Is governmental support key to competing against Starlink and Kuiper?

It is now a widely held belief that Elon Musk’s SpaceX/Starlink is the biggest threat to satellite industry incumbents and in a few short years, Jeff Bezos’ Amazon Kuiper. The threat is not isolated to the space and satellite industries. Telcos/MNOs and cloud industry players are likewise worried that these two players, indeed two key personalities with tremendous market power, can encroach heavily on their key offerings and vertical targets.

In July 2020, the UK space Agency made a $500 million investment into OneWeb and in July 2022 was taken over by Eutelsat in a $3.4 billion merger deal. In November 2022, Satellite Today reported that the European Union is moving forward with plans for IRIS2, a new sovereign satellite constellation for Europe, and announced it will commit 2.4 billion euros to the project. There will also be funding from the European Space Agency (ESA) and private sources. Then in August 2023, once again Satellite Today reported that Telesat Lightspeed is “now fully funded and that it has contracted to MDA to build the 198 satellites needed for the system. Lightspeed satellite launches are now scheduled to commence in mid-2026 and polar and global services scheduled to begin in late 2027.

Why are governments stepping in?

First, there’s obviously the financial picture. LEO systems are CAPEX-heavy, i.e., expensive and raising funds from private sources is not easy, especially in a highly challenging macroeconomic environment as is the case today. A government subsidy or funding mechanism alleviates the challenge of sourcing much needed capital to enable space programs to get off the ground whereby government funding ensures that national players and a thriving space industry continues. Economists have argued that government intervention is needed in times of market failure. In the current environment where two behemoths can potentially dominate the space industry and lead to market exit by national or regional incumbents, this could qualify as a market failure where government intervention is arguably needed.

Second, a government boost not only provides much needed funds for risky space programs that investors still view as not quite closing the business case, but more importantly, builds up confidence in the program such that private investment will follow as government financial support signals and/or validates the value proposition of the program. This appears to be the case with the UK Space Agency’s investment that eventually led or at least helped lead to the Eutelsat merger. Note as well that for both IRIS2 and Lightspeed, the EU and the Canadian government are not funding these programs 100%. Commercial funds will still have to be raised or must be part of the funding scheme. With government support and financial backing, investors will or should view such investments as less risky and more solid.

But what is in it for national governments and regional entities like the EU? After all, these are taxpayer funds that need to be justified for the benefit of Canadian, UK and EU nationals. And herein lies the third reason for government support. National or regional players fund key programs as part of an industrial policy strategy in order to achieve a number of goals. In the space sector and specifically for Canada, the UK and the EU, these inter-related goals include:

- technology development

- job creation

- national or regional competitiveness

- support of local/regional players

- economic growth.

Elon Musk and Jeff Bezos have the technological edge not just in the space industry but across multiple sectors. At present, SpaceX is putting a lot of pressure on traditional launch companies, and Starlink has caused consumers to churn from existing broadband access players, for instance Hughes and NBN Australia. Amazon has AWS and Amazon Prime to leverage as it provisions its Kuiper service. If incumbents in the Americas, Europe, EMEA and the Asia Pacific were to be financially challenged or put more directly, driven out of business, technology development and thus the national or regional space ecosystem will come to a halt. In achieving a technology development or incubation goal in the case of developing countries, national players in a highly critical domain such as space, can’t be left to play by the rules of the marketplace and potentially go bankrupt.

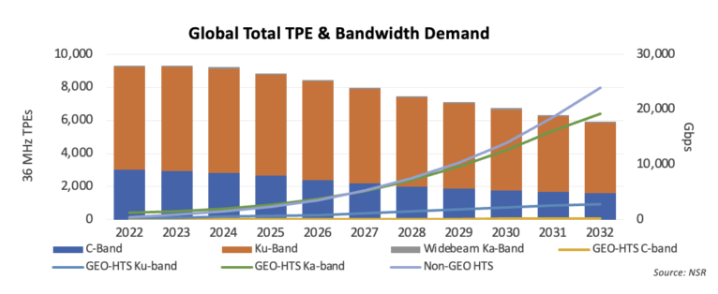

Indeed, in NSR’s latest Satellite Capacity Supply & Demand, 20th Edition report, the wholesale market remains healthy in terms of competition not just in the NGEO/LEO camp but also in GEO-HTS. Over time, however, NGEO-HTS will be the preferred solution, putting pressure on industry incumbents to craft a multi-orbit strategy. And this is what the large incumbent players have and will continue to do. National and regional operators are now looking into a multi-orbit and/or LEO strategy as well. The industry’s evolution into a NGEO/LEO world is moving fast where traditional players need external stimulus to put them at the same pace of adoption as SpaceX and Amazon.

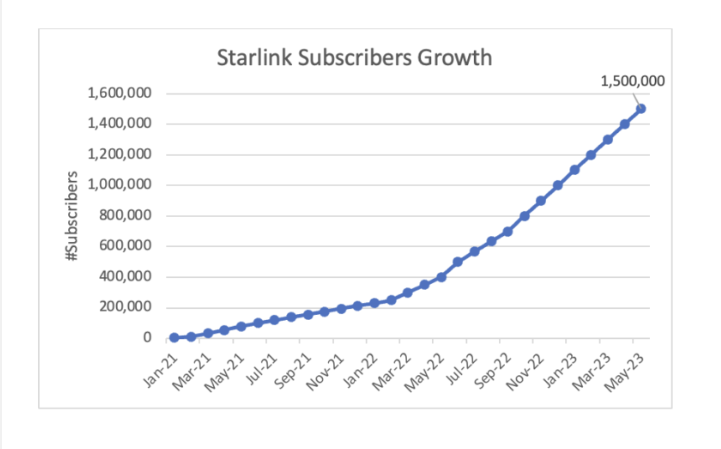

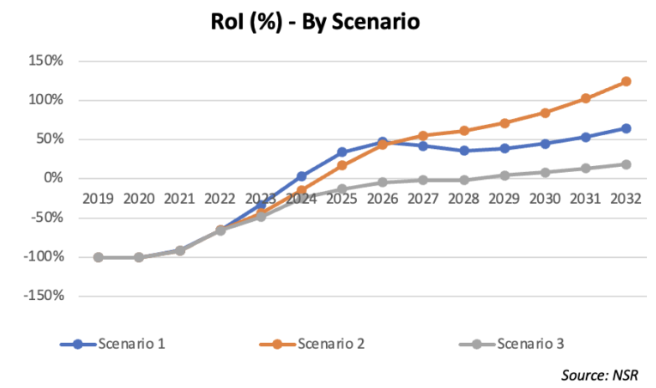

On the services side, NSR’s Starlink Feasibility: Business Model and ROI Analysis outlined Starlink’s cadence of subscriber growth, which is unprecedented, achieving 1.5 million subs in two short years. As mentioned above, telcos, MNOs and cloud providers are closely watching these developments especially as Starlink is also moving into other verticals like D2D, and Kuiper could leverage its AWS offering for cloud services. Many question the viability of Starlink’s business case, which provides a counter argument for government funding. Having ran a few scenarios, it appears that Starlink has a good chance of becoming revenue positive in a few years.

The space economy is estimated to be in the trillions over the long term, and space is a key domain for commercial, government and military programs. This also translates to job creation and an engine for economic growth. In its rationale for the OneWeb investment, the UK Space Agency indicated that the UK space sector grew by over 60% since 2010 and supports £300 billion of UK economic activity. Related to technology incubation and building a space ecosystem, job creation and not just basic jobs but high-quality, high-paying, next-generation technology-driven jobs where the comparative advantage of labor is a highly skilled workforce is where governments plan for.

In terms of national or regional competitiveness, support of local and regional players go hand-in-hand. Case in point is the nearly 20-year dispute over subsidies between Airbus and Boeing. Subsidies and government support seem to work (arguably) and appear to have provided results in the aerospace industry.

Governments have and continue to provide subsidies and conduct industrial policies to assist local and regional players in the space industry to survive, become viable and achieve competitiveness. Many of the recent initiatives seem to be positioned to compete against SpaceX/Starlink and down the road with Amazon Kuiper. It should be noted that the U.S. Government likewise awarded Starlink with $900 million in RDOF funds (which were eventually taken back) as well as contracts with the U.S. defence industry. Governments provide support for even strong players to achieve their goals including digital divide programs and to support a thriving space industry for commercial and government/military interests. Governments achieve multiple goals in terms of ecosystem development and having space as an engine for future growth appears to necessitate a targeted industrial policy of sorts. The space domain must be supported to remain viable and strong. A country like the UK or Canada or a region like the EU cannot let its space industry be out-competed and eventually be driven out of the marketplace by Mr. Musk and Mr. Bezos or lose their industrial edge to the U.S.

And of course, there is also the China LEO constellation at play, which have commercial and military implications for the West, a program that is heavily backed by Beijing. A government response is thus necessary to counter these initiatives.

The bottom line

Government funding seems necessary to compete against Starlink and Kuiper and more importantly, to protect, promote and ensure that national and regional space programs survive and thrive. However, several basic questions remain:

- Will the industrial policy and financial support by Canada, the EU and the UK work?

- Can government funding at the current level be enough to go against the deep pockets and the ability of SpaceX/Starlink and Amazon Kuiper to raise funds?

- If industrial policies do not work, what alternative solutions and steps can market incumbents and governments take?

It is still too early to predict the outcome of the recent government-led initiatives, but one thing is certain – the future of satellite and space companies will still and ultimately be determined by the marketplace, i.e. by customers and end users who will benchmark and procure services based on price, performance, speed to market and quality of service as their KPIs for determining from which LEO player and launch provider they will buy services.

Article (PDF)

DownloadAuthor