DIRECTV Stream is delighting customers against a backdrop of decline in the US pay-TV market

The USA continues to be exceptional in terms of the rate at which the number of pay-TV connections has declined. This article draws on Analysys Mason’s Pay-TV quarterly metrics 1Q 2022 and 3Q 2022 consumer survey results to assess the scale and cause of this decline, and to identify exceptions such as pay-TV company DIRECTV, which appears to have had particular success with satisfying DIRECTV Stream customers.

The decline of traditional pay-TV viewership and connections in the USA is uniquely severe

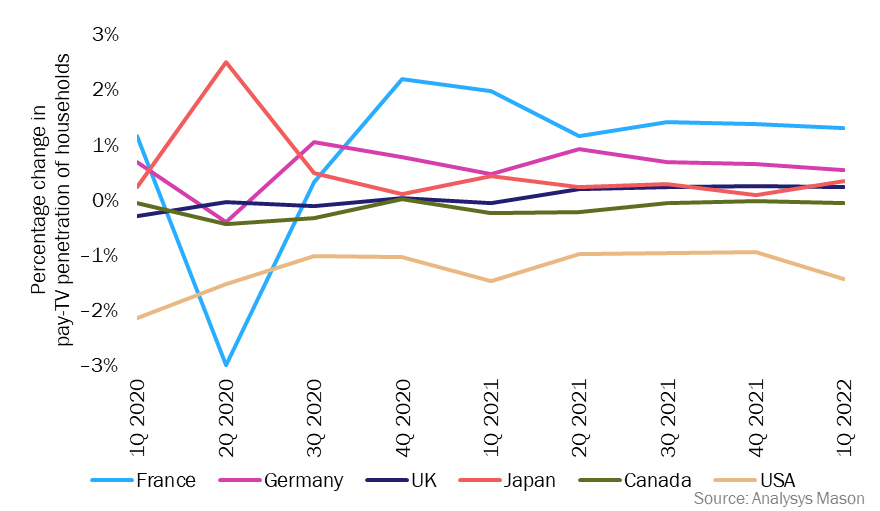

The audience measurement company Nielsen announced that streaming video viewing minutes surpassed cable viewing minutes for the first time in July 2022. This is a landmark moment in the decline of pay-TV services in North America but it was not unexpected. Our Pay-TV quarterly metrics tracks the number of connections for pay-TV services split by access technology, including pay-TV providers and communications service providers’ (CSPs’) own streaming video services. The USA has been unique in the consistent decline in the number of pay-TV connections for several years (Figure 1).

Figure 1: Change in total pay-TV penetration of households, by country, 1Q 2020–3Q 2022

The COVID-19 pandemic did not disrupt this decline in the USA. This is at odds with the trend in many other major economies. For example, consumers in France responded to the financial uncertainty of the pandemic by replacing their pay-TV services with streaming video, which caused a large decrease in pay-TV penetration between 1Q 2020 and 2Q 2020 (although there was a subsequent rebound). Quarter-on-quarter changes in pay-TV penetration have stabilised in 2022, apart from in the USA.

Price is the main factor driving churn; inflation will further exacerbate the decline of traditional pay-TV connections

Average revenue per user (ARPU) for pay-TV services is notably higher in the USA than in all other countries that we track. In 1Q 2021, ARPU was USD107 per month in the USA, higher than in Canada (USD46) and the UK (USD35). Such high prices contribute to churn and cord-cutting. 15% of survey respondents with a pay-TV service in the USA said that they intended to churn within the next 6 months. Price is the most cited reason for this churn: 64% reported it as a reason. Inflationary pressures in the US economy are pushing consumers to reassess their spending and it is likely that many will cancel or downgrade their costly pay-TV packages to free-up spending for other purposes, thereby increasing the rate of churn.

DIRECTV Stream’s high NPS shows that pay-TV providers can successfully offer streaming video services that delight customers

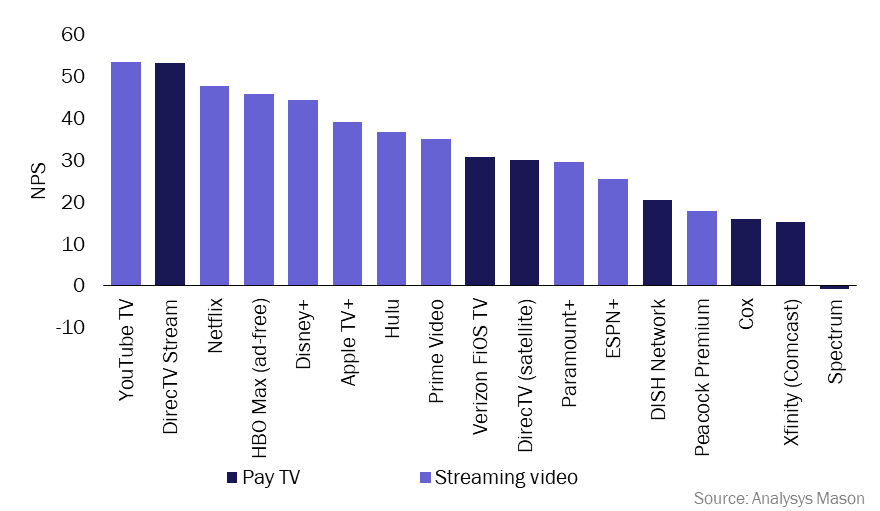

Traditional pay-TV providers need to improve the levels of customer satisfaction in order to prevent users from churning despite high prices. Pay-TV services tend to have much lower Net Promoter Scores (NPSs) than streaming video services (see Figure 2).

Figure 2: NPSs for pay-TV and streaming video services in the USA, 3Q 20221

DIRECTV Stream, a service through which users can access live broadcasts of TV channels as well as on-demand content, is an exception to the poor performance of pay-TV providers: it had the second highest NPS of the services listed above. Pay-TV providers should consider how they might replicate the following factors that have contributed to DIRECTV Stream’s high NPS.

- Improving the user experience. DIRECTV Stream has updated aspects of content discovery, following user feedback. For example, in August 2022 it launched its My Teams personalised hub, which lets users keep track of specific sports teams, and introduced a Team Selector function that enables users to view a team’s upcoming matches.

- Ensuring an adequate amount of semi-exclusive popular content. Content exclusivity is a trade-off: it can be expensive, but it can be a differentiator. DIRECTV Stream offers a selection of highly popular streaming content, but its offering is far from comprehensive. For example, DIRECTV is one of only three US providers that offers HBO’s House of the Dragon, which was HBO’s biggest-ever series launch in August 2022, but it does not include other popular content such as NFL sports. DIRECTV has positioned itself to offer a selection of high-quality content within a wider streaming video ecosystem.

- Partnering with other streaming video services. DIRECTV has partnerships with other streaming video providers, incorporating their content into its own packages. For example, users can add HBO Max and Starz subscriptions to their DIRECTV plan. This allows DIRECTV to complement its offers with additional content from other providers. Other providers are also establishing partnerships to replicate this style of content aggregation.

- Being flexible. AT&T, DIRECTV’s parent company, has decoupled DIRECTV Stream from its broadband services, while still offering discounts when DIRECTV Stream is bundled with AT&T’s fixed broadband plans. This flexibility allows users to subscribe to DIRECTV’s services without being tied to broadband. It also makes cancelling DIRECTV simpler; this helps to attract new customers as well as giving existing customers reassurance about their choice to continue to subscribe.

DIRECTV had several relatively poor-performing streaming video solutions before it appears to have had some success with DIRECTV Stream. Since AT&T sold a partial stake in the company in 2021, DIRECTV has not had to report its subscriber numbers. We believe that the company has lost around 50% of its satellite TV customer base in the 4 years to 1Q 2022. In contrast, its streaming video business appears stable in terms of subscriber numbers against the backdrop of declining engagement in traditional pay-TV services in the USA. The company is also excelling in satisfying its users. DIRECTV therefore provides an example of how to offer a good-quality streaming video service with a high level of customer satisfaction.

Analysys Mason’s forthcoming consumer survey on streaming video opportunities will include analysis of the relative strengths and usage of streaming video and pay-TV services.

1 Questions: “Are you currently a user of any of the following services?”; and “On a scale from 0 – 10 (where 0=not at all likely, and 10=definitely), how likely are you to recommend the following streaming services to friends or family members?”; n = 1366.

Article (PDF)

DownloadRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Forecast report

France: pay-TV and streaming video forecast 2024–2030

Forecast report

New Zealand: pay-TV and streaming video forecast 2024–2030