Hyper-automation can re-energise revenue growth, but only if operators look beyond mere cost reduction

01 October 2025 | Research and Insights

Article | PDF (6 pages) | Operator Spending| Automated Assurance| Monetisation Platforms| Service Design and Orchestration| Network Automation and Orchestration| Customer Engagement| AI and Data Platforms| Applications Data and Strategies

Automation has been a priority for the telecoms industry for a long time, but the lack of top-line revenue and margin growth demonstrates the need for greater ambition. Hyper-automation can create processes that are 100% automated, removing manual intervention wherever possible. To achieve this, automations must be self-learning and based on adaptable dynamic tools, and require access to deep insights. Recent technology changes mean that this once ambitious goal is now within reach for operators and the vendors that supply them.

There are various definitions of hyper-automation, but all are consistent with TM Forum’s description of Level 5 autonomous networking: processes need to become ‘self-aware and self-governing’, enabling them to manage their own performance and make changes to their logic without human intervention.

Hyper-automation requires both technological and organisational support

Achieving high levels of automation remains a major goal for every telecoms operator. Managing data, supporting staff training and adopting automation tools are critical to achieving this aim. In addition, there must be a strong desire across the whole organisation to automate each process, and motivations must be put in place because few hyper-automations can be achieved swiftly. Indeed, hyper-automation typically requires a period of data gathering to train AI-based tools.

The journey towards hyper-automation is therefore closely linked to the use of AI, access to data and the ability to implement insights into business processes. However, there is no single technology solution that can support all types of automation; operators need a toolbox of solutions and approaches to achieve their hyper-automation goals.

Organisations can use an array of technologies such as AI, machine learning and robotic process automation (RPA) to enable hyper-automation. AI-based technologies can now be used to automate increasingly complex processes, which until recently was not viable due to the cost, their dynamic nature and timescale of implementation. Low-code/no-code (LC/NC), agentic AI and generative AI (GenAI) technologies are all changing the economics of hyper-automation.

Agentic AI is the latest AI-based technology that can be used to support hyper-automation. It enables the creation of software agents that can interpret context, plan multi-step actions and learn from their environment, often by integrating powerful large language models (LLMs) for reasoning and discovery. Traditional AI typically responds to specific commands, while agentic AI systems can proactively identify problems, develop strategies and adapt to changing conditions to optimise outcomes. Tasks can be developed, tested and deployed significantly faster (and at lower cost) than with previous technologies.

Application vendors will continue to embed new hyper-automation features into their solutions to ensure seamless and straightforward adoption for operators. Vendors are also increasingly enabling LC/NC development to be performed, thus allowing customers to work with independent studios. New standards, such as the Model Context Protocol (MCP), are helping to drive the adoption of more-open development studios.

The automation layer is essential to hyper-automation

Each operator’s requirements are shaped by their internal systems architecture, adopted processes, services offered and customer base. This necessitates unique processes, which require software to be configured or developed to support them. Any significant operational transformation programmes mandate that legacy systems are retired to boost opex savings; adding new automations while leaving current systems in place may increase costs.

Operators are employing various approaches to deliver automation based on their skills and implemented systems. The emergence of new AI-driven tools that use natural language inputs allow non-technical staff to develop automations. This democratisation of development skills will help to alleviate resource constraints associated with accessing developers. It also empowers non-technical staff to make changes, thus significantly reducing the time and resources needed to support hyper-automation.

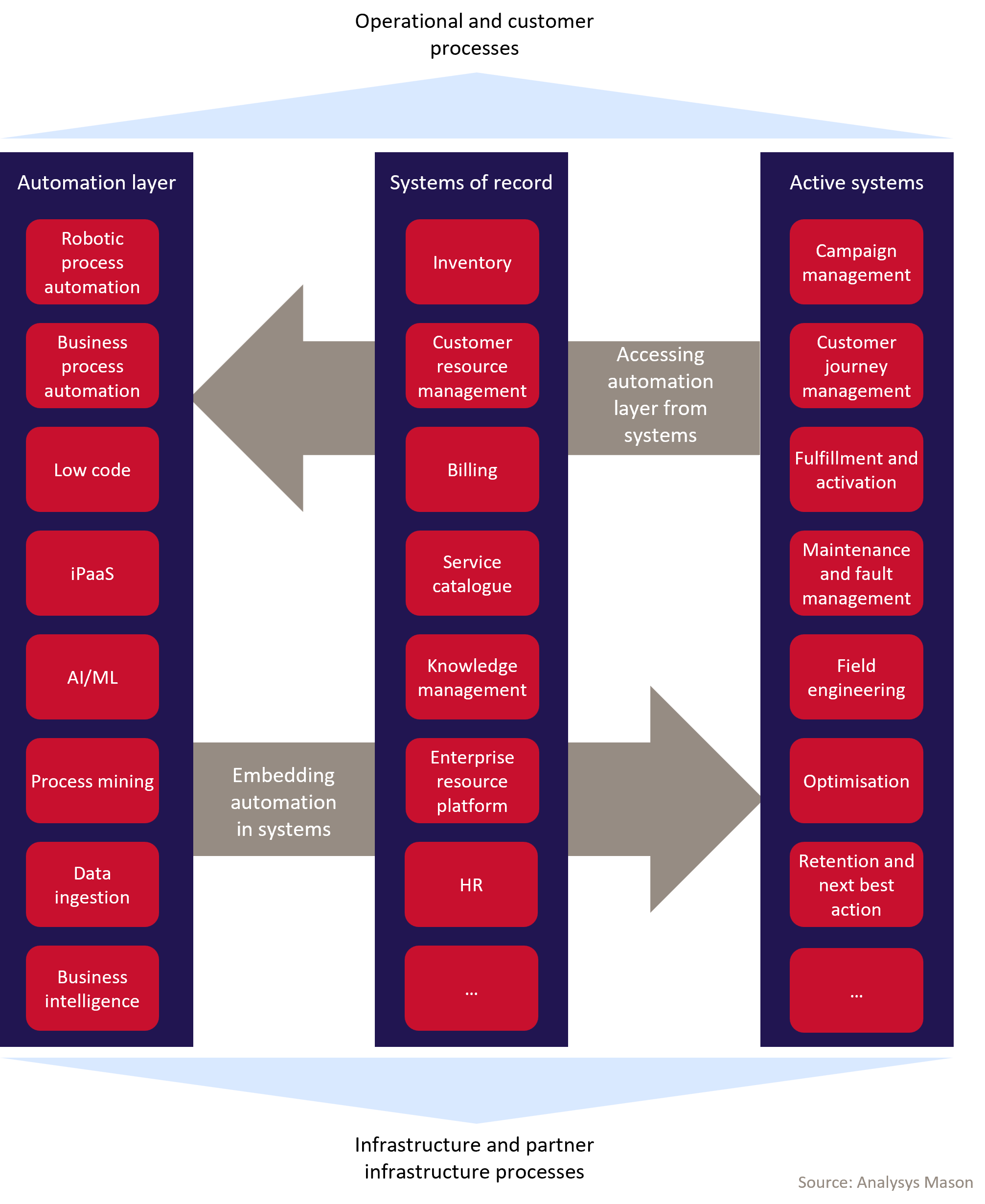

A layer of automation tooling (Figure 1) is essential to build, deploy and support hyper-automation. This layer comprises data, AI and process flow tools, which can be integrated into established applications or application platforms, or used independently to connect multiple applications, data sources and processes to support specific scenarios.

Figure 1: Integration and consolidation of the automation layer and active systems into the systems of record

Hyper-automation can be applied to both manual processes and existing automated processes

Telecoms operators have traditionally excelled at automating large-scale, repetitive processes. This has led to high levels of automation in consumer-services-related areas such as marketing, sales, delivery, billing and payments. However, there is still more that can be done.

Hyper-automation facilitates the scaling of complex manual processes by using AI-based technologies. Not every process needs to be fully automated; a common approach is to augment existing processes with a co-pilot that supports, improves and accelerates operations. Through iterative improvements, these processes can be increasingly automated once accuracy is sufficient and organisational confidence in the outcomes has been established.

There are two broad applications for hyper-automation.

- Manual processes. These processes have not previously been candidates for automation due to factors such as low transaction volumes, limited user engagement, complexity and dynamicity, which make the return on investment of automation less likely when using older technologies.

- Existing automated processes. Hyper-automation can enhance these processes by enabling greater personalisation or incorporating frequent changes to improve business outcomes. Examples include:

- proactive customer care (prompting prospective subscribers to purchase, carrying out preventative maintenance based on crowd-sourced data and using customer experience measurements to reduce churn)

- field work (where complex tasks require a wide range of knowledge and skills, and work often requires multiple visits).

The greatest potential for savings comes from use cases with a high number of staff because even small gains in process automation, when multiplied across numerous staff-based transactions, can justify projects.

Hyper-automation can lower operators’ opex

Higher levels of automation are essential to support new revenue streams without increasing opex. Hyper-automation can be used to lower the costs associated with staffing, which typically form 15–25% of operators’ total costs; the remainder comes from facility rental, financial borrowing and utilities.

There are notable examples from outside the telecoms industry where hyper-automation has achieved remarkable results (though the companies involved are not entirely comparable to telecoms operators). For example, Meta automated its network operations team, which supports over 2 billion monthly active users with a DevOps approach and its NetNORAD troubleshooting system for highly efficient operations. This resulted in a significant decrease in resources and a 90% reduction in costs.

Hyper-automation can provide a huge boost to efficiency, business agility and the customer experience

Hyper-automation is often justified by the efficiency gains achieved by reducing the number of manual processes and associated staffing costs. This can manifest in various ways, such as reducing the number of staff or delaying the hiring of additional personnel, but also by enabling the existing staff resources to accomplish more. Hyper-automation is therefore not solely about reducing operational costs via staff reduction; it can also enhance the customer experience, grow service revenue by supporting complex new services and improve resource efficiency (including infrastructure, networks and other assets).

Hyper-automation can reduce churn. It enables operators to better support the entire service cycle by creating more tailored services, ensuring faster and more reliable delivery, resolving issues more quickly and providing proactive support and self-service options. Additionally, the improved back-office functionality enabled by hyper-automation helps to reduce service outages, minimise billing errors and accelerate the creation of new offers.

The ability to create, deliver and monitor new services (made feasible by higher levels of automation) enables offerings such as network slicing, personalised services and service-level agreements tailored to specific service types. This capability allows operators to unlock new revenue streams in areas that were previously inaccessible due to their complexity.

Hyper-automating end-to-end processes also enables businesses to react to change more rapidly, without needing to reprogramme logic, retrain staff or instigate new processes. Indeed, hyper-automation technology can often recalibrate itself automatically based on changing inputs such as network capacity, as well as market factors such as competitors’ price changes or new offers. Business requirements, such as the need to grow service revenue or a change to the yield requirements for margins, can also be fed directly into hyper-automated processes.

Other benefits of hyper-automation include:

- energy reduction by introducing intelligent systems to dynamically adjust configurations and reduce energy usage

- accelerating the shutdown of legacy systems by using smarter planning and design tools to phase out outdated networks, infrastructure and applications more quickly

- the transformation of current business processes

- organisational change by facilitating new operational models, creating new roles and responsibilities and enabling the sharing of corporate systems across different operational entities.

Analysys Mason’s Telecoms operator opex reduction strategies: case studies and analysis includes several cases studies of operators that have implemented automation initiatives to reduce their opex. For example, BT is looking to reduce its gross annualised opex by 23% between 2024 and 2029, and Proximus reduced its opex by 1–2% between 2020 and 2022. Other examples include AT&T, Elisa, KPN, Swisscom and Verizon, all of whom are looking to achieve opex reductions by increasing their level of automation.

AI trends will have a major impact on both operators and vendors

The opportunities to reduce operational costs, enhance the customer experience and generate new service revenue act as significant motivators for operators. Trends in AI tools support these motivators and encourage both operators and vendors to adopt hyper-automation by lowering project costs, reducing maintenance requirements and minimising or eliminating the need for extensive training and skills to develop new automations (Figure 2).

Figure 2: Trends in AI tools and their implications for operators and vendors

| Trend | Implication for operators | Implication for vendors |

|---|---|---|

| Most of the programming for automations will be done using GenAI capabilities. |

|

|

| The use of DevOps will increase because AI capabilities will be accessible via natural language interfaces and the number of citizen developers will rise. |

|

|

| The use of agentic AI frameworks will grow and some will enable operators to develop software agents independently from applications. |

|

|

Source: Analysys Mason

How Analysys Mason can help

Analysys Mason helps vendors and telecoms operators to implement, understand and sell hyper-automation solutions by providing expert research, strategic guidance, assessment frameworks and consulting tailored to telecoms-specific challenges, with a particular focus on AI-driven automation, integrated OSS/BSS transformation and their implementation.

Analysys Mason runs dedicated research programmes such as Automated Assurance and Service Design and Orchestration that examine how hyper-automation, AI and GenAI can transform operations. We produce annual market share reports, 5-year forecasts, strategy documents and practical guidance for both vendors and telecoms operators.

Article (PDF)

DownloadAuthor