Network API revenue will hit a modest USD7.6 billion in 2030, with the potential to grow far beyond by 2035

13 June 2025 | Research and Insights

Article | PDF (3 pages) | Mobile Services| Enterprise Services| NaaS Platforms and Infrastructure

Network APIs are emerging as a strategic opportunity for telecoms operators to unlock new revenue streams and drive better returns on their 5G investments. They represent a promising new area for revenue growth at a time when revenue is either static or declining in most telecoms markets.

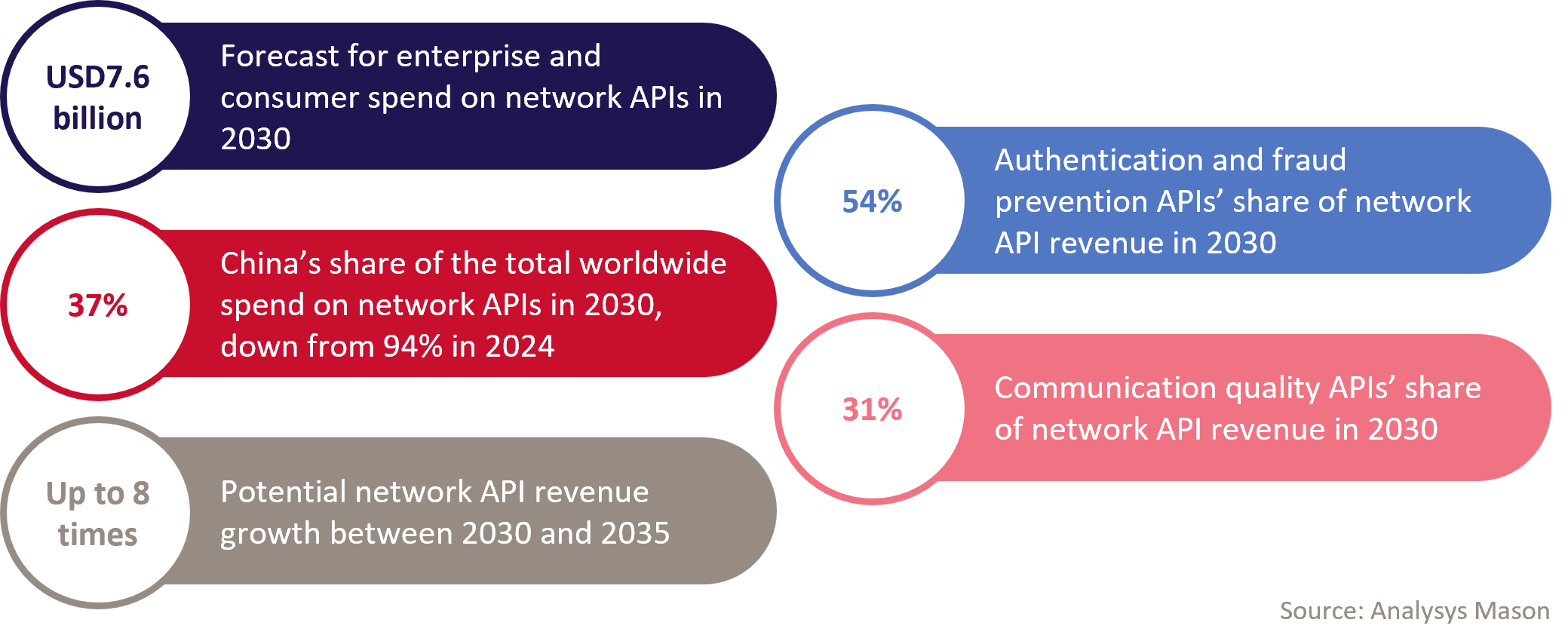

In Analysys Mason’s Network APIs: worldwide forecast 2024–2030, we estimate that enterprise and consumer spending on CAMARA-based network APIs worldwide will increase from USD550 million in 2024 to USD7.6 billion in 2030 (0.6% of all mobile service revenue) (Figure 1). However, our forecast will only be realised if ecosystem players meet critical development and adoption milestones. These will lay the foundation for long-term growth; network APIs could reach up to 5% of mobile services revenue by 2035.

Figure 1: Highlights from our network API forecast

Our network API revenue forecast of USD7.6 billion by 2030 marks just the beginning of a long-term growth trajectory

Network APIs are a long-term revenue opportunity and should be thought of as such. Operators are uniquely positioned to provide high-value APIs thanks to their high-quality, ‘clean’ subscriber data and user identities, which few other organisations can provide at the scale that operators can. Developments made between 2025 and 2030 will be critical in laying the foundations for a market that could grow up to eight-fold between 2030 and 2035. All stakeholders should therefore maintain a 10-year outlook and plan accordingly.

The demand for authentication and fraud prevention APIs will be the main driver of network API revenue growth. This demand will initially come from the financial sector, particularly for the SIM Swap API, but it is expected to grow across multiple enterprise verticals. Organisations are looking to move away from traditional two-factor authentication via SMS in favour of more secure, cost-effective and seamless user verification methods. The Number Verification API is set to generate significant volumes of spending, especially because major players such as Google and TikTok are already pushing for its adoption.

Operators should work to capitalise on the authentication and fraud prevention opportunity and become trusted partners for global enterprises in order to drive momentum in the adoption of other categories of APIs. Indeed, communication quality APIs, such as Quality on Demand (QoD), are especially well-positioned to drive the next wave of revenue growth after 2030. China has already demonstrated the market potential for this group of APIs; operators in other countries that can match Chinese players’ level of network programmability and automation over the coming years will be able to offer developers real-time network insights and control via user-friendly models, thus unlocking innovative use cases (provided that market demand emerges).

However, it is also important to maintain realistic expectations of revenue potential in the short term. Only 6% of the USD550 million of network API revenue generated worldwide in 2024 came from outside of China (USD33 million). Revenue in 2025 and 2026 may also not be groundbreaking, but operators should build the necessary organisational, technical and commercial elements to unlock the full market potential.

China’s early success can help operators elsewhere to justify further investment in network APIs

China is a promising test case for network APIs that shows the scale of the opportunity for operators around the world. China is the dominant network API market; it accounted for 94% of network API revenue worldwide in 2024 (USD521 million) (this will drop to 37% by 2030, and the absolute revenue figure for China will grow to USD2.8 billion).

Operators elsewhere should aim to replicate some of their Chinese counterparts’ success factors, including:

- rallying around a small number of CAMARA APIs (Number Verification and QoD, in China’s case) to unlock scalable use cases

- advanced network infrastructure with multi-domain network API exposure and network-as-a-service (NaaS) infrastructure, with highly performant API gateways

- competitive pricing that allows operators to make inroads with the Number Verification API in a bid to displace over-the-top one-time passwords (OTT OTPs) and enable the adoption of the QoD API for gaming among price-sensitive users.

However, much of the success in China stems from favourable market conditions, including strong and well-established API businesses from the three main operators (particularly China Mobile). These operators also have strong in-house capabilities for creating value-added services and digital products for both enterprises and consumers, and they have successfully integrated network APIs into many of these solutions. Chinese operators also benefit from regulations around consent and data management that are far less restrictive than those in many countries around the world, enabling quick commercialisation and minimal legal-team interference.

This means that the model used in China is not universally replicable. Operators elsewhere should tailor their strategies to local enterprise pain points, focus on APIs that address specific market needs and navigate their own regulatory and infrastructure landscapes.

Our forecast provides a realistic, bottom-up approach, factoring in actual operator revenue, API traffic and roadmaps

Our network API forecast report provides a full breakdown of spend by API category and geography. It also reports revenue for a selection of individual network APIs and 11 countries. It analyses the main drivers, trends and challenges that have affected the forecast.

We adopted a bottom-up approach when developing this forecast, starting from a base of over 550 network APIs that have been launched or planned by 124 operators in 70 countries. We also factored in collaboration alliances, operator revenue and API traffic figures across multiple continents, mobile and fixed network subscriber coverage, operators’ network capabilities, regulatory environments, application-to-person (A2P) messaging trends, vendor and channel partner roadmaps and business trends by enterprise vertical.

If you would like to find out more about our forecast and discuss findings, please reach out to Ameer Gaili or Jakub Konieczny. See our NaaS Platforms and Infrastructure programme for more research and insights into the network API market.

Article (PDF)

DownloadAuthors

James Kirby

Senior Analyst

Gorkem Yigit

Research DirectorRelated items

Survey report

Retail store visits: consumer survey

Survey report

Awareness and usage of eSIMs, and their impact on churn: consumer survey

Tracker report

Mobile pricing (SIM-only plans): trends and analysis 1Q 2026