EE’s new fixed–mobile convergence offer with unlimited mobile data is a milestone for the UK telecoms market

EE introduced a new fixed–mobile convergence (FMC) offer on 20 October 2023: fixed customers can take advantage of a mobile SIM card with unlimited data for GBP10 (EUR11.5) per month.

This new offering is part of a wider strategic shift announced by EE on 18 October 2023 and follows BT Group’s decisive move to make EE the flagship brand for both fixed and mobile services, originally announced in May 2022. EE also launched a digital consumer platform (EE ID) to offer products and services beyond connectivity.

The number of BT Group’s FMC accounts grew by just 100 000 in the 4-year period to 1Q 2023: a marginal increase compared to Virgin Media O2 (VMO2), which gained over 0.8 million FMC customers in the 12-month period to 1Q 2023.1 BT Group has consequently revamped its convergence strategy in order to achieve its target of having at least 30% of consumer customers take FMC bundles by 2028 (compared to 22% in 1Q 2023).2

EE offers unlimited mobile data plans to customers that take both fixed and mobile services

The FMC offer launched by EE in October, new for the UK, mirrors the approach adopted by several operators outside the UK (such as Maxis in Malaysia, as well as three out of the five key integrated operators in Italy).

EE’s FMC option provides the following features.

- Fixed customers are offered a mobile SIM with unlimited data and speeds of up to 10Mbit/s at GBP10 (EUR11) per month. The mobile plan is renewed on a 30-day rolling basis.

- Mobile contract customers that take one of EE’s fixed plans receive unlimited data on all its existing SIM cards.

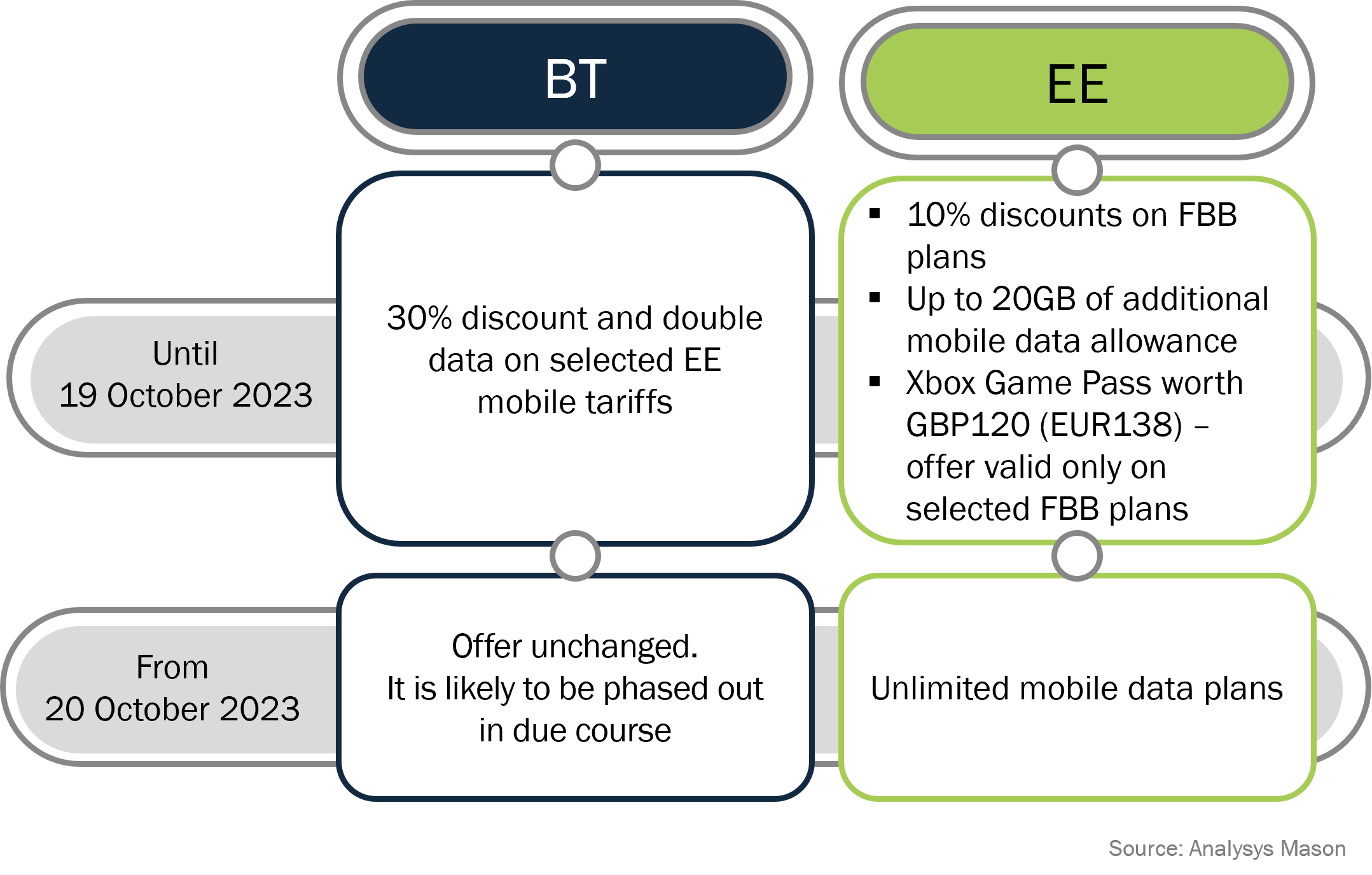

Both promotions are valid for eligible fixed and mobile contract plans.3 The offer, which is simpler than the offer that expired on 19 October 2023 (see Figure 1), is only available to EE customers. Current BT-branded fixed customers can change their subscription to an EE fixed plan for free.

Customers must create an EE ID account by registering their credentials on EE’s digital platform, and link both their fixed and mobile plans to the same EE ID account to enjoy the benefits of FMC.

Figure 1: Benefits granted to customers that take both fixed and mobile services, BT and EE

A change in BT Group’s FMC strategy was needed: the number of reported convergence accounts grew slowly from 2019 to 2023

The share of BT Group’s customers with a converged bundle increased by 1.4 percentage points to 21.6% between 2Q 2019 and 1Q 2023 (which is equivalent to 100 000 net additions).4 For comparison, in 2Q 2023, VMO2 had 1.5 million customers on its ‘Volt’ bundle, a premium FMC proposition launched in 2021.

BT Group had little incentive to push FMC bundles until the Virgin Media–O2 merger in May 2021 because it was the only infrastructure converged operator. After the merger, however, its multi-brand strategy was not adequate to compete effectively with VMO2’s convergent offering.

EE’s new strategic initiatives address key weaknesses of BT Group’s FMC strategy for the following reasons.

- EE has become the main brand for all fixed services (broadband and TV) and services based on connectivity (such as gaming) – the BT brand will provide only standalone services and social tariffs.

- EE intends to use the new FMC offering to upsell mobile services to fixed customers.5 This strategy has been successful at driving the adoption of FMC bundles in France, Spain and Portugal.

- Although EE’s new e-commerce platform will be used to sell additional products, one of its other main purposes is to help to further increase consumers’ awareness of the EE brand especially for fixed services. Marc Allera, EE Chief Executive, stated that “the real drive is not necessarily selling a lot of smart kettles, it is about becoming a more relevant brand for consumers for the future.”

EE’s strategic shift will likely unlock the growth of fixed–mobile convergence in the UK

We expect that EE will attract new FMC customers with its mobile offering. It has a large fixed-only customer base to which it can upsell mobile services.6 Its unlimited mobile data plan, with a monthly tariff of GBP10, is by far, the cheapest option on the market and none of its competitors have a similar convergent offer.7,8 The most-comparable standalone plans offered by the other mobile operators are 2.5 times more expensive at least.

The Virgin Media–O2 merger was a first milestone for FMC in the UK. Indeed, the number of FMC accounts in the UK increased by over 50% in the 2-year period to 2022.9 EE’s latest strategic move has the potential to become the second milestone, signalling further acceleration towards FMC across the UK market.

1 The latest data on FMC accounts reported by BT Group refers to 1Q 2023.

2 BT Group (18 May 2023), BT Group plc FY23 results (results for the 12-month period to 1Q 2023), see slide 13.

3 The offer is valid for fixed customers that take one of the following fixed plans: ‘Essentials’, ‘All Rounder’ and ‘Full works’. Only mobile contract SIM cards with a monthly tariff of at least GBP10 (EUR11) are eligible for the data boost. The data boost is not available for prepaid, smartwatches and fixed-wireless access (FWA) plans. EE’s website reports the precise eligibility criteria.

4 BT Group’s reporting for its FMC accounts goes up to 1Q 2023.

5 EE’s previous FMC offering was designed primarily to upsell fixed services to mobile customers.

6 8% of BT Group’s customers reported having mobile services bundled with their fixed broadband plan in 3Q 2023, according to Analysys Mason’s UK: consumer survey.

7 VMO2 includes unlimited mobile data in one of its ‘Volt’ bundles (its ‘Mega Volt Bundle’). The tariff for the mobile component of the bundle is GBP25 per month.

8 For more information on operators’ FMC bundles, please see Analysys Mason’s Fixed–mobile converged bundles pricing tracker.

9 For more information, please see Analysys Mason’s Fixed–mobile convergence in the UK: trends and forecasts 2023–2028.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Forecast report

USA: fixed–mobile convergence forecast 2025–2030