Operators in emerging Asia–Pacific are using FMC strategies to increase their market presence

Fixed-mobile convergence (FMC) bundles are an increasingly common feature in the emerging Asia–Pacific (EMAP) region; they account for a significant proportion of fixed broadband accounts in China and Thailand and are growing in popularity in several other countries, such as Malaysia. Operators in EMAP must assess the potential effects that convergence may have on the markets where they operate and should seek to minimise risks such as poor take-up and 'cannibalising' revenue. The way FMC is promoted varies by operator; some offer additional benefits if customers combine mobile and fixed contracts and others offer explicit discounts to customers. This comment details some of the findings of our recent case study report on FMC in EMAP.

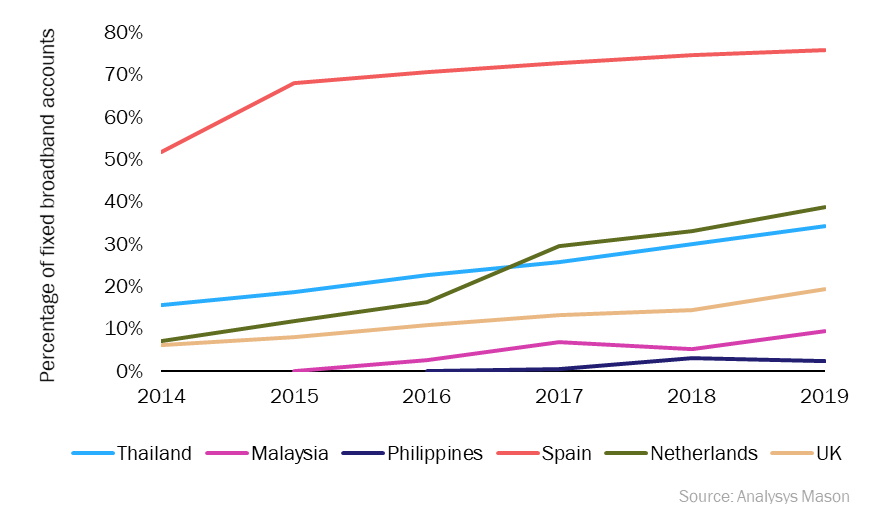

FMC penetration of broadband accounts is significant in some countries in EMAP and is rapidly growing in others

FMC penetration is highest in the region in Thailand (see Figure 1) and China. In Thailand, the largest fixed operator True, hard bundles mobile SIMs in broadband offers and has built a strong mobile base. This has caused competitiors to respond with their own FMC offers. In China, all operators offer FMC bundles, and fibre upsell has been crucial to the development of FMC as it has been in Europe. FMC has had less of an effect in the other three countries that we analysed (Malaysia, the Philippines and Vietnam). FMC offers have had some impact in Malaysia and Vietnam and it is likely that they will become increasingly prevalent in these countries. Fixed broadband services have not reached saturation point in EMAP and many fixed incumbents have not invested in extensive mobile infrastructure so mobile network operators (MNOs) have an opportunity to build a fixed base of subscribers using fixed-mobile convergence offers.

Figure 1: FMC penetration of broadband in selected countries, emerging Asia–Pacific and Western Europe, 2014–2019

Operators across the region are generally using three strategies to promote convergence

MNOs in competitive fixed broadband markets where FMC has already become prevalent (such as AIS and China Mobile) have had used discounting to drive fixed broadband take-up, but in both cases the operators had rolled out their own FTTH networks.

MNOs may not need to offer explicit discounts for mobile customers to encourage FMC take-up. Maxis in Malaysia is promoting a convergence offer that includes fixed broadband service over incumbent Telekom Malaysia's network so its retail pricing is confined by wholesale access costs. Therefore, it offers a mobile data bonus to converged customers rather than a discount. This strategy has been successful in an uncompetitive fixed broadband market.

Some operators have used convergence offers in a similar way to how they have been deployed in Europe: using a strong fixed broadband base to increase mobile subscriber numbers and protect the current subscriber base against churn. China Telecom and China Unicom pioneered this approach in China, and VNPT has used convergence offers to insulate its base in Thailand where the largest MNO, Viettel, has aggressively entered the fixed market.

We profiled five operators in our report, most of which have been successful with their FMC offers

Figure 2 summarises our case studies: we judge the relative successes of each operator based on how various metrics, including mobile and fixed market share of subscribers, subscriber net additions and revenue, have been affected by convergence.

- In Thailand, AIS has used its large mobile base and a discounting approach to convergence to gradually build a fibre broadband base, although intense competition in the fixed broadband market has delayed progress. AIS had a 10% share of fixed broadband subscribers as of 3Q 2019 – not as high as the 20% it had expected. However, FMC may become even more commonplace because 3BB and DTAC recently signed a partnership to begin cross-selling FMC discounts. This demonstrates the pressure that convergence has put on standalone operators.

- In China, China Mobile was the final operator to launch FMC in 2015. Its aggressive FMC offers stalled the progress of its competitors in gaining mobile market share while allowing it to develop a strong fixed broadband base. Its offer of free FTTH broadband to premium mobile customers has resulted in strong take-up (over 70% of total market fibre net additions in 2017 and 2018) and by leveraging its premium mobile base it has preserved the highest mobile + broadband ARPU in the market.

- Maxis has taken advantage of weak competition in the Malaysian fixed broadband market, favourable regulation and an established mobile base to launch a premium FMC offer that provides unlimited mobile data for fixed broadband subscribers. This offer has shown strong take-up: Maxis’s fibre net additions were higher than those of the incumbent Telekom Malaysia in 9M 2019.

- In the Philippines, PLDT has not made much impact with its FMC offer because of high prepaid mobile penetration and the high cost of broadband and postpaid mobile (currently broadband + postpaid mobile is around 14% of monthly GDP/capita). Its FMC offer was withdrawn within a year of launch.

- VNPT’s FMC offer has performed well in terms of mobile and broadband net additions, with an FMC offer that offers broadband customers a pool of mobile data to be shared between multiple mobile SIMs (these can be prepaid). VNPT is consoldidating and insulating its subscriber base and the high prepaid share in the market means it can rapidly increase its mobile base. Since launching the offer, VNPT’s mobile arm, Vinaphone, has overtaken Mobifone to become the second-largest operator in Vietnam in terms of subscribers.

Download

Article (PDF)Related items

FMC will be increasingly important for Belgian MNOs in light of Digi Belgium’s market entry

Article

Fixed–mobile converged bundles pricing: trends and analysis 1Q 2024

Tracker report

AI series: who will be the GenAI winners and losers in the TMT industry?