Satcom operators are reaping the benefits of their mobility strategies

In the past 5 years, satellite operators have undergone significant restructuring in their businesses and have enacted major shifts in their strategies which has resulted in a flat 5-year CAGR at the end of the 2022 calendar year. But further revenue growth is expected, going forward, as overall industry revenue, which declined in 2020, has increased over the last 3 years, albeit slowly. Recent low revenue trends in the video segment is holding operators back from steeper growth, but their strategic shift away from video towards new markets and business models in recent years has proven to be beneficial. In particular, operators with a mobility offering have experienced more robust year-on-year growth. Between 2021 and 2022, the mobility segment strongly rebounded, with revenue growing 14% year-on-year among five operators, which stands in sharp contrast to the video segment, which declined 11% year-on-year.

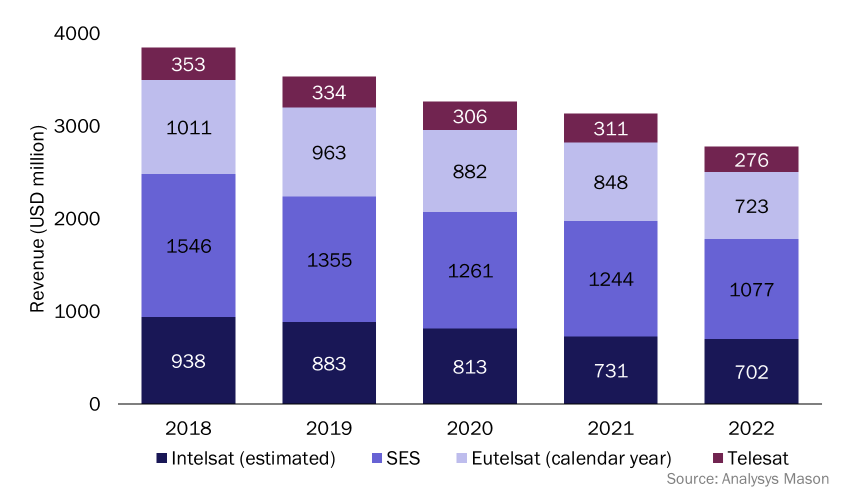

Figure 1: Video revenue per operator, selected operators, 2018–20221

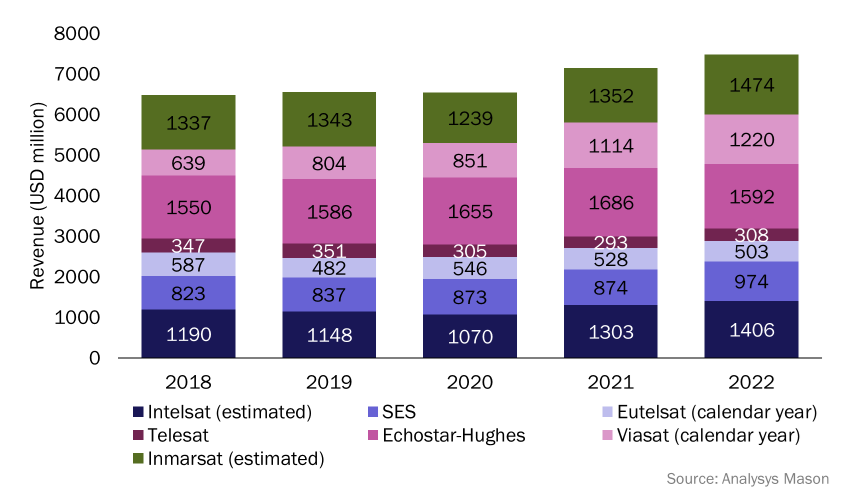

Figure 2: Non-video revenue per operator, selected operators, 2018–20221

There was a double digit increase for reported mobility revenue between 2021 and 2022

NSR’s Satellite Operator Financial KPIs, 13th Edition report, has found that the mobility segment has experienced the highest year on year revenue percentage increase among the larger, global operators. SES’s mobility segment revenue increased 28% year-on-year in FY2023; Eutelsat’s grew 42% year-on-year in 2023; Telesat reported higher revenue from maritime and aero customers in FY2023 than previous years. Operators are recognising the importance of enhancing their mobility offerings. For example, Viasat, even prior to its acquisition of mobility business, Inmarsat, prioritised allocating bandwidth capacity to its growing mobility service rather than its U.S. fixed broadband business. Hughes Network Systems’ announced in November 2023 that it will provide in-flight connectivity services to Delta Air Lines. This is the first time Hughes has made a deal directly with an airline, which highlights the growing trend of adopting new business models for mobility services. NSR, an Analysys Mason company, expects that as operators’ data businesses represent a higher proportion of their overall revenue compared to video, their total revenue will grow by higher percentages than they have in recent years.

Regional operators’ growth strategies

Although the mobility segment boosted the revenue of larger operators, many regional operators have also experienced year-on-year growth thanks to different strategies including inorganic growth, geographical expansion and offering managed services and satellite services in new markets. Yahsat’s revenue grew 6% between 2021 and 2022 due to strong performance from its managed solutions business. Hispasat’s revenue increased by 27% year-on-year, with growth driven by inorganic and geographical expansion. JSAT, APT Satellite and Spacecom also experienced revenue growth between 2021 and 2022 versus Thaicom which was the only publicly reported regional satellite operator in NSR’s analysis to have experienced revenue declines due to market headwinds, price erosion and fleet inefficiency.

The bottom line

Satellite communications operators are starting to reap the benefits of their pursual of new strategies, whether that is operating in a new vertical, consolidation, geographical expansion or new business models. Indeed the aggregated revenue of satellite communications operators have remained flat over the last 5 years, but there has been greater fluctuation depending on the industry vertical. Since 2022, the mobility segment has been the clear revenue booster for global operators following the pandemic dip of 2020–2021 and promises to remain a high-growth vertical in the coming years.

1 Revenue is calculated based on operators’ financial years, unless otherwise specified.

Article (PDF)

Download