SD-WAN retail revenue will double by 2025, but service providers should bundle more than just connectivity

29 September 2021 | Research

Article | PDF (3 pages) | SME Services| Enterprise Services

SD-WAN retail revenue worldwide is forecast to double between 2021 and 2025. Many providers have gained market share in recent years by offering managed solutions that bundle SD-WAN with the underlying connectivity. However, they should also consider providing packaged solutions that bundle SD-WAN with the key cloud and communications services that it supports.

This article draws on our SD-WAN worldwide forecast 2020–2025 and highlights the trends in the SD-WAN market and discusses their implications for market players.

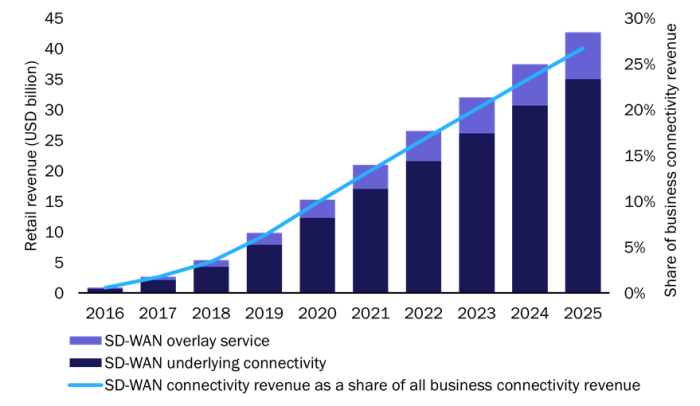

Underlying connectivity will account for the majority of retail revenue from SD-WAN services

SD-WAN software and connectivity revenue will grow from USD21 billion in 2021 to USD43 billion in 2025. Many service providers, especially telecoms operators, bundle the underlying connectivity needed for SD-WAN with overlay SD-WAN services. Both the software and the connectivity services are expected to deliver strong double-digit annual revenue growth. However, it is the underlying connectivity associated with SD-WAN that will account for the majority of revenue from businesses; we expect that this will account for over 25% of all business connectivity revenue by 2025 (see Figure 1).1

Figure 1: Revenue from SD-WAN overlay services and connectivity plus the share of business connectivity revenue generated by SD-WAN connectivity, worldwide, 2016–2025

Source: Analysys Mason, 2021

SD-WAN adoption is being driven primarily by a desire from many businesses to improve the performance of their cloud-based services. It has also been fuelled in some regions by the cost savings that are possible by migrating from MPLS connections to internet-based connectivity supported by SD-WAN. Initial deployments focused on customised solutions for large enterprises, which in some cases have grown to include tens of thousands of branches. However, lower-cost, standardised SD-WAN services are now more widely available, thereby driving rapid take-up growth among smaller businesses.

Supplying SD-WAN bundled with on-net connectivity services can help network operators to increase their customer value, improve their customer satisfaction and retention and defend against revenue loss. Many operators also provide off-net SD-WAN services (provisioned using wholesale access circuits from third parties) to extend their market reach. Some non-operator SD-WAN providers (including managed service providers (MSPs), systems integrators (SIs) and vendors (such as Aryaka)) also offer their customers managed third-party connectivity.

The provision of connectivity bundled with the SD-WAN overlay service is attractive for businesses that prefer to deal with a single supplier. For suppliers, it mitigates against problems with the underlay network and enables robust SLAs.

SD-WAN is a support service; its standalone value to businesses is limited

SD-WAN is valuable to businesses because it improves the performance of key cloud and communication services. Its value as a standalone service is limited. Service providers should therefore not only consider bundling it with connectivity, but they should also think about bundling it with other enabling services (such as security) and the applications that it supports (such as unified communications). This will result in a complete package of services that offers clear business benefits to their customers.

- Most vendors and service providers already integrate security with SD-WAN. Businesses not only want enhanced application performance from SD-WAN, they also want to enable services to be accessed securely from their offices and branch sites and by remote workers. To meet this demand, many SD-WAN vendors now provide security features such as firewalls, DNS security2 and CASB3 integrated with the dynamic routing capabilities of SD-WAN. Similarly, many security vendors such as Fortinet and Palo Alto Networks have extended their capabilities to deliver integrated SD-WAN services.

- Unified communications are a good example of an application that benefits from being bundled with SD-WAN. It is a widely used, business-critical service that requires low latency and its performance can be enhanced considerably by SD-WAN. There are many examples of collaborations between SD-WAN vendors and unified communications vendors. For example, Aryaka partners with 8x8 and RingCentral has 12 certified SD-WAN partners. Many other cloud applications and services also benefit from SD-WAN and we expect to see more integrated offerings emerging in the future.

There are several benefits for businesses associated with buying bundled services. They enable more-robust and enforceable SLAs based on end-user outcomes, they can help to reduce provisioning time, they provide a single point of contact for resolving problems and they can reduce the cost of procurement and management. Many businesses report a desire to reduce their number of suppliers and are open to purchasing a broader range of services from their connectivity provider.4

There are also benefits for service providers from supplying bundled services. These include an increased share of wallet, the potential to improve customer satisfaction and reduce churn, more opportunities to differentiate services and defence against competition from players in adjacent markets.

Providers should position their SD-WAN offers within a broad portfolio of other services

The rate of SD-WAN revenue growth may tempt some providers to think that a focus on SD-WAN bundled with connectivity alone is sufficient to deliver strong returns. However, the market is highly competitive and businesses are increasingly looking for providers that can support their broader business goals.

The penetration of SD-WAN will be very high in many regions by 2025 (we estimate that SD-WAN will be used at two thirds of businesses sites owned by large enterprises in North America) and growth rates may begin to slow. Operators and other service providers should therefore position their SD-WAN services within a broad portfolio of cloud and unified communications, security, remote access and LAN services. We believe that this will provide the best opportunity to deliver sustainable revenue growth in the long term.

1 Our SD-WAN worldwide forecast 2020–2025 and associated data annex provide forecasts for SD-WAN site adoption and service revenue by business size for eight separate regions worldwide.

2 Domain name system (DNS) security maintains the overall integrity and availability of DNS services (translating hostnames into IP addresses) and monitors DNS activity for signs of security issues elsewhere in the network.

3 A cloud access security broker (CASB) helps to extend security beyond users and organisations to their cloud-based services.

4 This is true even for very large enterprises. For more information, see Analysys Mason’s Large enterprises’ demand for communications and IT services: survey results 2021.

Article (PDF)

DownloadAuthor