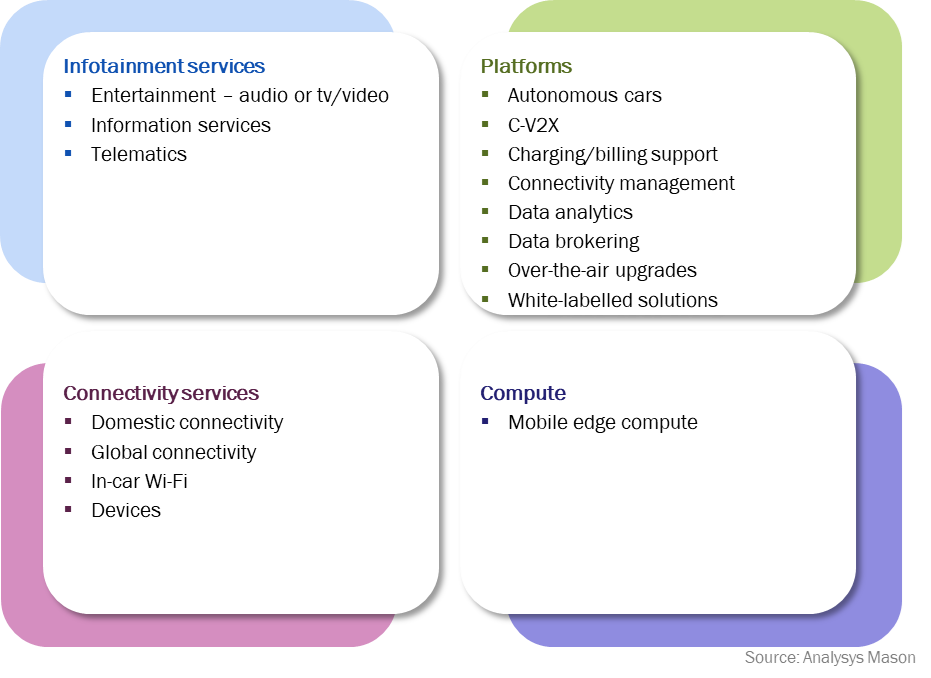

Analysys Mason’s report, Connected cars: six operator strategy case studies, assesses how selected mobile operators are extending their connected car portfolios, and analyses their strategies for growing their connected car businesses. It shows there are a range of connectivity, compute, platform and infotainment solutions that operators can consider.

Monetising connected car data traffic is not straightforward for mobile operators

Mobile operators that want to monetise connected cars face several hurdles.

- Premium car brands often provide data connections to the end customer for free for a few years following the purchase of a new car. Persuading customers to start paying a monthly fee at the end of that period is a challenge. Meanwhile, early attempts by operators to sell dongle-based aftermarket solutions direct to consumers have rarely been successful. People generally just use their smartphones to access content services in cars.

- Connected car data traffic volumes are relatively low. Where the connection is only used for telematics data, usage levels rarely exceed a few hundred megabytes of data per month per car. Even in electric vehicles (EVs) (which make much more use of the data connection for features such as over-the-air software updates), data usage per car only rises to low single digits of gigabytes of data per month. This compares to the average smartphone usage of 16GB per month in the USA.

- Many mobile operators have a weak starting position in the connected car value chain compared to the car manufacturers, and are much smaller in scale. For instance, Volkswagen has more than 25% share of the European car market, far greater than any telecoms operator’s share of the European communications business, and it is around twice the size of the world’s biggest telecoms operators in revenue terms. Car manufacturers are keen to retain control of the customer relationship, and any opportunities to upsell new services. They are not keen to cede this control to mobile operators, and the car companies are in a strong position to negotiate on price.

These factors leave mobile operators competing on price for basic connectivity contracts. Operators that want to maximise their revenue in the connected car market need to move into areas that are adjacent to traditional connectivity and that play to their strengths.

Proactive operators are seeking ways to make their connected car portfolios more attractive

The biggest (announced) OEM contracts have so far gone to companies that can offer platforms and solutions that simplify the task (and cost) of managing international and sometimes global fleets of connected cars. However, operators without the resources or scale to do this have other opportunities open to them (Figure 1).

Figure 1: Overview of operators’ connected car services and solutions

Some of the strategies that operators are employing to make their connected car services more attractive include the following.

- Bundling consumer plans with additional (telematics-based) value-added services. For example Telefónica’s consumer-targeted service in Spain includes SOS, crash, alerts and maintenance services with 20GB of data for EUR3 per month. A more expensive package includes anti-theft alarm services.

- Developing mobile edge compute solutions to support the delivery of new services. SK Telecom, for example, has launched a virtualised broadcast services platform designed for deployment on multi-access edge computing (MEC) infrastructure. This supports ultra-HD broadcast to car passengers, with local advert insertion and emergency alert features.

- Investing in contract and relationship management to smooth the task of working internationally. Singtel has developed a ‘one-stop shop’ solution by forging alliances with other operators in Asia. Its service covers contracts, billing, and support for vehicle connectivity across multiple countries.

- Offering consulting services. Telefónica helps customers to analyse connected car telematics data so they can find ways to improve business processes, or monetise and protect business assets.

- Providing white-label solutions. NTT DATA’s Ubigi subsidiary offers a white-label platform that enables OEMs to create and promote their own connected car retail offers.

Operators are also monitoring the evolution of the C-V2X market and positioning themselves to take advantage should local governments and transport authorities start to invest heavily in C-V2X infrastructure. Most are seeing a potential opportunity to operate the roadside network infrastructure, but Vodafone has gone further. It has developed a platform to enable automated exchange of data between vehicles, street furniture and other machines to support C-V2X safety applications. It has also developed a solution to enable automated exchange of micropayments between all these devices. It hopes this will enable monetisation of what it describes as the ‘pass-by’ economy.

Success is not guaranteed in any of these areas, but operators that do not add value to their services risk simply selling large numbers of low-margin connections.

Article (PDF)

DownloadAuthor