Netflix is cutting prices, but streaming video providers must pursue various tactics beyond price

18 April 2023 | Research

Article | PDF (3 pages) | Video, Gaming and Entertainment

After missing its projected growth in some quarters of 2022, Netflix announced the reduction of prices for some of its subscription plans in more than 30 countries starting from February 2023. While this move could boost the total number of subscriptions worldwide – making Netflix look better to investors – we believe it could also reduce revenue unnecessarily. Our research, based on a recent survey of streaming video services users worldwide, shows that consumers in some of the countries where the discount applies have a high willingness to tolerate price rises, suggesting that Netflix’s strategy may not account for regional nuances and may lack specificity.

Netflix is lowering its prices in over 30 countries

Streaming video is dominated by three major players worldwide. At the end of 2022, Netflix had 231 million paid streaming members, Amazon had over 200 million Prime customers and Disney+ had 162 million revenue-generating units (RGUs), which includes subscribers from its various sub-brands. According to our surveys, the same three companies have been the most popular in the majority of the world’s largest markets since 2021. However, the market context in which these players operate changed significantly in 2022. All three companies had, until recently, continued to increase prices. As both Disney+ and Netflix missed their projected growth targets during some quarters of 2022, they are looking for ways to ensure growth.

One way that Netflix is trying to ensure its growth is by defensively reducing its prices in countries where it does not have (and likely does not intend to offer) an advertising tier – this was announced in late February 2023. Netflix has dropped subscription prices in more than 30 countries in most world regions, primarily focusing on low- and middle-income countries. The discounts will apply to some subscription tiers with cuts set at varying amounts, but in some markets the cuts are reportedly as high as 50%. This decision was defined as a way ‘to improve member’s experience’ and represents a defensive plan to retain Netflix’s customer base after a period of fluctuation.

Pricing streaming video services is getting harder in the context of inflation and increasing competition

Our survey of 19 000 consumers worldwide in 3Q 2022 shows that, generally speaking, Netflix has the most-satisfied customers out of the major streaming providers. It had the highest Net Promoter Score (NPS) in 12 of the 17 countries that we surveyed. This does not, however, mean that Netflix can afford not to evolve. Netflix’s price cuts must be set against the context of inflation and the increased cost of living in 2022 and 2023 as well as the still-growing amount of choices that consumers have for their streaming video services. Netflix appears to be trading off ARPU for subscriber numbers so as to provide investors with a success story. However, we suspect that they are also reducing prices in some countries where they don’t necessarily need to. This move could also result in a loss in revenues if applied in the wrong territories. Figure 1 shows consumer attitudes towards price rises for streaming video services, as explored in the Analysys Mason report Customer satisfaction with streaming video services: consumer survey.

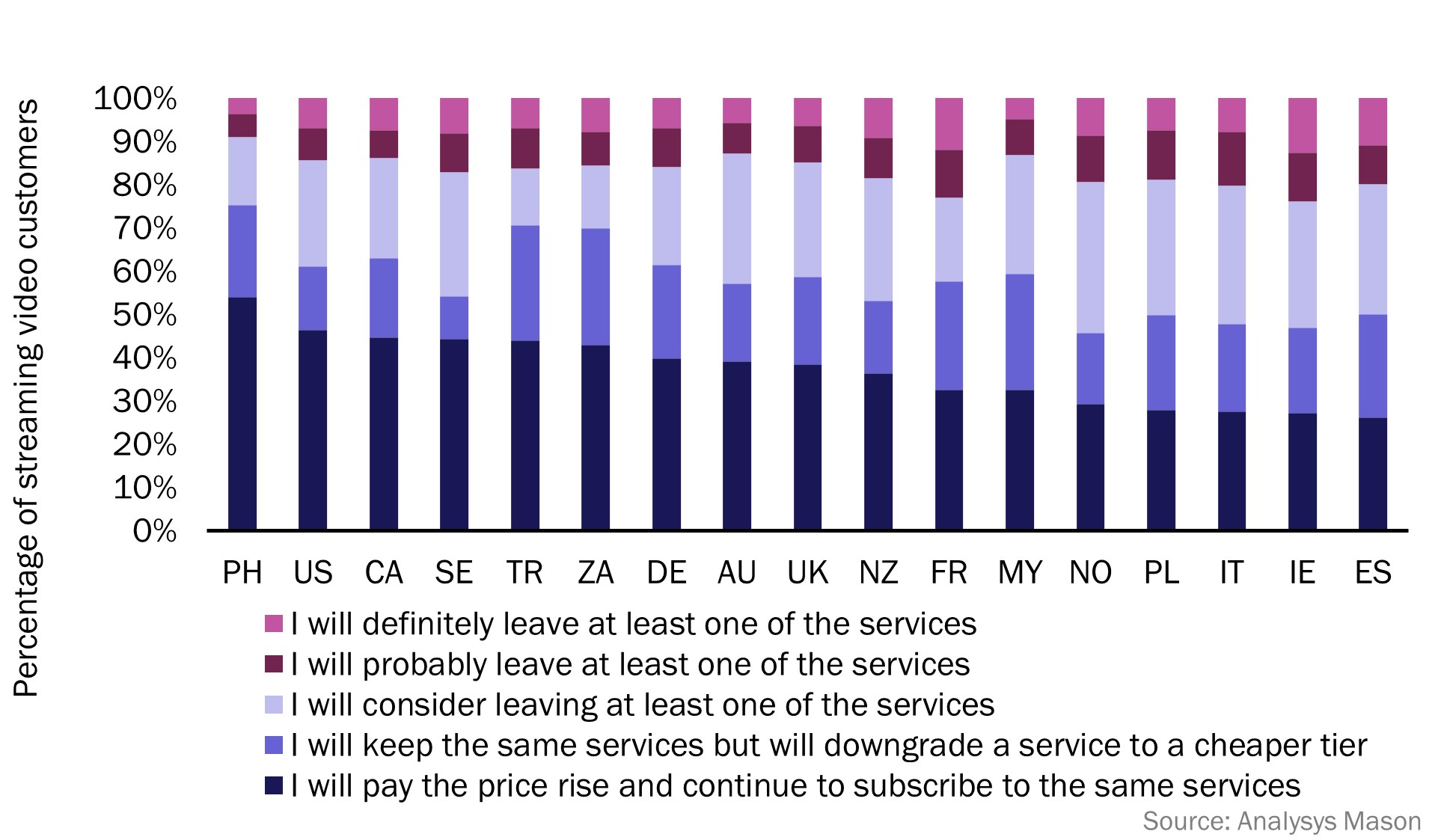

Figure 1: Consumers’ attitudes towards streaming video price rises, by country, 3Q 20221,2

1 Question: “Many streaming video providers have increased their prices in the last 12 months. Next time they increase their prices what are you most likely to do?” n = 14 749.

2 PH = Philippines, US = United States, TR = Turkey, ZA = South Africa, CA = Canada, SE = Sweden, AU = Australia, UK = United Kingdom, DE = Germany, NZ = New Zealand, MY = Malaysia, FR = France, PL = Poland, IE = Ireland, NO = Norway, IT = Italy, ES = Spain.

In the Philippines, the discount on Netflix’s Standard plan will have a 13% price reduction equivalent, while there will be no cut on the Premium plan. Similarly, Malaysia will see a 25% reduction on Netflix’s Basic plan. The survey shows that the Philippines is the country that is most willing to pay more, despite the price cut. Malaysia, along with the Philippines, has one of the lowest percentages of customers thinking of definitely leaving streaming video services should prices rise. This means Netflix’s price reductions are not necessarily needed in certain countries – mostly countries that have a lower GDP per capita, where Netflix has less customers – as a way to gain subscribers, but that Netflix might consider price reductions in territories with a lower willingness to pay the price rises such as Ireland, Poland or Spain, as shown in the survey.

Streaming video providers must continue to pursue differentiation tactics beyond price

Ultimately, Disney+, Netflix and others are looking for ways to ensure continued growth for investors. Diversifying their pricing approach is one way to potentially achieve this, though ARPU will inevitably fall as a result. It is, however, not their only option. Streaming video providers must also do the following.

- Continue to delight customers with their core content offering. As growth slows, competition among streaming providers increases. To satisfy customers, companies should ensure that their services continue to delight consumers and offer a sufficient amount of original, exclusive or semi-exclusive content.

- Monetise account sharing. After testing the introduction of fees for password sharing in certain countries in 2022, Netflix has announced its plan to start rolling this out more broadly in 2023. It rolled out new policies around account sharing in Canada, New Zealand and other countries in February 2023 but had, at time of writing, not changed its approach in the USA.

- Diversifying their core product. Examples of this include live broadcasts, sports and gaming. Netflix has recently acquired four games studios and released more than 50 titles, and Apple has invested multi-billion-dollar-sums to ramp up its sports streaming offering.

For further insight from our consumer survey relating to the streaming video industry please see Analysys Mason’s report, Streaming video opportunities for operators: consumer survey and Customer satisfaction with streaming video services: consumer survey.

Article (PDF)

DownloadAuthors

Martin Scott

Research Director

Paola Molteni

ConsultantRelated items

Article

TV services remain essential for many operators, even if media asset sales mark a change in ambition

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Forecast report

France: pay-TV and streaming video forecast 2024–2030