CSP spending on telecoms software and services will reach USD100 billion in 2023

Communications service providers (CSPs) continue to contend with challenging market dynamics: customers want increasingly more-dynamic, personalised, high-capacity and low-latency services; competition looms from new entrants and adjacent players such as webscalers; and investors are demanding better capital and operations efficiency. CSPs' efforts to respond to these three business imperatives will account for most of the growth in spending on telecoms software and professional services (TSPS). This comment highlights the findings of our Telecoms software and services: consolidated worldwide forecast 2019–2023 report, including the areas of greatest spending growth and the key drivers of that growth.

CSP spending on telecoms software and services will grow at a CAGR of 6.5% during 2018–2023 to exceed USD100 billion

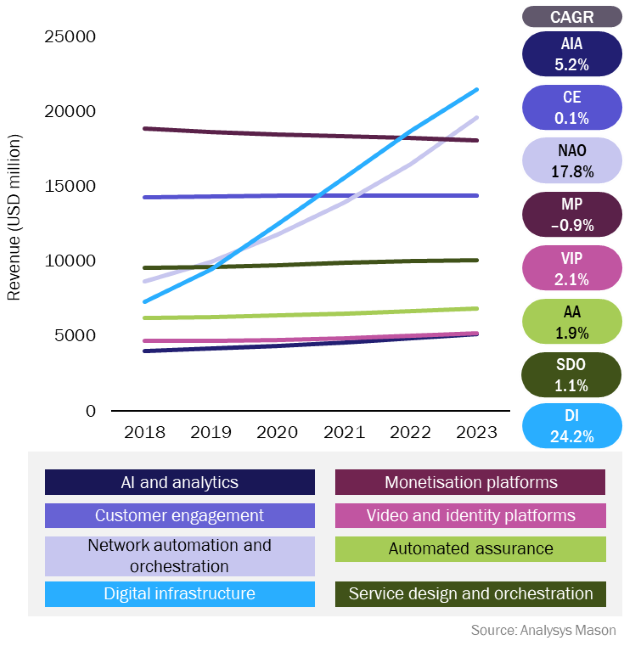

Figure 1 shows actual 2018 CSP spend on telecoms software and professional services as well as forecasted spending for 2019–2023, split into our eight product segments (AI and analytics, customer experience, network automation and orchestration, monetisation platforms, video and identity platforms, automated assurance, service design and orchestration and digital infrastructure).1

Figure 1: Telecoms software product-related and professional services revenue by segment, worldwide, 2018–2023

Digital transformation, 5G and enterprise services will underpin telecoms software and professional services spending growth

Three key drivers will boost overall TSPS spending growth and accelerate the shift in spending away from legacy software solutions during the forecast period: digital transformation (to realise general operational efficiency and agility benefits); 5G; and an expanded range of enterprise services based on network function virtualisation and software-defined networking (NFV/SDN), multi-cloud connectivity and edge computing.

- Digital transformation will facilitate customer-focused automation initiatives for service management, AI-driven customer engagement and workload migration to cloud-native operations. NFV/SDN will play a major role in enabling automation and agile orchestration. Digital transformation, however, mandates that CSPs (and their vendors) change the way that they organise and resource their businesses, which requires vision, time and ongoing effort; few if any CSP digital transformations will be complete by 2023.

- Many new and promising 5G-based enterprise services require network slicing and edge clouds, which make good use of 5G's greatly increased speed and capacity, but which also increase network and operational complexity. CSPs will need to invest in software and services to automate and optimise 5G and end-to-end operations to ensure efficiency and to meet performance expectations and opex reduction goals.

- The enablement of new enterprise services such as SD-WAN is becoming a key area of CSP investment. Demand for edge clouds will rise during the forecast period as enterprises seek operational efficiency with acceptable latency for a new set of applications. Beyond the services themselves, CSPs will need to invest in order management and delivery systems, as well as assurance and analytics systems for the most-agile and differentiated services.

These three drivers will lead to strong spending growth in the two newer software and services segments, NAO and DI, which will become the two-largest segments. This development will change the mix of spending in the other six software segments, with a higher priority placed on products and services that support the three drivers. Compared with our forecast released in January 2019, we have increased our 2018–2023 spending growth expectations for the three highest-growth segments based on discussions with operators and vendors.

Several forecast trends emerge from an analysis of Analysys Mason's more-granular data, which is available to subscribers of our research programmes.

- Product spend will overtake professional services spend in 2022 as CSPs buy virtual network functions (VNFs) solutions (shifting capex from hardware to software); seek out standard, minimally-customised vendor solutions; and use supported open-source products wherever possible. Product-related revenue will grow at a CAGR of 10% during 2018–2023, driven by NFV, SDN and cloud computing migration.

- Delivery of software as a service (SaaS), rather than through perpetual or term licences, will rise from 5% to 12% of total product spending between 2019 and 2023, led by CSP spending in the customer engagement (CE) and AI and analytics (AIA) segments. Over 20% of product spending in these segments will be delivered as SaaS by 2023 because SaaS's benefits (including minimal upfront investment, usage-based expense and the ability to experiment incrementally with new customer engagement and other models) are clearest to CSPs in these areas.

- Professional services spending will grow by only 3% annually through 2023. The best revenue growth opportunities will emerge from NFV/SDN and network orchestration integration, as well as CSPs' shortage of in-house skills to create data analytics-driven open, multi-vendor, 'best of breed' disaggregated architectures.

CSPs and vendors will need to change significantly to capture the full benefits of software and services investments

In order to maximise the benefits of digital transformation, 5G and expanded enterprise service opportunities. CSP and vendor organisations will need to embrace new ways of achieving business goals, such as with DevOps, intent-based design, analytics-based automation and more-flexible commercial contracts. Increased importance will also be placed on multi-vendor ecosystems and modular 'componentised' solutions that can be integrated and automated end-to-end to support agile services.

Our research regularly confirms that support and direction from upper management and organisation-wide understanding and reinforcement of business goals are fundamental to successful digital transformations.

Long-term vision, incremental goals and new approaches will help CSPs and their vendors maximise TSPS investment returns

CSPs must consider their end-to-end strategy for digital transformation, 5G and expanded enterprise services from the outset to ensure a cohesive transformation across the business or risk fragmented operational systems, islands of automation and mismatches between, for example, 5G network requirements and SDN-based backhaul capacity availability. SaaS delivery can be especially pertinent to CSPs where investment demands are high, and investment risk and demand are unclear, such as with 5G roll-outs and edge computing, respectively. CSPs can improve agility and competitive differentiation by automating the delivery and ongoing operations of enterprise services through the use of customer self-service portals, model-based design and configuration, orchestration and other tools.

Vendors need to consider that CSPs' digital transformation journeys will increasingly require them to be part of multi-vendor ecosystems and vendors must therefore design their products to be modular and incorporate open-source software and open architectures to allow easier integration. Vendors can also provide much-needed expertise to CSPs in the midst of digital transformations. For example, they can augment CSPs' in-house expertise through consulting, VNF onboarding, integration, education, data science/data analytics, DevOps, build-operate-transfer and other services. Finally, vendors should increase software delivery flexibility through SaaS, revenue-sharing and other options, and evolve their own organisations to support flexible delivery and their customers' desire to take advantage of it.

1 See Analysys Mason’s Telecoms software and services: consolidated worldwide forecast 2019–2023 for spending breakdowns by product and professional services, geography and service type, as well as definitions of and details about spending drivers at the software segment and sub-segment level.

Telecoms software and services spending will grow at a CAGR of 6.5% between 2018 and 2023 to exceed USD100 billion, largely as a result of NFV/SDN-based digital transformation, 5G roll-outs and enterprise service expansion. This comment provides analysis of the key business imperatives behind the growth and growth expectations for Analysys Mason's eight telecoms software and professional service segments.

Downloads

Article (PDF)Latest Publications

Strategy report

Retrieval-augmented generation: considerations for GenAI platform vendors targeting telecoms operators

Strategy report

Intelligent automation strategies for next-generation RAN

Strategy report

eBPF for cloud-native networks: operator use cases