SMBs tend to prefer to work with business applications vendors that have ESG credentials

11 May 2022 | SMB IT

Article | PDF (4 pages) | Business Applications| Cyber Security| Devices and Peripherals| IT and Managed Services| IT Infrastructure| UC and Digital Services

Sustainability is a high priority for businesses as they emerge from the COVID-19 pandemic. Indeed, 46% of the respondents to Analysys Mason’s survey of small and medium-sized businesses (SMBs) said they are more likely to purchase IT solutions from vendors that have environmental, social and governance (ESG) policies in place than from those that do not.1

SMBs’ interest in the sustainability of IT solutions varies by size of business, geographical location and vertical industry. Suppliers that are cognisant of these differences and can market their sustainability standards appropriately to each type of SMB are the best-placed to take advantage of the boost in SMB spending on IT products and services post-pandemic.

SMBs are looking for IT software vendors with credentials in sustainability

Sustainability issues are becoming increasingly important to SMBs for a variety of reasons. Consumer behaviour is rapidly changing to reflect environmental concerns, and SMBs stand to gain from this as consumers seek independent companies that reflect their values.2 Other advantages to implementing an ESG policy include enhanced recruitment prospects, because people are likely to accept a job at a lower salary if the organisation is sustainable or socially responsible, and an increased appeal to investors, because climate risk and sustainability are key influencers of investors’ portfolios.

Sustainable IT solutions are therefore becoming ever-more important to SMBs, especially after the increase in the amount of digitalisation during the COVID-19 pandemic. Governments worldwide have also started to recognise the effect that digital processes have on the environment. SMBs must consider sustainability issues when investing in digital transformation in order to fully embed sustainability into their business models.

The significance of ESG priorities differs by geography and increases with business size

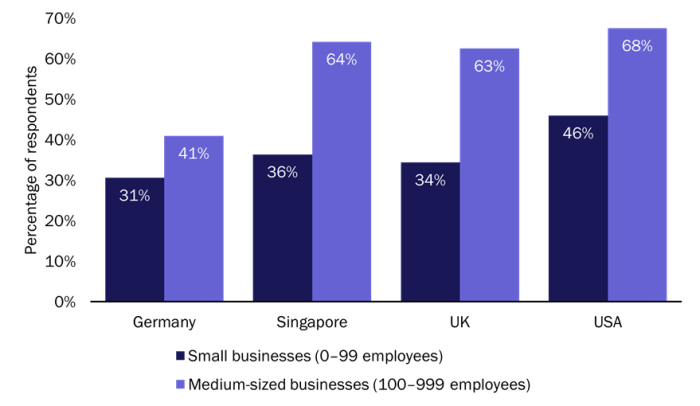

The results of our survey show that are some differences between small businesses (SBs; 0–99 employees) and medium-sized businesses (MBs; 100–999 employees). SMBs’ preference for vendors with ESG policies increases by business size and is most pronounced among MBs in Singapore, the UK and the USA (Figure 1). 59% of all MBs reported being more likely to purchase IT solutions from vendors with ESG policies in place in 2022, compared to 38% of SBs.

Figure 1: SMBs that reported being “more likely” to purchase from vendors that have ESG policies in place, by business size, Germany, Singapore, UK and USA, 1Q 20223

Source: Analysys Mason, 2022

One might assume that smaller businesses have swifter decision-making processes and can therefore switch to sustainable vendors more quickly than larger firms. However, SBs face more difficulties when implementing sustainability strategies such as a lack of awareness of opportunities, technical uncertainty and limited access to finance. MBs are thus in a stronger position to choose green suppliers.

SMBs in the high-GDP countries of Singapore, the UK and the USA have similar goals in terms of increasing the sustainability of their IT solutions. Conversely, 60% of respondents in Germany reported that the likelihood of them purchasing IT solutions from sustainable vendors will stay the same. This is probably because the market for sustainable vendors in Germany is already large due to the high levels of public awareness of sustainability issues in the country.

For example, the German government is keen to accelerate sustainable digital innovation. It has committed to reaching net-zero by 2045; this is 5 years sooner than the government in the UK. Germany has also issued more sustainability policies than other major economies. These include the Corporate Due Diligence in Supply Chains Act (June 2021) and its sustainable finance strategy (May 2021).

ESG priorities for business applications are sector-specific

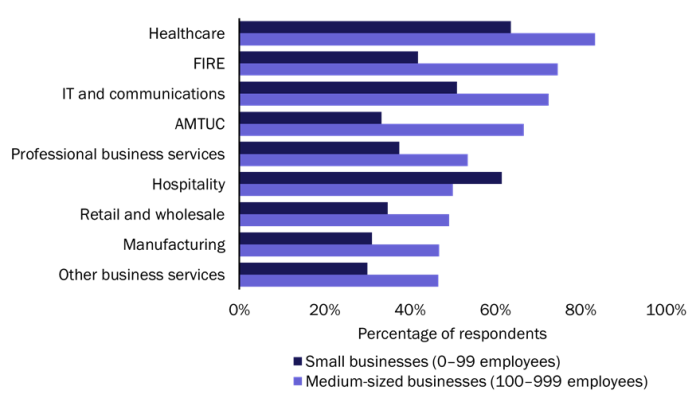

SMBs in the healthcare sector are the most likely to purchase IT solutions from sustainable providers, while those in the manufacturing, retail and wholesale and hospitality sectors are the least likely (Figure 2).

Figure 2: SMBs that reported being “more likely” to purchase from vendors that have ESG policies in place, by business size and vertical industry, Germany, Singapore, UK and USA, 1Q 20223,4

Source: Analysys Mason, 2022

The manufacturing sector accounts for a considerable proportion of resource consumption, waste generation and carbon emissions worldwide. As such, SMBs in this sector may be more reluctant to look for sustainable solutions than those in other sectors. Sustainable IT is also likely to be low on the agenda of SMBs in the manufacturing sector because other activities will have a far greater impact on the environment. For example, they may instead focus on using recyclable materials and renewable energy/energy efficient machines and adopting a circular economy.

Finances are also an issue for SMBs in the hospitality, retail and wholesale and manufacturing sectors. Indeed, 47% of the respondents to a survey of 1021 firms by YouGov for World Kinect Energy Services in 2020 that were in the manufacturing and hospitality sectors reported that financial concerns were a barrier to more sustainable practices. 58% of respondents from the hospitality sector said they had had to shelve sustainability plans during the pandemic.

Business application providers should use targeted marketing to take advantage of SMBs’ interest in ESG initiatives

Business application providers should note that sourcing from sustainable vendors and working with eco-friendly partners are important considerations for SMBs. They should recognise that the spend on sustainability-related purchases varies by business size, geography and industry in order to appear the most attractive to potential customers.

The most appropriate methods for communicating ESG credentials are likely to be sector-specific and should highlight the benefits of sustainable IT solutions in terms of resource efficiency, cost reduction and state regulation. Information about ESG policies must be accessible, with materials and metrics that are easy to find and understand.

1 Analysys Mason conducted a survey of 1149 SMBs in Germany, Singapore, the UK and the USA between December 2021 and January 2022.

2 93% of respondents to a survey of 14 000 consumers worldwide by IBM Institute for Business Value reported that the COVID-19 pandemic has affected their view on environmental sustainability.

3 Question: “In the future, my company’s likelihood of purchasing IT solutions from vendors that have ESG (environmental/social/governance) policies is…Scale is 1 to 5, where 5 = more likely and 1 = less likely.” n = 1149.

4 FIRE stands for finance/banking, insurance and real estate. AMTUC stands for agriculture, mining, transportation, utilities and construction.

Article (PDF)

DownloadAuthor