Samsung’s entry into the cloud-gaming market may be part of a wider trend that increases QoE demands

Samsung announced at its October 2023 Developer Conference that its mobile-centric, cloud-gaming service will be launched worldwide in 1Q 2024. The service primarily targets casual gamers and aims to increase ad engagement for its audience of around one billion Samsung Galaxy handsets. Cloud gamers place greater performance demands upon, and have higher expectations of, connectivity services. As cloud-gaming take-up increases, operators will need to ensure that their services can support the quality of experience (QoE) that consumers demand. While the connectivity requirements for Samsung’s service appear to be undemanding, the launch of this service may lead to a wider cascade of demand for cloud gaming that eventually does require a change in connectivity performance.

Samsung is aiming to engage over 200 million casual gamers that use its handsets today

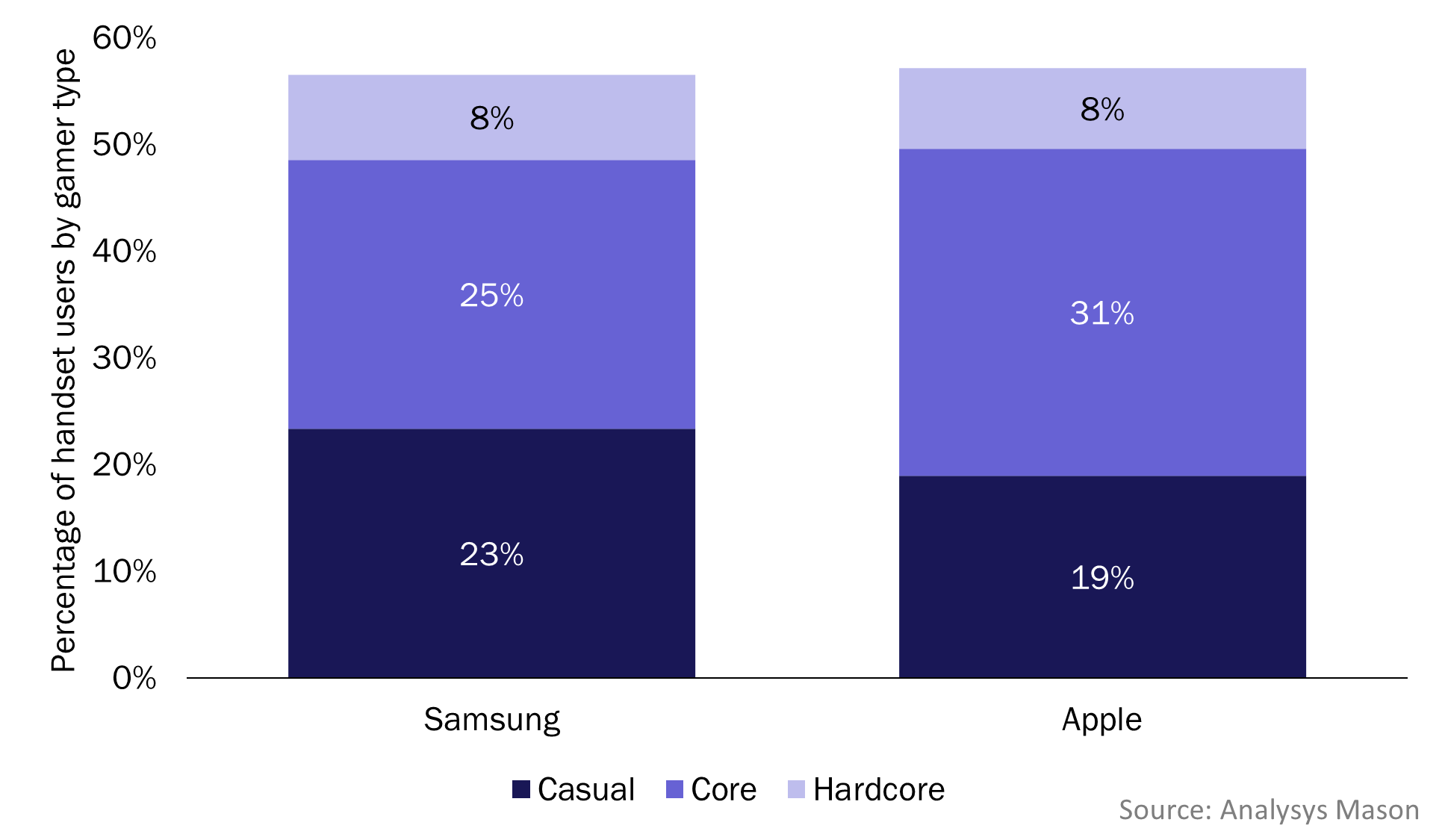

Samsung’s announcement is part of a resurgence of companies trying to engage casual gamers with cloud gaming (for example, Netflix is targeting this same group of gamers on the TV set with their new proposition). Samsung wants to leverage its huge base of Galaxy handset users, which it claims to be around 1 billion worldwide. Analysys Mason’s 3Q 2023 worldwide consumer survey data shows that 57% of Galaxy owners are gamers and of these, 23 percentage points are casual gamers (see Figure 1). This means that Samsung has a potential audience of about 230 million casual gamers.

Figure 1: Split of Samsung and Apple handset users by gaming category, worldwide, 3Q 2023

We segment gamers into four categories: non-gamers (not shown above), casual gamers (who usually do not pay for games) and core and hardcore gamers who pay for some or all of the games that they play. Our data shows that Samsung has a lower share of paying gamers than Apple, which could reflect the different spending habits of their users.

Part of the issue with monetising casual gamers is the cost barrier to entry. Jong Hyuk Woo, vice president and head of gaming services at Samsung Electronics, recently told VentureBeat that “not everyone has a USD400 to buy a console or a USD1000 gaming PC. He added that cloud gaming “is a way to bring that content to the masses who don’t have that access. But on mobile, it’s a little different. Everyone has a gaming device in their pockets.”

The cost of deploying cloud-gaming services is falling, which allows Samsung to address a different market to Microsoft and Sony

Samsung is aiming to improve ad conversion for gaming: the pipeline between consumers seeing adverts for games and actually playing them has previously required multiple steps, steps which Samsung is aiming to reduce. Woo explained to VentureBeat that “90% of the people who have expressed interest in a game publisher’s content, via an ad, don’t actually ever get into the game.” He added that “we believe that cloud streaming can do something for mobile game publishers by completely collapsing that user acquisition funnel, getting rid of the download and installing and the visit to the App Store. It can dramatically reduce that, that funnel and the inefficiencies within that model. And so game publishers are going to see a significant increase in the number of users who are coming into their games.”

The cost of deploying cloud-gaming services is falling over time as compute and rendering prices in the cloud decrease and as the paradigm shifts, for some players at least, from offering top-end PC and console games that have greater processing demands (the kind played by core and hardcore gamers) to the kind of games that casual gamers are used to playing (the area where Netflix and Samsung appear to be most focused). These falling costs make it more-commercially viable for providers to offer cloud-gaming services for free, or bundled with another service, rather than as a high-priced subscription service. Woo told the developers at Samsung’s conference that “we support, and are optimised for, free-to-play games. That means that we are not charging users a subscription or any kind of upfront payment to get access to your content. You can almost think about it as this Android environment virtualising the App Store function in the cloud.”

Aside from free-to-play models, our consumer survey indicates that gamers are increasingly interested in subscription models. It is likely that cloud-gaming services based on these models, such as the cloud-gaming services included in Xbox Games Pass Ultimate and PlayStation Plus Premium will continue to grow in popularity and engagement with core and hardcore gamers. In the meantime, Netflix, Samsung and others will chip away at their multi-million casual gaming user base, increasing engagement with their respective device and service ecosystems.

As cloud-gaming take-up grows, operators will need to ensure that their services are able to support the QoE that consumers demand

As we outlined in our recent article about Netflix’s foray into cloud gaming, telecoms operators are likely to find themselves drawn into supporting cloud-gaming services such as those offered by Netflix and Samsung indirectly. In addition, if these services help to increase engagement with cloud gaming among casual gamers, then it could potentially have a cascade effect, amplifying engagement with affordable cloud-gaming services such as Prime Gaming from Amazon’s Luna platform, or premium services from other providers such as Microsoft.

Reliable home Wi-Fi and/or cellular connectivity in the places where such games might be played is essential for cloud gaming. At the developer conference, Woo stated that 4G, 5G and Wi-Fi connections can adequately support their cloud-gaming experience, citing latencies of between 40ms on Wi-Fi and 55ms on 5G. While such latencies are potentially adequate, they still underdeliver, given the level that many gamers demand for higher-performance games.

If such services stimulate the demand for more bandwidth-hungry gaming opportunities then there may be further opportunity to monetise connectivity: our 2022 survey of consumers found that existing cloud gamers are willing to pay extra for their connectivity, with their fixed broadband spend averaging 14% (USD6) higher than the market average, and their mobile spend averaging 38% (USD13) higher. Retail tariffs that target gamers by offering zero-rated data for gaming could logically further extend operators’ existing retail partnership with Samsung to sell handsets.

1 For more information, see Analysys Mason’s consumer survey, conducted in 3Q 2023; n = 19 000.

2 VentureBeat (17 August 2023), Samsung Game Launcher lets you play mobile games over cloud without downloads.

3 We will be updating this, and other survey reports, with our latest 2023 results.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Forecast report

France: pay-TV and streaming video forecast 2024–2030

Forecast report

New Zealand: pay-TV and streaming video forecast 2024–2030