Operators need to provide better education and support to capture more of SMEs’ spend on IT solutions

Listen to or download the associated podcast

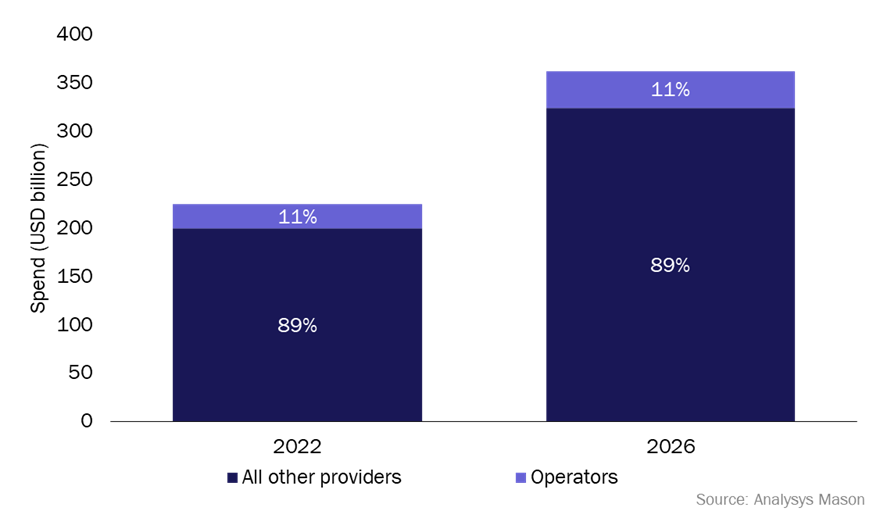

Small and medium-sized enterprises (SMEs) spent USD220 billion on operator-addressable IT products and services worldwide in 2022 and this figure is expected to increase to USD360 billion by 2026.1 However, operators are only capturing about 10% of that spend and this is not projected to increase during the forecast period unless operators change their approach (Figure 1). Operators will need to educate customers and invest in sales and support staff to make customers aware of the benefits, offer IT assessments, and provide a strong service and support wrap in order to win more of SMEs’ IT solutions business.

Figure 1: SME spending on IT solutions by provider type, worldwide, 2022 and 2026

Operators need to provide SMEs with better education and support to increase IT solutions sales

Operators are in a unique position in that they already have established relationships with SMEs and selling IT products and services to them should be a natural progression for operators.

However, SMEs often need a substantial amount of education and handholding during the buying process and post-purchase, and this has implications for how operators sell IT solutions to these smaller customers. Operators must be prepared to invest in educating their customers, in-house sales teams, call centre staff and on-site retail business consultants. Those operators with an indirect channel approach will also need to incentivise their channel partners.

Operators have adopted several strategies to sell more effectively into the SME market

Operators have adopted several different strategies to sell more effectively into the SME market.

- Direct sales via websites or digital marketplaces. These sales are hands-off, low-cost for the operator and allow SMEs to make direct purchases. However, it can be hard for SMEs to buy IT services without advice. This approach is most likely to succeed with simple IT services, such as basic endpoint protection or cloud storage/back-up, and with younger purchasers who are more open to buying online. Several operators are investing in developing marketplaces, including A1, Comcast and Starhub but there are no definitive success stories yet.

- Operators’ websites offer information on IT offerings with a click-through to in-house sales teams for information or to make a purchase. Online information and marketing materials can inform potential customers about new services. However, operators often need a salesperson, with IT expertise, to speak with the end customer, assess needs, provide education, then recommend a solution, before the sale can take place. The challenge is that operators’ sales teams may need training to make recommendations or an operator may need to add IT experts to their sales teams. Several operators, including Globe Telecom and Verizon have click-throughs to speak directly to a business expert. Other operators report significant demand from small businesses to interact directly in this way and to have an opportunity to negotiate on price before agreeing a purchase. This selling approach is suitable for complex IT products and services and may also appeal to older purchasers who may need more education and interaction.

- Operators sell IT services via business consultants located on-site within their retail stores. A few operators, such as BT and Vodafone, have business experts located in some retail stores. However, these salespeople are used to selling communications services, not IT services. So, operators may need to invest in training-up their business salespeople or have additional IT experts in stores. This approach will probably appeal to smaller SMEs that have traditionally taken consumer services and to older buyers who like the ‘touch and feel’ of ‘bricks-and-mortar’ stores.

- Operators rely heavily on the indirect channel/channel partners to sell IT solutions to SMEs. Operators taking this approach include Gamma and Vocus. A large channel partner ecosystem could potentially help operators to sell their IT products and services to end customers. Typically, IT products and services are limited via the channel, leaving partners space to add in their own solutions, but partners could also be incentivised to bundle an operator’s IT services with basic connectivity. IT solutions that are proprietary to the operator, or need scale to deliver cost-effectively, are most likely to be attractive to channel partners. This type of approach should appeal to more established and larger SMEs that already have strong relationships ties with existing partners.

Operators that can address SMEs’ pre- and post-sales needs will attain the valuable status of ‘trusted advisor’

Many operators adopt a mixture of the approaches outlined above to suit the needs of different customer types. However, some common issues need to be addressed in all cases. Where possible, businesses should have access to specialised staff for pre-sales and post-sales support.

It is costly to provide account managers for small businesses but access to a named person or team of specialists can have significant impact on customer satisfaction. For example, Proximus assigns SMEs with a “Business Expert” for added support and will make on-site visits to customers. In order to sell the more complex IT products and services to small businesses, operators should explain the benefits of the solutions, written in simple language and ideally tailored to vertical and size of business, as well as offer basic assessments of a customer’s business needs and IT capabilities.

Additionally, end customers will probably require extensive IT support and training. All this investment in training will have a significant impact on cost, but SMEs expect low prices. However, there is evidence that small businesses value customer care as highly as competitive pricing – 61% of SMEs ranked “customer care” as important compared to 62% of SMEs which ranked “price” as important.

1 Includes cloud, security and unified communications services but excludes equipment and professional services.

Article (PDF)

Download