Unpacking the aftermath of recent GEO satellite failures

Space is tough. GEO satellites are realized on redundancy and reliability as their core philosophy. With decades of research, design, development and operations data, manufacturers have been able to achieve systems & spacecrafts with lower failure probabilities. Clearly, this does not ensure success with every launch. From a market forces perspective, GEO players are experiencing increasing competition from non-GEO players across applications. Large satellites such as Viasat-3 and Jupiter-3 are the response to competition, targeting better price economics and higher bandwidth attributes. Smaller GEO-HTS, specifically Astranis are focused to fill the service gaps while targeting specific and remote regions, Alaska for example. But the recent GEO satellite setbacks, Viasat-3 Americas and Arcturus, are most certainly going to change the focus from competition to risk mitigation, at least for the near term for these key players. How does this change in dynamics impact the overall market?

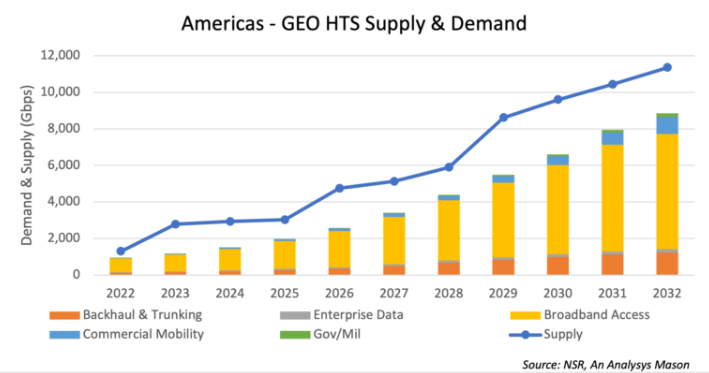

According to the NSR’s assessment in its Satellite capacity supply and demand, 20th edition report, the Americas (North America, Central America & Caribbean and South America) have a massive Satcom opportunity but the capacity constraint in GEO-HTS has been restricting this growth, especially for Consumer Broadband applications. The scenario was expected to improve with the provisioning of new GEO-HTS satellites but with the failure of Viasat-3 and Arcturus, NSR envisions the following impact across key market variables:

- Supply-Demand Dynamics: GEO-HTS capacity supply in the Americas was expected to increase by >2x during 2022-2023 addressing the capacity constraint challenges. Most of this addition was expected from Viasat-3 & Jupiter-3, driving growth in Broadband Access and other markets. Jupiter-3 has been recently launched and it is likely to be provisioned in the coming months. NSR expects that with the reduced supply in the region, the growth in low ARPU business, i.e. Broadband Access, will get most effected as Viasat will focus on achieving the best possible topline with the existing capacity or some repurposed capacity. Jupiter-3 will continue to drive growth in the region for GEO-HTS Broadband Access markets. In the mid and long term, as these lost capacity influxes are replaced, the segment will witness growth recovery. Arcturus, which was aimed to serve Alaska, will witness supply delays of around 6-8 months as Astranis is in advanced stages of developing Block 2 satellites.

- Capacity Pricing: Capacity Pricing is a function of the gap between Capacity Supply & Demand. In its Satellite capacity supply and demand, 20th edition report, NSR forecasts cumulative demand growth at CAGR 25% in the region driven by key applications such as Broadband Access, Enterprise, Backhaul and Mobility markets. Considering the impact of limited ramp-up in Supply, demand growth and competition, NSR estimates the expected pace of price erosion to likely slowdown in the near term. Moreover, there is significant possibility of deals in the region at premium pricing resisting the overall price decline.

- Market Capture: Undoubtedly, Starlink will benefit from this regional market state in the Broadband Access Market. Viasat is more likely to focus on higher ARPU segments such as Gov/Mil, Mobility and Enterprise. Hughes with Jupiter-3 will look to expand in the Broadband Access market despite Starlink’s competition. SES+O3b and Eutelsat + OneWeb are other key players, which will compete across SLA-based demand segments, and witness growth in their market capture. Small GEO players like Astranis will gain local momentum as they tap specific use cases over targeted regions with network gaps.

The bottom line

With the recent failures in the GEO-HTS market, the challenges for players such as Viasat-3 and Astranis have increased multi-fold. NSR expects a certain impact on market dynamics resulting in reduced growth and market capture. Market positioning and earlier recovery will be the prime focus for these players. Viasat, with Viasat & Inmarsat assets, is relatively strong to rebound from this current scenario. They will quickly repurpose some assets & lease capacity if needed, to ensure continued topline growth targeting higher ARPU applications. Additionally, execution to replace this lost spacecraft must be on high priority. Astranis on the other hand, has the benefit of Small GEO satellites, i.e., lower lead time. The operator will and must focus on addressing the failure causes and accelerate the production of the next block of satellites.

Overall, in the near term, NSR estimates that GEO-HTS will lose significant opportunities, especially in the Broadband Access markets in the Americas to Non-GEO. However, in the mid and longer term, the segment will recover to the forecasted growth trajectory.

Article (PDF)

DownloadAuthor