Incumbents are confronting disruptive operators with their own mobile data pricing strategies

In an analysis of mobile pricing in France, the UK and the USA in 2Q 2016, we observed that competition in the mobile market is largely between operators that use disruptive pricing tactics and those that do not, and demonstrated clear differences in the pricing approaches of these two types of operators. We also argued that the mobile plans of these 'disruptive' operators should appeal to the mass market and not just price-conscious segments. In this article, we use data from our most recent mobile pricing tracker to investigate the changes in mobile pricing in the three countries since 2Q 2016. We analyse whether and how operators with traditionally more premium positioning have adapted their prices to those of their disruptive peers.

The market is adapting to the lower prices introduced by the disruptive operators

In our previous analysis, disruptive pricing tactics were found to have two key characteristics.

- Prices per gigabyte were lower than the average market price for all data allowance sizes.

- Premiums for very large or unlimited plans were minimal; disruptive players also tended to offer larger data plans than their competitors.1, 2

These two characteristics enabled disruptive operators to communicate their price advantages clearly, and capture market share quickly. Moreover, these operators have steadily improved their network quality (often considered their area of weakness), and are bundling key services to match those of their more premium competitors. Unsurprisingly, they have been shifting consumer expectations about the relationship between value and quality. In our new analysis, we see that competition in the three markets has begun to adapt to these changes, although not in identical ways.

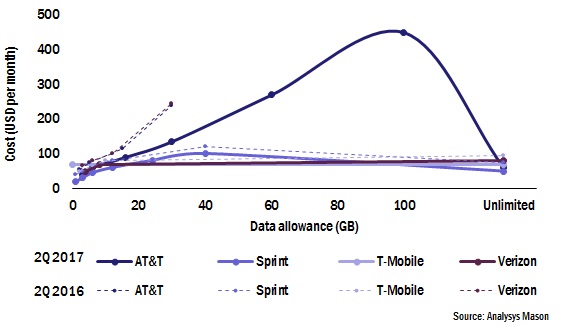

US operators have all adopted unlimited data plans but restrictions enable them to charge premiums for capped plans

AT&T and Verizon in the USA have recently introduced discounts to approach the prices of Sprint and T-Mobile, the operators associated with disruptive tactics. In our 2Q 2016 analysis, we observed that T-Mobile and Sprint’s data plans were consistently cheaper than those of AT&T and Verizon. Moreover, they were the only ones with unlimited data plans. Since then, AT&T and Verizon have reduced prices across most data tiers and introduced their own unlimited plans at relatively competitive prices.

However, unlimited plans in the USA often come with several restrictions that allow some operators to charge premiums for their capped plans. For instance, AT&T’s Unlimited Choice plan comes with 3Mbps connectivity and video quality limitations, as well as a monthly 22GB per SIM fair usage limit, while its capped plans come with full-speed connectivity. The Unlimited Choice costs USD60, the same as the 6GB capped plan. Sprint also has three capped plans that are more expensive than its unlimited plans, although its expectations of premium on them appear more modest than those of AT&T. In summary, the introduction of unlimited plans in the USA has led to two-tier data pricing: affordable unlimited plans with speed restrictions, and capped plans that command premiums due to the absence of such restrictions. We believe that this split may become less pronounced in the future (that is, AT&T’s steep curve will flatten (see Figure 1)), because T-Mobile no longer offers capped plans and Verizon’s pricing structure greatly incentivises unlimited plans.

Figure 1: Mobile plans by price, allowance and operator, USA, 2Q 2016 and 1Q 2017

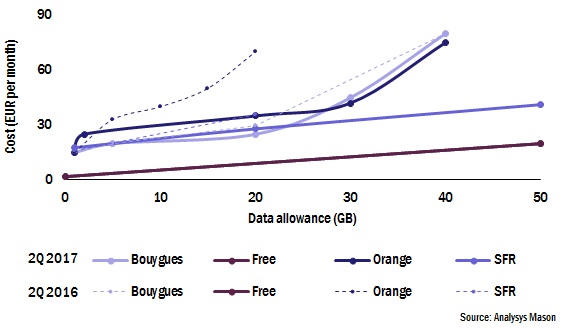

Operators in France are trying to extract premiums, but in the high- rather than the low-end of the market

In France, Free Mobile’s plans are still the cheapest across all data tiers, but the other operators did revise their pricing to narrow the gap slightly. Orange and SFR have extended their available data plans to more than their previous limit of 20GB per month to 40GB and 50GB respectively, more closely matching Free’s plan of 50GB per month.3 Unit prices have declined, but some operators, especially Orange and Bouygues Telecom, still expect premiums from their higher-end customers as indicated by the steep upward curves after 30GB (see Figure 2). The difference in pricing here stems mostly from these operators’ bundling of media content subscriptions, as well as international calls and roaming benefits. SFR has come the closest to mimicking Free Mobile’s approach, yet, despite all adjustments, disruptive pricing remains salient in France.

Figure 2: Mobile plans by price, allowance and operator, France, 2Q 2016 and 1Q 2017

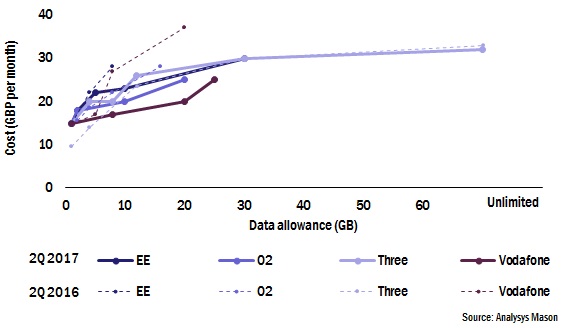

O2 and Vodafone have undercut Three’s prices in medium and large data tiers

Mobile data prices in the UK have not been as different across operators as they have been in France and the USA, but Three’s more-affordable and unlimited data plans have caused a shift in the market. However, all operators decreased their prices recently, especially for larger data allowances. In fact, both O2 and Vodafone have introduced tiers that are priced below those of Three, challenging the latter’s distinct position as the most affordable option in the UK. Vodafone’s new offers are the cheapest in the market after 10GB, a major shift from its premium pricing that we observed in 2Q 2016. Three’s small premium for its unlimited data plan might continue to attract heavy data users, but O2 and Vodafone are well-positioned to target segments with medium-to-high data usage.

Figure 3: Mobile plans by price, allowance and operator, UK, 2Q 2016 and 1Q 2017

Is it the turn of ‘disruptive operators’ to make a move again?

The price advantages of disruptive operators have begun to diminish, especially in the UK and the USA, where other operators also implemented affordable mobile plans. In our next analysis, we will be curious to see whether, and how, disruptive operators will reinforce their ‘consumer-friendly’ image, as their competitors close the pricing gap. They might rely on further price cuts or seek more-innovative tactics to stand out in their markets.

1 We considered operators’ main SIM-only monthly rolling postpaid mobile plan prices, except for Orange’s ‘Origami’ and SFR’s ‘Forfait’ prices, which are based on 12-month commitments. The data allowances shown are not exhaustive, particularly for smaller allowances. Larger data allowances have been omitted if they cannot be shown on the same scale and do not significantly alter the trend depicted.

2 Prices are as of March 2017 for the USA, and January 2017 for France and the UK. Some operators might have changed pricing since then (for example, Free in France).

3 Since our analysis, Free Mobile launched an unlimited plan; this has no real impact on our observations in the French market because Free already held a great pricing advantage on large data plans with its 50GB plans. However, unlimited offers would confirm that Free, and potentially other disruptive operators, wants to stay ahead of the competition in terms of its largest offered data tiers.