NSR’s top satcom industry predictions for 2024

2023 marked a significant phase of consolidation, competition and challenges in the satellite communications (satcom) industry. Two major mergers and acquisitions took place, namely between Viasat and Inmarsat, and Eutelsat and OneWeb. These strategic moves underscored the industry’s response to the intensifying competition from Starlink and other non-geostationary-Earth orbit (non-GEO) players. Both Starlink and OneWeb successfully completed the first phase of their satellite constellation. Starlink emerged as a key industry driver in terms of revenue growth, particularly in the broadband access market, with over 2.2 million subscribers. The company’s next major target is the commercial mobility sector.

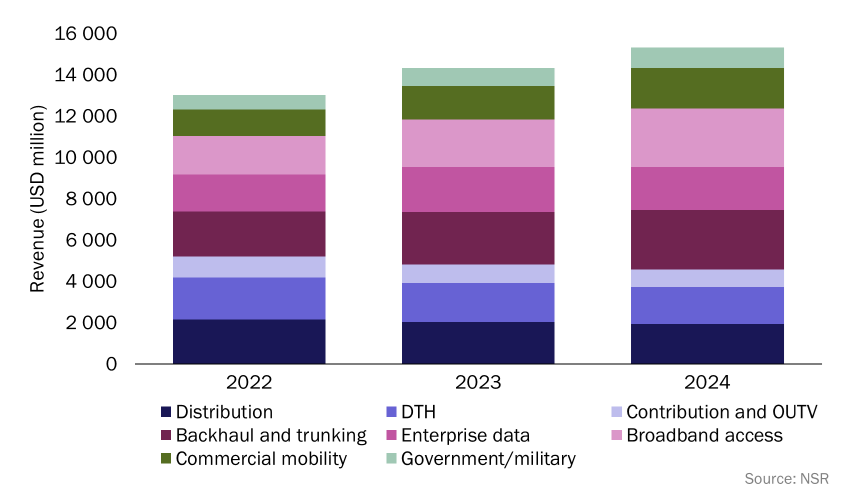

Economic and geopolitical challenges worldwide continued to hinder the growth potential of the satcom industry in various regions, including North America and Europe. In addition to macroeconomic challenges, the industry witnessed major setbacks with the Viasat-3, Arcturus and mPower satellite failures. Despite these challenges, according to NSR’s Satellite capacity supply and demand, 20th edition report, the overall satcom market had around 10% growth in capacity revenue in 2023. Starlink’s acceleration and a continued surge in backhaul demand was the primary driver for this market growth. Therefore, despite challenges, the satcom industry demonstrated resilience and adaptability in 2023. Subsequently, how will these trends impact the satcom market performance in 2024?

Figure 1: Capacity revenue by application, worldwide, 2022–2024

Our predictions for the satcom industry in 2024

Building upon various trends observed in the satcom industry and in other industries in 2023, here are NSR’s key predictions for the satcom industry in 2024:

- The satcom industry landscape is changing rapidly as more players and solutions are infused in the mix. As a result, we expect more vertical and/or horizontal consolidation across the satcom industry value chain in 2024.

- The satcom industry has been incorporating advanced and value-added technologies such as software-defined satellites and networks (SD-WAN), cloud integration, edge computing, security, and more to improve operational efficiencies and offer more value to the customers. 2024 will kickstart the exploration of AI integration and benefits within the satcom ecosystem. We envision enterprise VSAT stakeholders to be the first movers in the space.

- Jupiter-3 will drive the GEO market growth in the Americas across broadband access, backhaul and enterprise VSAT markets.

- Starlink will continue to grow in the broadband markets. However, the pace of growth will be lower than it was in 2023 as it expands in emerging economies where the average revenue per user (ARPU) is lower. The company will have significant opportunities to grow its market share in terms of subscribers in the in-flight connectivity and maritime markets.

- OneWeb, along with Eutelsat, will start penetrating the enterprise VSAT and backhaul markets through downstream partnerships and by filling the demand gaps.

- Kuiper is set to significantly advance in its satellite manufacturing and constellation deployment plans. Most likely, it will start launching its satellites in 2024.

- There will be an increase in collaborative and/or multi-orbit projects across different use cases, similar to the SES and Starlink partnership and the Eutelsat and OneWeb capability integration.

- Major drivers of demand in the satcom industry will be: digital transformation in enterprise VSAT, network upgrade and expansion in backhaul and trunking, autonomous maritime platforms and unmanned aerial systems in government/military, end-user broadband expectation in commercial mobility and government programmes with the purpose of bridging the digital divide and connectivity gaps in the broadband access markets.

- Satellite direct-to-device (D2D) services will be limited to emergency alerts and messaging in 2024, but the ecosystem will continue evolving at an extraordinary speed with Starlink starting to launch D2D satellites. AST and Lynk are also progressing their constellations while traditional actors, like Iridium and ViaSat/Inmarsat, are finding their way into the smartphone ecosystem. 2024 is a critical year for the future of the D2D segment with 3GPP’s Release18 expected to significantly expand satellite D2D capabilities. The voice and data capabilities will be crucial to unlocking the multi-billion dollar opportunity in this market.

- Video market size will continue to erode, reaching 5.3% in 2024, but it will remain the largest revenue contributor to the satcom market (around 30%) aggregating to USD4.56 billion in cumulative revenue.

The bottom line

In 2023, the satcom industry faced a dynamic landscape marked by consolidation, competition and challenges, including significant mergers, the rise of Starlink and setbacks with satellite failures. Despite economic and geopolitical hurdles, the sector demonstrated resilience achieving growth in capacity revenue.

In the satcom industry in 2023, the primary development was Starlink’s expansion of the industry sphere. But there will be more balance between non-GEO and GEO progression in 2024. Very high throughput satellites (VHTS), such as Jupiter-3 and Viasat-3, are instrumental to compete with the capacity influx from constellation players across bandwidth and pricing. NSR forecasts that with Jupiter-3 solution deployments in the Americas, Viasat-3 satellite launches and increased collaboration between GEO and non-GEO players will be positive for GEO revenue growth. Regional GEO high throughput satellites (HTS), such as Satria-1, will also play a key role in overall GEO market advancements. Aligning with downstream bandwidth, pricing, flexibility and technology requirements should be the top strategic imperative for industry stakeholders.

Looking ahead to 2024, the industry is poised for further transformations, with predictions pointing to increased consolidation, the integration of AI and the pivotal role of VHTS and HTS. Collaborative projects, bridging the digital divide and digital transformations will continue to drive demand and market expansion, emphasising the industry’s adaptability in the face of evolving challenges. Overall, in our Satellite capacity supply and demand, 20th edition report, we predict 7% revenue growth in 2024, aggregating USD15.32 billion in cumulative revenue.

Article (PDF)

DownloadAuthor