Transport network spending is increasing and vendors must adapt to the changing market

05 October 2022 | Research

Article | PDF (3 pages) | NaaS Platforms and Infrastructure

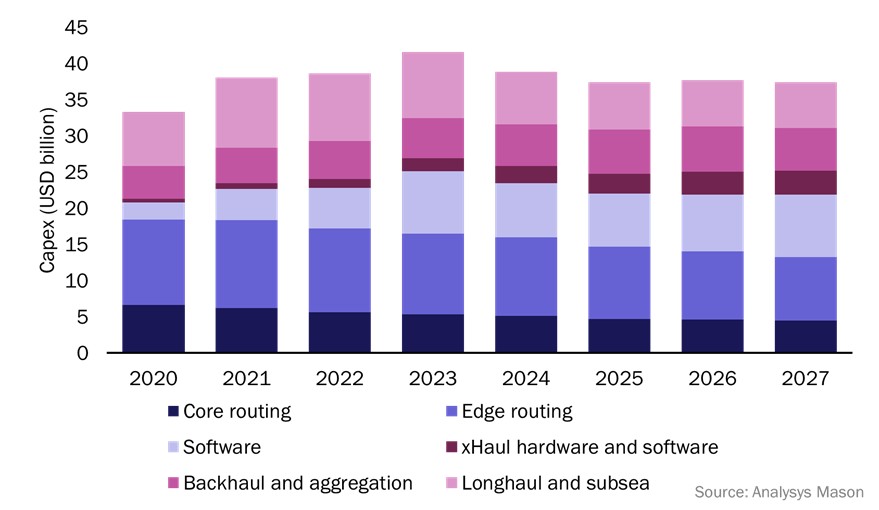

The rising demand for high data rates and reliable connectivity is leading to significant growth in operator spending on transport networks, and is driving change in transport technology and the ecosystem. We expect that operators’ annual transport network capex will peak at USD41.5 billion in 2023, up from USD33 billion in 2020, and will continue to average at USD38 billion until 2028 (Figure 1). To successfully tap into this revenue potential and to improve their market share, vendors will need to diversify their offerings and business models quickly to meet the demands for new transport network architecture and technology. These technology changes are driven by the need to support greater scalability, convergence, manageability and agility.

Figure 1: Operator capex on transport networks, by technology/architecture category, worldwide, 2020–2027

We have identified specific emerging growth areas within the transport network market, and it will be important for all vendors to consider focusing on at least one in order to maximise revenue growth. These areas are network convergence, xHaul and longhaul and subsea network investment.

This article is based on Analysys Mason’s new transport networks framework report and accompanying vendor list. These resources will help vendors to understand the changing structure of the transport networks market and the largest growth areas, while identifying important players and ecosystems within the sector.

Operators are increasingly investing in converged access networks, which places new demands on transport

One way for operators to build scale, reduce cost and improve operational efficiency is to evolve towards a single transport network that can support fixed, mobile and sometimes Wi-Fi access networks. Operators are also interested in network convergence because of the growing need to support a diverse range of 5G enterprise and consumer use cases that require capabilities, such as ultra-low latency and multiple types of connectivity. We forecast that 62% of operators’ transport network capex in 2027 will be to support converged access, up from 11% in 2020.

Additionally, operators are looking to converge the IP and optical layers to increase the flexibility, simplicity and scalability of the transport network. The convergence of these two layers will require vendors to support key technical enablers, such as software-defined networking (SDN), 400GE routing and XGS-PON.

400G+ coherent pluggable optics are a key enabler of IP-optical integration. 400G was once limited to metro/edge networks, but now supports longhaul and subsea networks. The 400G coherent transceiver can be plugged directly into the router, helping to simplify the network infrastructure.

SDN increases interoperability across the networking layers, offers the potential to obtain IP and optical equipment from multiple vendors, improves network visibility and allows operators to route traffic to the lowest-cost layer. The SDN market is expected to be worth around USD70 billion by 2024. XGS-PON technology has gained increasing attention from operators for achieving capacity above 10Gbit/s.

We have identified Ciena, Cisco, CommScope and Huawei as being particularly well-placed to provide software and technology in all areas of the network convergence ecosystem.

xHaul is expected to disrupt the mobile backhaul market

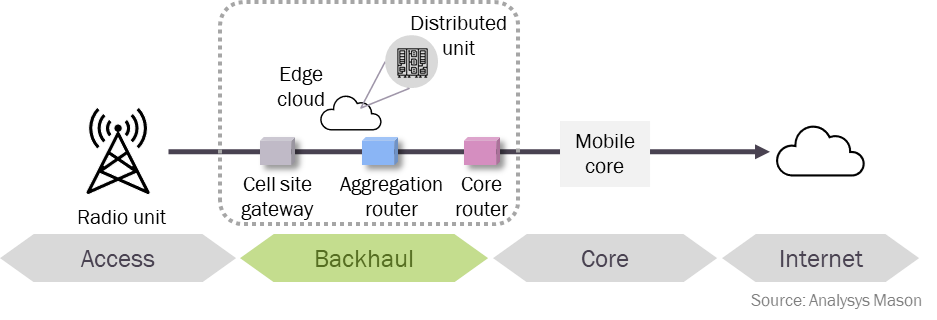

Rising volumes of traffic will drive spending on backhaul capacity, and disaggregated RAN architecture will introduces two new categories, fronthaul and mid-haul, which connect different RAN elements at very high speed and low latency. An xHaul architecture can support all three on a single platform. Vendors that offer xHaul-ready hardware and software are likely to be at a competitive advantage, particularly as operators shift away from traditional backhaul architecture. xHaul investment is growing, driven by RAN disaggregation and virtualisation, as well as the need for 5G densification. The modular architecture of xHaul offers flexibility to achieve the lower-latency and higher data rates required of advanced 5G use cases. We forecast that operator spending on virtualised-RAN-related xHaul technologies will overtake spending on conventional backhaul technology after 2025.

Key components of an xHaul architecture (Figure 2) include; cell-site gateways that link the radio unit to the distributed unit; an aggregation router or fronthaul gateway to combine multiple fronthaul and mid-haul links; and the core router to connect all these links to the core. These elements may come from a single or multiple vendors and may be virtualised or physical.

Figure 2: Important product/technology categories within the xHaul sector

Ciena, Cisco, Ericsson, Huawei, Juniper and Nokia are influential in the xHaul ecosystem and are likely to be important partners for service providers and specialist suppliers.

Ownership of longhaul and subsea networks is diversifying to include new ecosystems and connectivity hubs

The requirement for advanced global connectivity to support growing data traffic demands has changed longhaul and subsea technology and investment, and has encouraged hyperscalers and wholesalers to get increasingly involved. Hyperscale and cloud companies such as Meta, Google and Microsoft have been investing directly in the roll-out of longhaul networks, to increase the pace of global connectivity. This has created a clear shift away from the operator consortia that traditionally built these networks. Therefore, we expect telcos to invest in new transport network ecosystems and hubs that include hyperscaler or wholesaler investment.

This change in ownership has the potential to save telcos up to USD85 billion in capex, which is particularly important in a period of high expenditure, when two capex-intensive cycles, 5G and fibre, are coinciding with growing global demand for cloud computing, software as a service (SaaS) and video streaming. Operators will benefit from establishing collaborative relationships with hyperscalers, to pursue mutual benefits rather than entering competition.

Transport networks that are built by wholesalers and hyperscalers have economic and technological benefits. In general, hyperscaler networks cost far less per unit of capacity than ones built by traditional telcos, because the hyperscaler network infrastructure is built from scratch. Longhaul and subsea transport networks are evolving quickly and are being redesigned using cost-saving technologies such as mesh-networking, super coherent optics, carrier aggregation and low-earth orbit (LEO) satellites.

Analysys Mason’s Transport networks: a technology and investment framework report covers these three important trends in depth, and discusses the important technologies, players and ecosystems for each. The report also lays the foundations for future forecasts and strategy analysis.

Article (PDF)

DownloadAuthor

Grace Langham

Analyst, expert in sustainability and ESGRelated items

Company profile

Comviva: network API exposure infrastructure

Article

DTW Ignite 2025: vendors and partners are ready and waiting for operators to fully commit to network APIs

Podcast

Network-as-a-service (NaaS) providers will collectively generate USD14.7 billion from their offerings in 2029