Australian challenger operators are using bold strategies to rapidly gain share in the B2B market

28 January 2022 | Research

Article | PDF (4 pages) | SME Services| Enterprise Services

Listen to or download the associated podcast

Competition in the Australian B2B market has increased significantly since the National Broadband Network Co (nbn) intensified its focus on business services in 2018. Most successful challenger operators’ strategies have some common features that are helping these players to grow their market shares, and established operators must act quickly to develop effective responses.

Further information on the operators highlighted in this article and our assessment of prospects for the Australian market as a whole are provided in our report, Operator business services: Australia forecast 2021–2026.

The conditions in the Australian business connectivity market are beneficial for challengers

nbn plays a key role in the Australian market. It was established in 2009, and now offers wholesale connectivity services that cover most Australian homes and business premises.1 nbn announced an increased focus on the business market in 2018; it launched Enterprise Ethernet services, later followed by services that are specifically tailored to small and medium-sized enterprises (SMEs), as well as pricing discounts in designated Business Fibre Zones.

Challenger operators have also increased their attention on the business market because they believe that there is an opportunity to encourage businesses to switch provider when they migrate to the nbn network. All operators have access to the same set of wholesale inputs, so there is limited scope for differentiation on the basis of service or coverage (areas in which established operators have typically had an advantage over challengers). Several operators run their own networks in key business districts, but nbn dominates national supply.

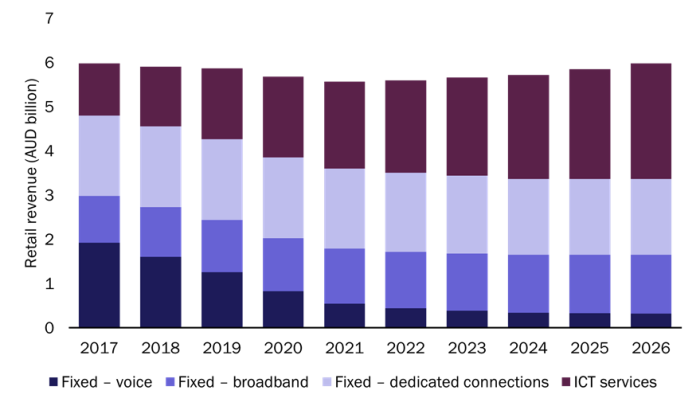

Business revenue from legacy connectivity services has fallen sharply for established operators over the past few years. However, the transition to the nbn network is drawing to a close,2 and the increased adoption of cloud services means that fast, reliable data connectivity will be crucial to many businesses. We anticipate that fixed retail revenue for businesses in Australia will remain stable between 2021 and 2026, despite increased competition. At the same time, operator revenue from ICT services that are sold alongside data connectivity is expected to grow rapidly (Figure 1), thereby making the combined telecoms and IT market an attractive one for new players.

Figure 1: Telecoms operator fixed and ICT service retail revenue for businesses, Australia, 2017–2026

Source: Analysys Mason, 2022

Challenger operators are employing a variety of bold strategies

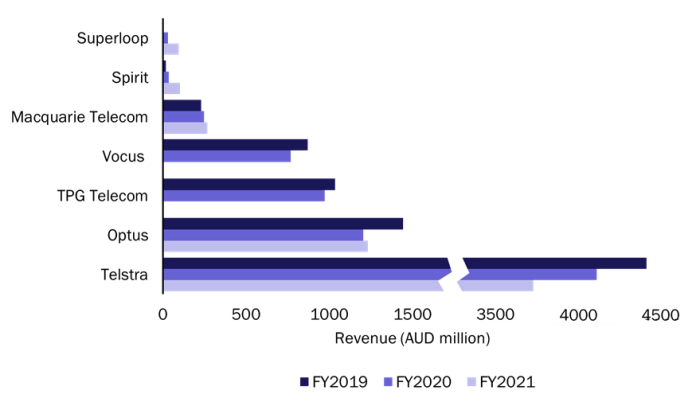

Challenger operators in the Australian B2B market are doing well and are rapidly gaining share, albeit from a small base (Figure 2).

Figure 2: Business revenue as reported by operators, Australia, FY2019–FY20213

Source: Analysys Mason, 2022

- Macquarie Telecom is an established challenger in the mid-market that differentiates itself on the basis of customer satisfaction.4 It was the first Australian operator to launch SD-WAN (in 2017), and this has become central to its strategy. Macquarie Telecom signed a 6-year deal to gain access to nbn’s business-grade products in 2018; it believes that this deal greatly enhances its ability to compete in the fixed market.

- Spirit Technology Solutions (Spirit) is a B2B specialist that provides IT and telecoms services. It has grown rapidly through acquisition and completed 12 deals between 2019 and 2021. These acquisitions have enabled Spirit to extend its coverage and increase its range of IT capabilities. Its acquisition of telecoms provider Nexgen Australia in April 2021 effectively doubled its business customer base to more than 10 000. Spirit differentiates by offering businesses a single point of contact for all their technology needs across connectivity and IT services. It also operates a digital sales platform that supports multiple services. Its revenue has diversified and grown rapidly due to its acquisitions.

- Superloop is a connectivity and managed services provider in Australia, Singapore and Hong Kong. It acquired Exetel (an Australian ISP) in August 2021 and now has 16 000 business customers, most of whom are in Australia. Its portfolio of business services includes connectivity, security, SD-WAN and managed Wi-Fi. More than half of its small business customers5 take at least two services and it is actively looking to cross-sell to larger businesses.

- Aussie Broadband has more than 400 000 consumer and business customers and is expanding into the enterprise and IT services markets. It increased its focus on the business segment in FY2021, resulting in 90% year-on-year growth in the number of business broadband connections. It announced a bid to acquire Over The Wire, a technology company and platform provider, in December 2021. If successful, this acquisition will enable it to extend its capabilities into cloud, security and IT services.

The strategies of each of these challengers are different, but there are some common themes that can be observed.

- IT services are offered by most, and there is an emphasis on selling multiple services.

- Acquisition is a route to growth for many challengers. Some deals have been driven by a desire to increase customer numbers and reach, but many have been selected to extend IT capabilities.

- Customer service is a fundamental part of Macquarie Telecom’s strategy; Spirit’s provision of a single point of contact for each of its customers also addresses this need. Other challengers highlight the quality of their customer service in their marketing material.

Established players retain some advantages in the market, but must also adapt to the challenge of new players

Established operators retain many advantages in the market such as brand recognition, established sales channels and an existing large customer base. The three main players also benefit from being converged network providers; they should offer more fixed–mobile converged services to play to this advantage.

Established operators should also learn from the new entrants. They should place an increased emphasis on bundling connectivity and IT services, especially in the small business market. They should also pay attention to improving customer satisfaction. Telstra has already put account management for small businesses in place, and operators should continue to offer dedicated business support alongside their digital service platforms.

Telstra has stated that it expects its fixed enterprise revenue to return to growth from 2024 after several years of decline This is certainly achievable, but will require continued efforts to extend its portfolio and defend its market share.

1 Coverage excludes 11 000 ‘complex installations’.

2 The ISDN switch-off is due for completion in 2022.

3 Financial years end on 30 June, except for Optus (31 March) and TPG Telecom (31 December). Revenue figures from Telstra and Optus include revenue from Australian enterprises but exclude that from SMEs; Telstra’s figures also exclude revenue from mobile services and Telstra Global. Macquarie Telecom’s figures include revenue from its hosting business. Aussie Broadband does not report business revenue separately so is not included in this chart.

4 Macquarie Telecom has an industry-leading Net Promoter Score of more than +70.

5 Superloop defines small businesses as those with fewer than 20 employees.

Article (PDF)

DownloadAuthor