COVID-19 will boost OTT video viewership but will reduce the total value of the TV and video market

The COVID-19 pandemic means that people are consuming more video content, but it is also putting pressure on the conventional business models that underpin the TV and video sector; the sports model, in particular, is struggling. The disruption caused by the outbreak will affect the value of transactional, advertising and subscription revenue. This comment explores how the value of TV and OTT video services will change in 2020 and 2021 as a result, and how operators can best position themselves to maximise future revenue.

COVID-19 is changing the way in which people consume video

The restrictions on social interaction imposed by governments in response to the pandemic are increasing video viewership: Telefónica reported an 8% increase in the number of accesses to its operator OTT service and a 14% increase in viewing time in early March 2020. The launch of Disney+ outside of North America has coincided with the pandemic, causing a boost in the number of triallists and paying customers: it had more than 50 million paying subscribers in early April 2020.

The disruption to sports broadcasting is a key concern for operators and pay-TV providers. Sports content often commands the highest per-channel revenue of all pay-TV services, and OTT video providers have been blindsided by the cessation of almost all televised sporting activities. At the time of writing, several pay-TV providers, notably BeIN Sports, have suspended rights payments to sports leagues that have cancelled matches. This will not only affect retail revenue, but also the ability of sports-specialist companies to bid in future rights auctions. This fundamentally changes the outlook for OTT linear services, and wipes out more than USD5 billion of revenue in the remainder of 2020; it will also have longer-term effects.

The pandemic will reduce the total pay-TV retail revenue by 3.4% in 2020 despite strong gains for SVoD and TVoD

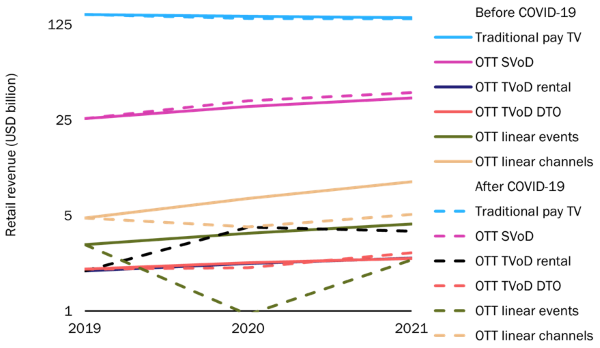

Disruption from COVID-19 is changing the value of transactional, advertising and subscription revenue. Figure 1 shows the impact that COVID-19 is likely to have on retail revenue in a number of countries around the world.1 These countries currently account for around 75% of the worldwide pay-TV and OTT video revenue. The total retail revenue for pay-TV and OTT video services in these countries will be USD6.5 billion (3.4%) lower in 2020 than predicted in our pre-COVID-19 forecasts. Retail revenue for 2021 will be USD3.5 billion (1.8%) lower.

Figure 1: Pay-TV and OTT video retail revenue in a selection of countries, before and after the impact of COVID-19, 2019–2021

Source: Analysys Mason, 2020

We anticipate that consumers will generally retain traditional pay-TV services throughout the pandemic due to the growing importance of in-home entertainment. The disruption to live sports will result in a 4.0% decrease (compared to our previous forecast) in retail revenue in 2020 (a drop of around USD5.8 billion for our selection of countries) as providers give sports channels for ‘free’ for several months or substitute other premium content while events are disrupted. Traditional pay-TV retail revenue in 2021 will be 2.0% (USD2.8 billion) lower than our pre-COVID-19 forecasts.

The number of consumers using free trials for SVoD services is likely to increase in the short term as consumers shop around for content. Service stacking will increase as people consume more. We do not expect that the total number of people using SVoD will accelerate more rapidly than previously predicted. Instead, we believe that the average spend and the number of subscriptions per user will increase, thereby boosting retail revenue in our selection of countries by 9.7% in 2020 (+USD3.1 billion) and 9.4% in 2021 (+USD3.4 billion) versus previous forecasts.

TVoD revenue will increase significantly. Retail revenue for TV and movie rentals will be 85% above our previous forecasts (+USD1.9 billion) in 2020, while revenue from ‘download to own’ will decline (–8%, –USD173 million). People that have not previously engaged with TVoD rentals will do so for the first time.

OTT linear channel services will be negatively affected by the disruption to live sports. We expect that sports programming will resume in 2021 as usual, but that the pandemic will delay market growth by 12 months. We therefore expect that the 2020 retail revenue for OTT linear channels will be 38% (–USD2.5 billion) lower than our previous forecasts and the 2021 retail revenue will be 42% (–USD3.8 billion) lower.

OTT linear events will be similarly affected; the majority of the remainder of live sporting events in 2020 will be disrupted and this will lead to a 75% decline in retail revenue in 2020 (–USD2.8 billion) compared to our previous forecasts. However, other live events distributed online (such as live music) will be boosted once lockdowns are lifted but social distancing conditions remain. Sports may resume without live crowds.

Advertising-funded OTT services will suffer significant financial pressure in the short term. An increase in consumption will lead to an increase in costs. At the same time, advertising revenue will fall, primarily because of lower consumer spending, thereby resulting in a lower ‘follow-through rate’ where advertisements lead to fewer purchases and the willingness of advertisers to purchase slots therefore falls. This double pressure will be weathered by larger players, but may cause commercial problems for single-country players such as ad-funded platforms in India.

Operators must respond with increased flexibility

The market situation and outlook will continue to change rapidly. We still believe that the major opportunity for the video industry in the coming years is in advertising; we estimated that this would account for over 50% of the projected USD95 billion growth in TV and video revenue between 2019 and 2024 before the COVID-19 crisis. It is likely that advertising-funded platforms will suffer from financial difficulty in 2020, but the market should rebound and the increase in consumption of free video content is likely to become monetised.

Service stacking will be temporarily boosted by the pandemic, but the number of subscriptions that any one user takes will fall in the longer term. Operators’ best response to managing this uncertainty is to be flexible and approach services in a modular manner. Services such as Danish operator YouSee’s Bland Selv will be able to cope with the short-term shift in viewing preferences (allowing customers to directly substitute sports channels for other content through its self-service platform, without a loss in revenue) and the longer-term shift of consumers towards a more-nomadic use of TV and video services.

1 These countries are Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Latvia, Lithuania, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Turkey, UK and USA.

Downloads

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Author