AT&T’s Gigapower joint venture will open up the provision of FTTP in the USA

AT&T and BlackRock Alternatives formed a joint venture (JV) in December 2022 to build and operate a commercial FTTP platform, Gigapower, that will provide wholesale access outside AT&T’s established 21-state wireline footprint in the USA. This move provides another signal that the US wireline market is entering a period of profound transformation that will leave it more aligned with the market structures seen in Europe.

The formation of Gigapower is a prudent but scalable experiment

The initial Gigapower roll-out is small; 1.5 million premises will be passed compared to the 30 million premises that AT&T plans to pass on a standalone basis. Nonetheless, this is a reasonably large and potentially scalable experiment in open access, which is not widely adopted in the USA. There are still significant areas of the USA with no planned FTTP coverage, and open access provides some protection against overbuild.1

AT&T sees an opportunity because AT&T Fiber is selling well. However, this FTTP product is currently available only in AT&T’s legacy wireline footprint areas, which means that a substantial proportion of the FTTP customer base is migrating away from AT&T’s own xDSL services. AT&T believes that it is more prudent to co-invest outside this footprint, even though it can still use its national mobile customer base by cross-selling. The risk, of course, is the trade-off between ARPU and network utilisation.

For infrastructure investors such as BlackRock, wholesale-only with a sound anchor-tenancy (AT&T) is a preferred model because it leaves the (generally less-profitable) business of retailing to the ingenuity of others. Multi-asset infrastructure investors have been heavily involved in carve-outs, JVs and open-access plays in Europe and Latin America, and may view the USA as the next geography to target.

The case for wholesale FTTP in the USA is simply a matter of supply meeting demand

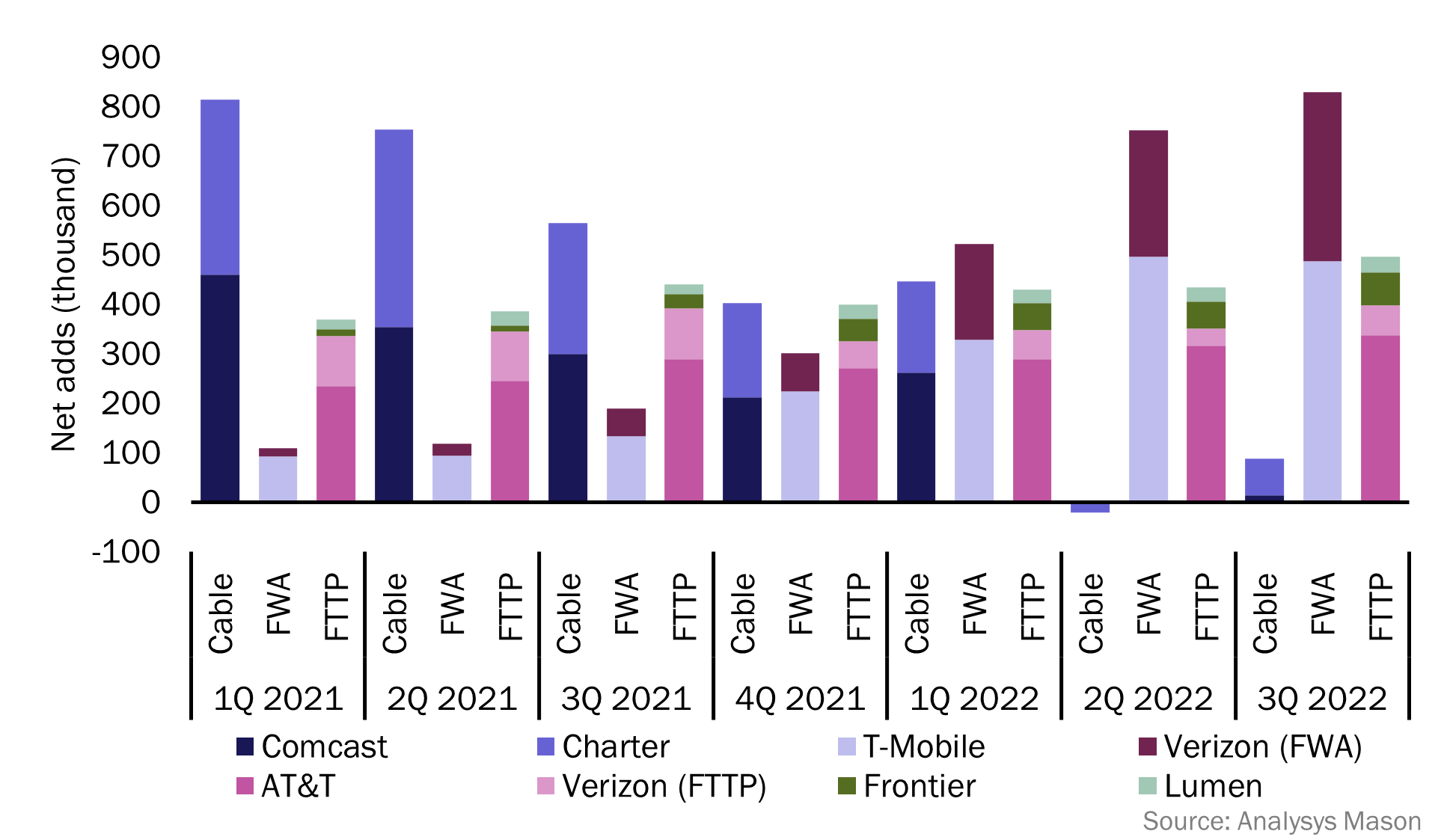

US cablecos, whose collective broadband market share reached 64% in 2020, are now under pressure from both FWA and FTTP. As a result, the size of their subscriber base will, as for cablecos pretty much everywhere else on the planet, start to decline (Figure 1).

Figure 1: Net adds, major broadband service providers, USA, 1Q 2021–3Q 2022

Cablecos are having to accelerate their network investments. DOCSIS4.0 has lower unit capex than fibre, but has significantly higher opex. A shrinking subscriber base results in a higher cost per line, so price cuts must be implemented to recover subscribers, thereby leading to lost margins. Some smaller cablecos are planning coax-to-FTTP upgrades, but the two largest players in the USA appear to continue to be committed to DOCSIS4.0.

5G FWA can seem to be a capex-free option. This is certainly how T-Mobile currently sees it; the investment in 5G mobile coverage is made, but FWA offers a monetisation opportunity as long as there is fallow capacity. MNOs do not sell FWA everywhere they have 5G networks; they pre-approve premises as eligible for FWA based on actual/forecast mobile usage. T-Mobile and Verizon currently each have about 40 million eligible premises (about 30% of premises nationwide).

MNOs’ decisions of where and when to offer FWA connections depend on traffic trends and the consequent level of network stress.2 5G standalone networks can help to alleviate this stress, but not forever. Indeed, isolating FWA traffic may turn out to be the most important use case for 5G standalone. Mobile traffic growth is actually quite modest in the USA. The CTIA recorded an increase of just 14% year-on-year in 2020 and a post-COVID-19 rebound of just 27% in 2021, even though these figures actually include new FWA traffic.3

Upgrades to mobile networks involving massive MIMO, cell densification and/or the use of mmWave are all options to extend the life of FWA, but they do come “burdened with some capital”,4 and will not be able to compete on performance against 10Gbit/s symmetrical optical networks.

Open-access fibre JVs can expose just how low the underlying monthly cost of connectivity can fall. The asset life of FTTP passives is at least 25 years, and infrastructure plays and utilities typically enjoy a lower cost of capital than vertically integrated telecoms operators. Open-access JVs are likely to have plenty of opportunity for manoeuvre on wholesale pricing because there is a large gap between US broadband ARPU (exceptionally high by global standards) and the underlying cost of FTTP Layer-2 connectivity. The bitstream prices paid in Europe, including in countries where construction costs are comparable to those in the USA, are of the order of EUR14–25 per month for local interconnect.5 European broadband prices are of course affected by regulation, but nonetheless, unregulated alternative operators in Europe believe that FTTP, at these sorts of tariffs, is an attractive, future-proof investment. Moreover, they have a range of commercial wholesale models that can provide steady payback over far longer periods of time than is typical for telecoms investments.

There is a major opportunity for FTTP infrastructure investors

All major US operators strategically want a part of the broadband market. T-Mobile and Verizon are currently growing their broadband customer bases at a national level with FWA, and are seeing how far 5G will take them. We doubt either is strategically wedded to FWA. It probably is not fast enough6 or reliable enough to be a major part of the future, and upgrades will be costly.

As such, we forecast a commercially led opening up of FTTP business models, plus more involvement from infrastructure investors. The US broadband market will start to look more like the markets in Europe and Latin America in terms of structure.

- AT&T will use Gigapower to better understand the advantages and drawbacks of open access, and not solely in out-of-footprint areas.

- Low-cost wholesale FTTP is likely to be an increasingly attractive option for MNOs in selected but ever-expanding areas. MNOs will also make investments in new or existing FTTP infrastructure. T-Mobile has experimented with FTTP in Manhattan, and is reported to be looking for a partner for some build and to be investigating commercial options for FTTP access with third parties.

- Tier-2 ILECs and altnets will struggle to match the penetration of AT&T Fiber and Verizon FioS (theirs are typically 5–10 percentage points lower) and they, too, will start to consider using the wholesale model. Brightspeed (the fifth largest ILEC in the USA) already offers bitstream. This group will engage more with infrastructure investors in more capital-intensive areas.

1 For more information, see Analysys Mason’s FTTx coverage and capex: worldwide trends and forecasts.

2 For more information, see Analysys Mason’s Verizon’s post-auction plans for FWA will run up against the limitations of 5G.

3 CTIA (2022), Annual Survey Highlights 2022.

4 T-Mobile (2022), Edited transcript Q3 T-Mobile US Earnings Call.

5 For more information, see Analysys Mason’s Wholesale FTTx tariff tracker.

6 The current median downlink speed for T-Mobile is 100Mbit/s. T-Mobile (2022), The state of fixed wireless access.

Article (PDF)

DownloadAuthor