Operators should focus on customers rather than technology when seeking to exploit edge computing

Operators typically present their plans for edge computing based on the location of the edge server, for example discussing plans for network or customer edge. Operators should instead talk (and think) about their plans for edge in terms of different groups of customers. They can then focus on the requirements of the specific group, and how best to match their edge offer with these needs, rather than starting with the technology and its capabilities. We suggest that operators use three categories: internal customers (using edge as part of an end-user proposition), business retail customers and wholesale customers.

This article is based on our report, Operator strategies for edge computing.

Operators need to understand what the edge computing opportunity will look like

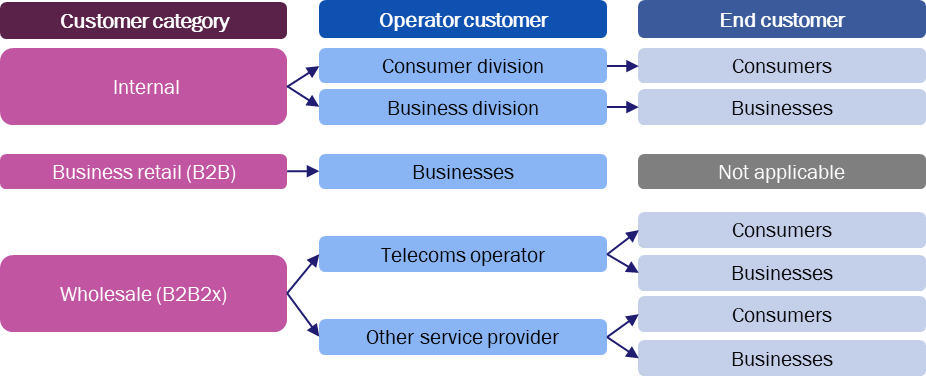

Figure 1 provides a simple view of operators’ edge opportunities by customer category.

Figure 1: Opportunities for operators to sell edge computing1

Source: Analysys Mason

More operators should consider the internal opportunity

Operators could use edge computing to support internal services, either for consumers or businesses. Operators such as Rakuten and SK Telecom are developing gaming and television products that use edge computing, but most operators are not targeting the consumer market with similarly ambitious services. We expect more operators to use edge computing to develop products that are offered by their business divisions. Colt, Lumen and others have talked about using edge locations to host SD-WAN gateways, and RingCentral, which has many operator partners, is exploring how edge locations could improve performance.

These internal opportunities to use network edge computing (sometimes called public or multi-tenant edge) could be exploited by both fixed and mobile operators.

Differentiation for the operator in these internal solutions will not come from the edge computing capability directly (because the customer may not even be aware that edge computing is part of the solution), but from the service itself – such as gaming or unified communications (UC) services that are ‘better’ than competing offers (in that they have more features or improved performance).

Internal customers could provide a valuable anchor tenant to support the business case for investing in edge locations. Operators that are building network edge capacity for business retail customers should also be exploring how internal customers could also include edge in their products.

Most operators are currently focusing on business retail opportunities

In the second opportunity, the operator provides edge capacity for business customers to use to support their own services. For example, a retailer could use edge computing in a checkout-free store or a distributor could deploy edge computing in a warehouse.

Most solutions in this category use customer edge (sometimes called on-premises, private or single tenant edge) computing, but these could be migrated to network edge compute over time.

Differentiation for the operator is likely to come not from edge computing as an isolated service but as part of an integrated solution in which private networks are a key complementary service, and other connectivity, security and cloud products also figure.

These opportunities are open to both fixed and mobile operators but are being pursued more aggressively by mobile operators as part of their 5G network strategies.

Fewer operators are discussing wholesale opportunities

Operators could sell capacity on a wholesale basis to other operators or service providers, and in many ways this is the simplest opportunity. For example, an operator in Europe could sell capacity to a US operator or to a different type of service provider, such as a gaming company or TV broadcaster.

Differentiation will largely come from the locations that are available rather than the technology because most operators will use technology developed by hyperscalers such as AWS and Azure that have other potential channels to market.

This opportunity is open to both fixed and mobile operators although Lumen, a fixed operator, has been more open in its plans in this area than others. For most mobile operators, this type of wholesale offer will be largely new territory. Most are not accustomed to selling services to wholesale customers, aside from a small number of MVNO deals. Fixed operators have more of a track record in these types of wholesale solution, which may in part explain why Lumen has been an early mover.

The wholesale opportunity will probably be a question of scale – can the operator invest in locations more quickly than competitors? Operators, including Lumen, Verizon and others, invested and then withdrew from data centres when it became apparent that public cloud providers were far more willing to invest in infrastructure. For the wholesale market, operators will need to invest in edge locations where public cloud providers are not going to invest, or jointly invest in locations with the public cloud providers. Operators in countries where the public cloud providers such as AWS and Azure are not present may be in a stronger position than those in countries where the public cloud providers already have data centres.

Operators should explore different ways of exploiting investments in edge computing

The opportunities that an operator decides to address with its edge computing proposition will, to a significant extent, depend on its approach in other areas. For example, only operators with ambitious plans for consumer services will pursue the internal opportunity for consumer services. Business-focused operators will be interested in both internal business opportunities and the business retail proposition. Operators with an existing wholesale base are most likely to pursue the third opportunity.

However, any investment in network edge capacity is into a resource that can be shared by different types of customer. For example, operators that are building network edge compute capabilities should also consider how they can address wholesale opportunities, and other internal use cases could also be explored. Most operators have so far focused on the technology and the location of the edge server. More attention should be on the potential customers, how investment in the technology can meet their needs and how the service can be differentiated from the edge offers of competitors.

1 For an operator that has invested in its own edge computing capacity, either alone or with partners. Other opportunities, such as the rental of real estate, are also available to operators but not captured here.

Article (PDF)

DownloadAuthor