Consumer brands Free in France and Sky in the UK are moving into the business market

Free and Sky are established operators in the consumer market in France and the UK, respectively. Both entered the business market in 2021 with low-cost voice and broadband services that are primarily aimed at small businesses. They aim to use their consumer brands and capabilities to gain a significant share of the small-business market, posing a threat to established players in the market.

Both operators are covered in our recent forecast reports for France and the UK.

Free and Sky have entered the business market with services that are competitively priced compared to those of established players

Free is the fourth largest telecoms operators in France in terms of revenue and mobile connections, and second in terms of fixed broadband connections. Free entered the consumer mobile market in 2012 and quickly gained market share due to its highly competitive pricing, undercutting other mobile network operators (MNOs) in France. Free will use a similar strategy in the business market and plans to gain significant market share by offering “best-performing technologies at a fair price.”

Free launched the Free Pro brand to target the French business market in March 2021. Free Pro has two offerings; Free Pro mobile and Freebox Pro. Free Pro mobile is operated by Free Mobile, using its 4G and 5G network to deliver business mobile services. Freebox Pro delivers fibre broadband, telephony, Wi-Fi, 4G back-up, and includes cyber-security and cloud storage services. Freebox Pro is operated by Jaguar Network, Free’s B2B subsidiary. Free Pro offers a EUR10 per month discount on its mobile prices for businesses that take both Freebox Pro and Free Pro mobile services. At the time of launch, Free claimed that its Freebox pro offering was less than half the price of a comparable bundle for a 10-person business.

Free has set a target of acquiring a 4–5% share of the business service market in France. Analysys Mason’s recent report, Operator business services: France forecast 2021–2026, estimates that this would generate between EUR440 million and EUR550 million in annual revenue for Free. By October 2021 (6 months after launch), Free Pro had 10 000 corporate customers, of which most were small businesses. However, Free only generated 1.9% of its revenue from B2B services in France in 2021, and stated that Free Pro was not yet making a significant contribution to this revenue.

Sky has been owned by Comcast since 2018 and is the largest pay-TV provider in the UK as well as the second-largest provider of consumer broadband after BT. Sky also offers mobile services through its MVNO, Sky Mobile. Sky launched Sky Connect in March 2021, describing it as a new entrant in the enterprise telecoms market.

Sky Connect’s services are similar to, but more limited than, Freebox Pro, and include fibre broadband, telephony and 4G back-up. Despite offering consumer mobile services, Sky does not yet offer business mobile services. Sky notes that it is developing Sky Connect by drawing on the experience of Comcast Business, which has become one of the leading broadband providers to SMEs in the USA. Similarly to Free, Sky’s business services are competitively priced compared to those of established operators. It is also drawing on expertise from parent company Comcast, which has developed a successful B2B business in the USA in the last decade.

Micro and small enterprises are highly price-sensitive, making Free Pro and Sky Connect attractive solutions

Free’s entry into the French consumer mobile market in 2012 had a significant disruptive effect on the market; ARPU fell by nearly 25% from 2011 to 2013. We may see a similar, albeit weaker, trend in the business market, although inflationary pressure will also have an impact on pricing in nominal terms. Less than a month after the launch of Free Pro, Bouygues Telecom launched a similar offer to the Freebox Pro. Bouygues Telecom did have a comparable business offering before the launch of Free Pro, but it was only offered with the commitment of a 3-year contract.

Vodafone (another challenger operator in the business broadband market in the UK) also highlights its low prices and claims to undercut Sky Connect. According to an independent price check performed by FDM on behalf of Vodafone, both Sky Connect and Vodafone are more than 10% cheaper than BT and Virgin Media’s comparable business offerings.

Our recent business survey indicates that price is the most important selection criteria for micro and small businesses when they choose a communications provider. 61% selected it as important, ranking it above customer care and fault response (selected as important by 58% and 55% respectively). However medium-sized and large enterprises (50–249 and 250–999 employees) do not rank price as the most important selection criteria when choosing a communications provider; they rank criteria such as customer care and technical solutions as more important than pricing. Free and Sky may need differentiators other than pricing if they wish to gain share in the medium-sized and large enterprise market, which Free has stated it aims to do.

Existing players may need to respond with more competitive pricing but can also reduce churn in other ways

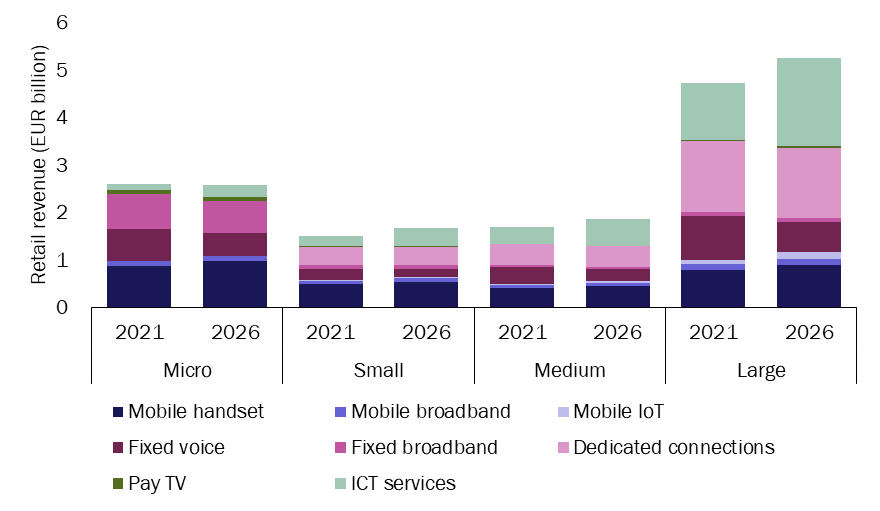

As consumer broadband markets become increasingly saturated, we might expect similar moves from other consumer-focused players hoping to gain market share in the small business market. Indeed, the micro and small enterprise market is potentially lucrative for operators and, unlike large enterprise markets, is dominated by voice and connectivity services. Analysys Mason estimates that the micro and small enterprise market accounted for 25% and 39% of business revenue generated by operators in the UK and France (Figure 1) respectively in 2021. Other consumer-focused brands Jio (in India) and Three UK also launched or enhanced their business services in 2021. Free is also present in Italy, through Iliad Italia, and could launch similar business offerings there.

Figure 1: Telecoms operator retail revenue from businesses by service type and business size, France, 2021 and 2026

Source: Analysys Mason

Competitive pricing may help existing operators to reduce the churn of business customers to lower-cost solutions offered by new entrants. However, a narrow focus on pricing may not be advisable; micro and small enterprises view customer care as almost as important as pricing. Established operators should also invest in enhanced customer care services for small businesses and the provision of targeted service bundles including basic IT services.

Article (PDF)

DownloadAuthors

Matt Small

Analyst