Satcom operators can turbocharge the space economy through launches, pricing and partnerships

20 February 2026 | Research and Insights

Article | PDF (3 pages) | Earth Observation| Emerging Space Applications| Government and Military Space| Satellite Capacity| Satellite D2D| Satellite Manufacturing and Launch| Satellite Mobility| Satellite–Telecoms Integration| Space Ground Segment| Space Infrastructure

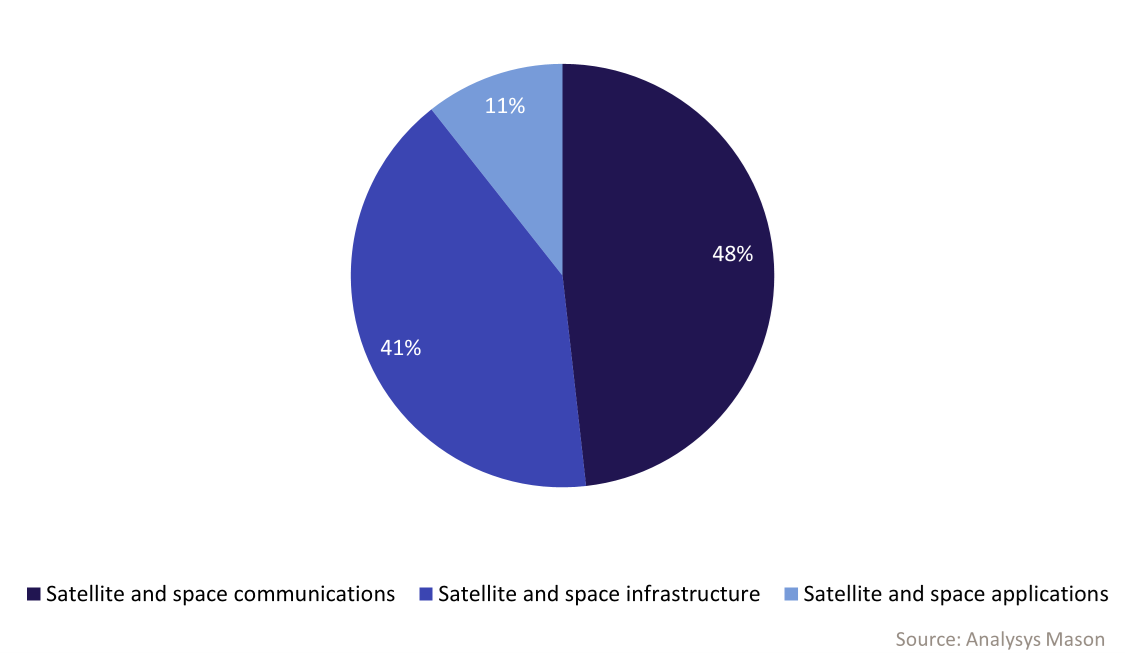

Analysys Mason’s Global space economy: trends and forecasts 2023–2033 projects that the space economy will generate cumulative revenue of USD1.8 trillion worldwide between 2023 and 2033. The main market segment will be satellite communications (satcom), which will contribute over USD847 billion by 2033, almost half of forecast space revenue (Figure 1). Industry players must build and launch thousands of constellation satellites in a timely manner to capture the satcom opportunity. They must also decrease their service pricing and integrate more with mobile network operators (MNOs).

Figure 1: Space economy cumulative revenue share by segment, worldwide, 2023–2033

The global space economy is a USD1.8 trillion opportunity that will require the launch of thousands of satellites

The satcom segment has grown exponentially in recent years, thanks to players such as SpaceX Starlink, Amazon Leo and Chinese operators launching several thousand constellation satellites that offer broadband communications as well as newer direct-to-device (D2D) services.

These launches have given new momentum to building satellites that had not previously seen so much activity, and to ramping up production at scale. Indeed, manufacturers are facing not only shorter time-to-launch windows, but also clients wanting greater onboard capabilities, more flexibility (in terms of, for example, software-defined platforms) and higher throughput on smaller, less expensive platforms.

Operators that are building their own mega-constellations, such as Amazon, SpaceX, and China’s Guo Wang and Qiaofan, have in many cases internalised manufacturing production, and in some cases launching too. The high-volume production trend has led other manufacturers to build and expand facilities to accommodate a flurry of other non-GEO operators who have followed suit and now plan for large constellations. Outside the aforementioned players, Analysys Mason forecasts an addressable market of 7000 constellation satellites to be built and launched by 2034.

However, available launchers, and their timeslot to put these satellites in orbit, are limited. Launchers also remain expensive, and are falling behind SpaceX’s Falcon 9 and its upcoming ‘big brother’, Starship. The latter may bring new opportunities, but it will be focused on large government projects and will only slowly benefit commercial players. Therefore, operators must anticipate launch delays and higher pricing as competition from other constellations slowly builds over the next few years.

Satellite operators must lower prices in emerging regions and integrate more with MNOs

The newer services that satcom constellations offer, such as D2D, greatly expand the addressable market for satellites. They can bring affordable, truly global coverage, and this is expected to unlock demand elasticities, especially in under-developed and emerging economies. However, pricing must come down to ‘ground levels’ so that customers in these economies see them as an option for their connectivity. For example, Analysys Mason’s Predictions for the space industry in 2026 noted that Starlink must ensure its newly arrived services in India are less expensive than terrestrial fixed broadband services in the country to ramp up its market adoption.

For D2D in particular, satellite operators will be looking to grow demand for uninterrupted service and access to connectivity and roaming in areas outside of their current network coverage. They will have to deploy part or all of their services with or via MNOs to leverage their large customer bases. Indeed, MNOs will likely offer satellite D2D to complement their current services and encourage customer retention, thus avoiding churn.

In the end, the success of satcom hinges on players launching satellites at a high cadence, offering affordable constellation-based services (in particular D2D) and partnering with terrestrial network operators to attract customers. By doing so, satcom operators will turbocharge the space economy in the coming years.

Analysys Mason has over 30 years’ experience of providing space research, insights and strategic advisory to clients throughout the value chain. From market assessments and data-driven analyses to complete space strategy development, we have extensive expertise in helping our clients navigate the rapidly evolving space domain. For more information on our space capabilities, please visit Space Industry Consulting and Research Services | Analysys Mason.

Article (PDF)

DownloadAuthor

Claude Rousseau

Research Director, expert in space and satelliteRelated items

Podcast

Analysys Mason’s research topics for 2026

Framework report

Satellite communications and spectrum: a framework for understanding the regulatory landscape

Forecast

Defence satellite mobility addressable market: worldwide trends and forecasts 2024–2034