There is a clear divergence in operators’ digital services strategies in different regions

Operators in Asia and Africa are investing more actively in the digital economy than those in Europe and North America. Large ecosystem plays are also more commonplace. Operators should reflect on why this is because it is likely to affect the investment opportunities that are available to them. In this article, we share some findings from our Digital economy initiatives tracker, give some reasons for regional differences and offer a detailed view of the ecosystem play of a specific operator in Asia (Globe Telecom).

Operators in Asia and Africa participate more actively in the digital economy than those in Europe and North America

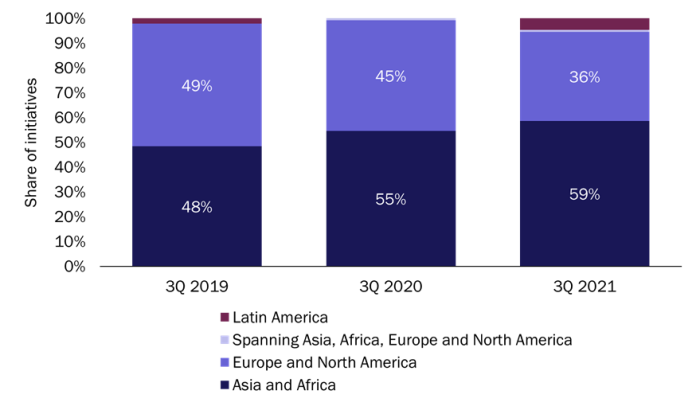

Our Digital economy initiatives tracker clearly shows that operators in Asia and Africa are more active in the digital economy than those in Europe and the North America. Indeed, only 36% of the live initiatives included in our tracker in 3Q 2021 were in Europe and North America, compared to 59% in Asia and Africa. Moreover, the share of active digital economy initiatives from operators in Asia and Africa has increased over time (Figure 1).

Figure 1: Share of digital economy initiatives by region, worldwide, 3Q 2019–3Q 2021

Source: Analysys Mason, 2021

Some of the reasons for this difference are as follows.

- Operators are more important tech innovation hubs and funding sources in Asia and Africa than in Europe and North America. Tech innovation hubs that exist independently of operators (such as Silicon Valley) are less well-established in Asia and Africa than in Europe and North America. Furthermore, funding sources for digital economy ventures are more limited, and telecoms operators constitute a key funding channel. For example, Kickstart Ventures, a corporate venture capital arm of Globe Telecom in the Philippines with USD240 million of assets under management (AUM) and a preference for Philippine start-ups, is the largest corporate venture capital firm in the country. Operators in Asia–Pacific in particular also often belong to conglomerates (for example, SoftBank in Japan, Reliance Industries in India and SK Telecom in South Korea); this offers rich opportunities for testing and launching digital economy initiatives due to the potential to draw on diverse conglomerate assets.

- Many operators in Europe and North America have had bad experiences in the digital economy in the past, largely due to the dominance of tech players in key verticals. Our tracker clearly shows that a disproportionate amount of failed digital economy initiatives by operators have occurred in Europe and North America, thereby discouraging further forays into the digital economy space there. Indeed, 74% of the terminated operator initiatives in our tracker were based in Europe and North America. This is largely due to difficulties in competing with Amazon, Apple, Facebook and Google, whose primary markets are in Europe and North America and who have pioneered some digital economy verticals (such as digital advertising) and made inroads into others (such as mobile financial services).

- The revenue growth prospects for digital services are higher in Asia and Africa than in Europe and North America. As such, operators are more incentivised to invest in the digital economy in Asia and Africa. This trend is partly due to higher GDP growth, but there are other reasons. Many countries in Asia and Africa have less-restrictive regulations in terms of data handling and mobile banking; this is critical for digital advertising, digital healthcare and mobile financial services. Furthermore, cash is generally the traditional form of payment in Asia–Pacific and Africa, so the marginal benefit of mobile wallets is greater than in Europe and North America, where card payments are the norm.

Operator digital economy ecosystem plays are common in Asia and Africa, but are rare in Europe and North America

Globe Telecom (Globe) in the Philippines provides a good example of an ecosystem play by an Asian operator and it gives a sense of the range of possible tie-ups between service areas (Figure 2). Note also that Globe is aiming to achieve double-unicorn status with one of its investments; billion-dollar valuations are a key driver of many digital economy investment decisions in Asia and Africa, as is the idea that digital economy investments can help operators to become digital lifestyle companies.

Figure 2: Globe Telecom’s digital services strategy, Philippines

| Services (verticals targeted) | GCash, ECPay, PureGo and Rush (mobile financial services), AdSpark (digital advertising) and KonsultaMD and HealthNow (digital healthcare). |

| How does the operator invest in these services? | All except ECPay are portfolio companies of Globe’s corporate venture builder 917Ventures, though some of these (such as GCash) are part-owned by external investors. ECPay is 77%-owned by Globe Telecom. |

| Synergies targeted | Synergies with the core business:

|

| Aims |

|

Source: Analysys Mason, 2021

The investment approach is very different in Europe and North America, where operators are generally selective about the verticals that they target. A consequence of this lack of digital economy portfolio diversification is greater investment risk and a tendency for operators to double down or walk away when challenged. For example, Orange in Europe, whose main digital economy service focus (Orange Bank) continues to be loss-making after 4 years, has chosen to increase the bank’s capital by EUR230 million (USD267 million) and buy out its partner Groupama’s 21.7% stake in order to accelerate its development and improve its chances of reaching its 2023 breakeven target. On the other hand, US operators in the digital advertising space have generally struggled to compete with Google and Facebook, and most (namely AT&T, Verizon and Altice) have explored exit options in the last few years. However, it could also be argued that more focused portfolios enable operators to put more attention and resources into their offerings.

Being mindful of how digital economy investment conditions vary by region can give operators a better sense of how to invest. Operators in Europe and North America should therefore generally focus on specific verticals rather than taking the ecosystem approach of their counterparts in Asia and Africa.

Article (PDF)

Download