Project management solution vendors should do more to understand the opportunities in the SMB market

The COVID-19 pandemic has had a positive impact on the project management sector. Indeed, major players in this field such as Atlassian, Asana, Monday and Smartsheet experienced year-on-year revenue growth of over 40% in 2021. This growth was driven by a net increase in the number of new customers and by customers migrating to the cloud in order to maintain visibility of projects in a remote working environment.

Many vendors expect that these high growth rates will continue during 2022 due to the current boom in spending on digital transformation, particularly among small and medium-sized businesses (SMBs; defined as those with fewer than 1000 employees).

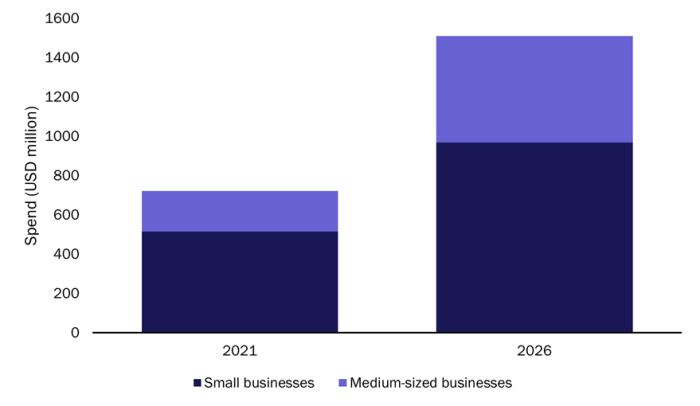

Analysys Mason forecasts that SMBs’ spending on cloud-based project management solutions worldwide will grow at a CAGR of 16% to reach USD1.5 billion by 2026 (Figure 1).

Figure 1: SMB spending on cloud-based project management solutions, worldwide, 2021 and 2026

Source: Analysys Mason, 2022

Success in the SMB segment is crucial if vendors are to maintain such high levels of revenue growth. Project management solutions have historically had a lower penetration among SMBs than other business management solutions such as customer relationship management (CRM) and inventory management tools. SMBs typically have fewer, smaller projects than large enterprises and so have less of a need for project management solutions. Indeed, project managers in SMBs often use a template created in Excel to track a project’s status. However, the continuation of remote working, increased employee turnover and difficulties in recruiting skilled project managers in the SMB space are boosting the need for cloud solutions to enable project members and senior management to access project status information. Vendors should therefore increase their understanding of the specific needs of SMBs to capitalise on the growing demand for project management solutions.

The net increase in the number of new SMB adopters of cloud-based project management solutions will sustain strong revenue growth in the coming 5 years

The main driver of spending growth on project management tools is the net increase in the number of SMB customers. The results of our SMB survey from January 2022 show that the penetration of project management tools among SMBs is now 59%, which is almost four times the figure from 2019. Analysys Mason expects that an additional 1.7 million SMBs worldwide will adopt a project management tool in the coming 5 years.

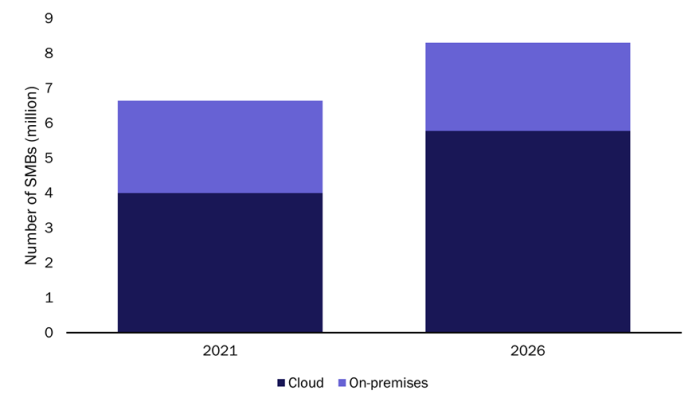

The other factor driving spending growth is the rapidly growing demand for cloud-based solutions. Most project management solutions have traditionally been hosted on-premises; indeed, prior to the pandemic, on-premises deployments were four times more common among SMBs than cloud-based solutions. However, our latest SMB survey shows that the take-up of cloud-based project management solutions has grown 12 times faster than that of on-premises deployments since 2019. We expect that two thirds of all SMB project management solutions will be cloud-based by 2026 (Figure 2).

Figure 2: Number of SMBs using project management solutions, by type of deployment, worldwide, 2021 and 2026

Source: Analysys Mason, 2022

Vendors should work to better understand the SMB segment and should ensure that their marketing is helpful for these customers

The market for project management solutions is crowded and competitive. There are two main types of project management solution in the market:

- add-in modules for industry-specific management systems or enterprise resource planning (ERP) (for example, Procore, Autodesk Constructware and Fishbowl)

- vertical-agnostic products offered by ISVs that are designed for project and work process management (for example, Jira, Asana, Monday.com, Smartsheet and Citrix Wrike).

Solutions of the latter type have become increasingly popular due to their flexibility and customisability. Vendors should therefore work to understand their potential customers’ demographics and address their needs in order to acquire new customers and retain their high levels of revenue growth.

We recommend that vendors do the following.

- Target the mid-market. Medium-sized businesses (MBs; 100–999 employees) have greater appetite for cloud-based project management solutions than small businesses (SBs; fewer than 100 employees). Indeed, the penetration of these solutions among MBs is twice that among SBs, and MBs are 1.5 times more likely to adopt new solutions within the next 12 months than their SB counterparts.

- Target high-growth verticals. Professional services, IT services, manufacturing, healthcare and construction have historically been the major verticals for project management solution adoption in the SMB space. However, the results of our latest survey show that the overall number of new customers in the past 2 years was the highest in the wholesale/retail sector. The take-up of cloud-based solutions grew the most in the service,1 AMTUC2 and wholesale/retail sectors.

- Promote the value of real-time project status tracking. Many SMBs use Excel templates to manage projects; this is particularly true among SBs. Vendors should therefore demonstrate to business owners and project managers how having access to real-time project KPIs can improve employee productivity and customer satisfaction/retention.

- Provide technology consulting services. 74% of SMBs need help when selecting solutions to improve their business operations. Channel partners and industry ISVs play a crucial role in offering guidance to address industry-specific issues. Vendors should therefore strengthen their partnerships with industry ISVs and resellers to increase their exposure to potential SMB customers.

The SMB market for project management solutions is highly fragmented and diverse, so vendors must work hard to increase their market shares. It is therefore essential that vendors understand higher-value targets and help to address their pain points to effectively monetise opportunities.

1 The service sector includes healthcare, hospitality, admin/support/repair/maintenance/waste management and services not elsewhere categorised.

2 AMTUC stands for includes agriculture, mining, transportation, utility and construction.

Article (PDF)

Download