Satellite opportunity for connecting the unconnected

The International Telecommunications Union (ITU) recently announced that 2.6 billion people, or about one third of the world’s population, remain “offline”, without access to the internet. Recognising this, social inclusion and national broadband strategy programs around the world have been attempting to address this challenge, including with the development of fibre networks taking centre stage, as seen in places such as Australia and Ireland. However, fibre networks can only take countries so far. In Australia’s case, fixed line services on the national network represent ~93% of the population.

Consequently, satellite is one of the only options to cost-effectively serve the remaining populations and has a strong role to play in national broadband plans.

NSR, An Analysys Mason Company’s Rural Broadband Connectivity report has found that social inclusion programs will add 4.7 million satellite connectivity sites by 2031. However, this is typically for use in challenging geographic locations with deployments for some key use cases not going ahead. Wider spread usage potential should not be ignored as the transformative impact of satellite connectivity pushing ‘nothing’ to ‘something’ creates an opportunity where fibre is lacking.

Connectivity is a core component of economic growth for supporting commerce development and social development, such as Taiwan’s recently announced telemedicine project. As such, calls are increasing for a need to accelerate timelines and close the digital divide. Achieving these goals means exploring all opportunities on the table and satellite should one of these.

The Opportunity

A direct and immediate push on satellite services could be a critical connectivity solution to realize immediate returns for the unconnected.

Space economics are changing rapidly. From easier to install terminals to cheaper spacecraft, new use-cases and market segments are being positioned for growth. Social inclusion programs such as Universal Service Obligations or rural broadband funds are areas that will benefit from these changes, by using satellite connectivity to address immediate needs and demands as communities wait for fibre to arrive.

Most rural broadband programs focus on the long-term economic benefits of connectivity. Over the potential decades required for these programs to be completed, significant economic and social opportunities can be lost to these communities due to lack of robust connectivity.

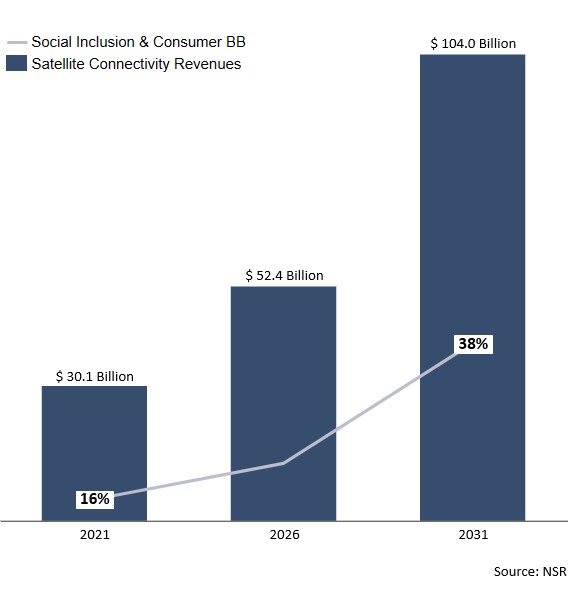

NSR’s Rural Broadband Connectivity report sees consumer broadband and social inclusion set to account for nearly 38% of satellite connectivity revenues by 2031. This market is growing and leaving it to deal with the last 2% connectivity challenges is to miss a solid opportunity.

Figure 1: Consumer and Social Inclusion to account for nearly 38% of Satellite Connectivity Revenues by 2031 [Source: NSR, An Analysys Mason Company, 2023]

At the same time, advancements in high-density non-GEO coverage from providers such as Starlink, OneWeb, and SES are unlocking new throughput and other capabilities providing significant economic benefit potential. Utilizing satellite connectivity to ensure access now and prevent loss of opportunities while awaiting fibre access should be considered.

The Challenge

Movement by national regulators is important to the creation of favourable programs that can leverage space infrastructure plays. Without cooperation from both industry and government, inclusion efforts will face significant challenges to realizing near-term economic benefits.

From the service provider side of the equation, a mix of business models will be required to increase subscriber uptake of satellite services. “Pure-play” consumer broadband connectivity cannot capture low-ARPU customers. Options such as the hotspot model seen via “Internet para Todos” in Mexico have strong potential here where one connectivity location can provide services to cover the core needs of the surrounding community.

The Bottom Line

Gaining access to “something” now has huge positive ramifications for those still awaiting connectivity. Governmental bodies with broadband strategy responsibility would be wise to consider satellite connectivity tenders to achieve their goals at a faster rate and service providers would be wise to pursue them.

Author

Sarah Halpin

Analyst, space and satellite, expert in government and military spaceRelated items

Article

SpaceX’s Starshield is a strong value proposition for the government and military Earth observation market

Forecast report

Consumer and enterprise broadband via satellite: trends and forecasts 2023–2033

Report

Satellite operators’ financial KPIs 2024