The automotive sector will drive the demand for 5G

Analysys Mason forecasts that the total number of IoT connections (over both cellular and LPWA networks) could reach 5.4 billion in 2027. The number of traditional cellular IoT connections (that is, using 2G, 3G/4G and 5G networks) will grow to 1.7 billion by 2027 and the number of IoT connections using LPWA technology could reach as much as 3.6 billon (if LPWA technology meets our expectations). 5G will power 3% of all IoT connections (or 8% of those using traditional cellular networks), and the automotive sector will be the key vertical market. The number of lower-bandwidth connections in this sector will also increase, supported by LTE-M. This article examines the key trends of IoT adoption in the automotive sector and provides an overview of our recent forecast report, IoT in the automotive sector: trends and forecast 2018–2027.

The automotive sector will continue to contribute the highest share of connectivity revenue

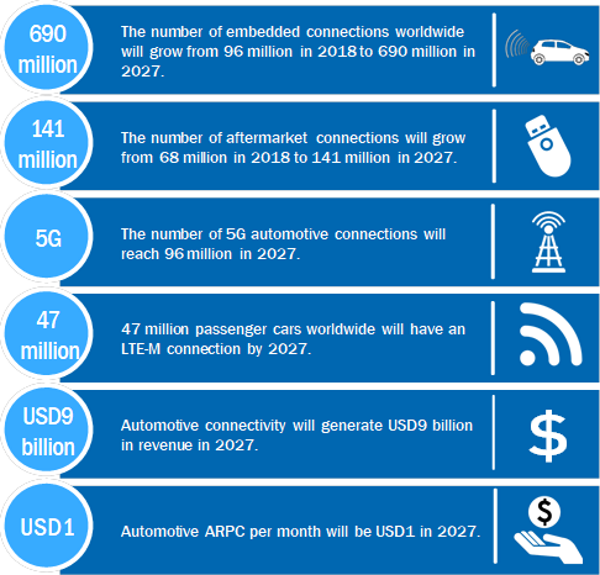

Automotive connections (including those made by embedded SIMs and aftermarket devices in passenger vehicles) will continue to be the most important component of the total wide area IoT connectivity market. The number of automotive connections worldwide will increase to 831 million by 2027 and will account for just over 20% of all IoT connections (49% of traditional cellular IoT connections). More importantly, this sector will generate over USD9 billion in connectivity revenue, which represents 38% of the total connectivity revenue (53% of traditional cellular IoT revenue). Key metrics regarding the impact of IoT in the automotive sector are shown in Figure 1.

Figure 1: Key data for automotive IoT, worldwide, 2027

Source: Analysys Mason, 2019

The high level of competition in the automotive market and the large number of regional and multi-country contracts means that it is challenging for single-country operators to win deals. The big global operators such as AT&T (25 million automotive connections) and Vodafone (18 million automotive connections) are well-established, but MVNOs such as Globetouch are winning deals and putting pressure on these established players. The car companies themselves also have significant buying power. Operators that are only now looking to enter the IoT market might do well to target other sectors.

Emerging networks will extend operators’ potential to support automotive applications

Analysys Mason’s recent report, Aftermarket automotive propositions: the opportunity for operators, gives an overview of the aftermarket connectivity providers that are trialling the potential of LTE-M for aftermarket applications. LTE-M is sufficiently high-bandwidth to support many applications, supports mobility and is a relatively cost-effective solution for replacing 2G, thereby making it an ideal candidate to support some aftermarket applications such as tracking. We forecast that the number of LTE-M aftermarket automotive connections worldwide will rise to 47 million in 2027, out of a total of 141 million aftermarket connections.

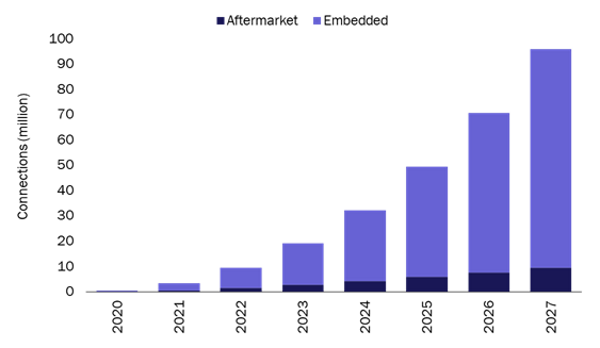

5G has been the subject of significant hype in relation to IoT, but deployments for some use cases are now closer to being launched. The automotive sector is well-placed to benefit from 5G technology (IoT opportunities created by 5G) because it will generate high volumes of connections and requires high bandwidth for some applications (for example, in-car entertainment). Different companies in the value chain are also collaborating closely through the 5GAA (for example, vehicle manufacturers, hardware providers and operators). We forecast that the number of automotive 5G connections will reach 96 million in 2027 (see Figure 2).

Figure 2: 5G automotive connections, worldwide, 2020–2027

Source: Analysys Mason, 2019

Connected cars will create incremental revenue opportunities for operators in the consumer IoT sector

There is a growing opportunity to deliver automotive B2C services in the retail sector. For example, AT&T is already delivering in-car Wi-Fi plans to over 1 million subscribers. B2C services are being delivered using both embedded and aftermarket connected car solutions; the latter is supported by companies such as mojio in partnership with operators. This opportunity is also attracting investor interest; in February 2019, mojio raised USD40 million of funding,1 with investors including Deutsche Telekom and TELUS, and Springworks was acquired by Tantalum in December 2018.2 B2C applications could lead to significant revenue growth for operators and will probably drive the immediate implementation of 5G in the automotive sector before future applications such as C-V2X and C-V2N emerge.

In addition to the automotive opportunity, Analysys Mason has updated its IoT forecast for all sectors (10 sectors), all technologies (2G, 3G/4G, 5G, NB-IoT, LTE-M and other LPWA), and all country markets. The updated forecast is published on DataHub.

1 Mojio (2019), Mojio Closes Oversubscribed $40M Series B Funding Round. Available at https://www.moj.io/blog/mojio-closes-oversubscribed-40-million-series-B-funding-round.

2 Tantalum (2018), Tantalum Acquires Springworks to Expand Global Connected Car Footprint and Accelerate Innovation. Available at https://www.tantalumcorporation.com/tantalum-acquires-springworks-to-expand-global-connected-car-footprint-and-accelerate-innovation/.

Downloads

Article (PDF)Latest Publications

Article

If Vodafone IoT is a success as an independent firm, other operators will also spin off IoT divisions

Forecast report

Italy: wireless IoT market trends and forecasts 2023–2032

Forecast report

Sweden: wireless IoT market trends and forecasts 2023–2032