Operators need to address customer misconceptions to position themselves in the underserved SOHO market

Many small office/home office (SOHO) businesses rely on consumer-grade communications and IT services but could benefit from upgrading to business-grade services. For operators, this is likely to generate additional revenue and offer more opportunities to upsell value-added services, but selling business services to SOHOs is far from straightforward. One of the crucial steps to achieving this is to address the misconceptions that many SOHOs have about whether they really need business-grade services and whether operators are interested in meeting this need for them.

Several operators are attempting to do this, and their experiences could offer useful lessons that all operators could learn from, such as developing marketing collateral that is more targeted and offering consumer-style benefits with small-business products.

This article draws on findings from our recent case studies report, which examines how 10 different operators are approaching the SOHO market.

Operators need to educate SOHOs on the benefits of business solutions

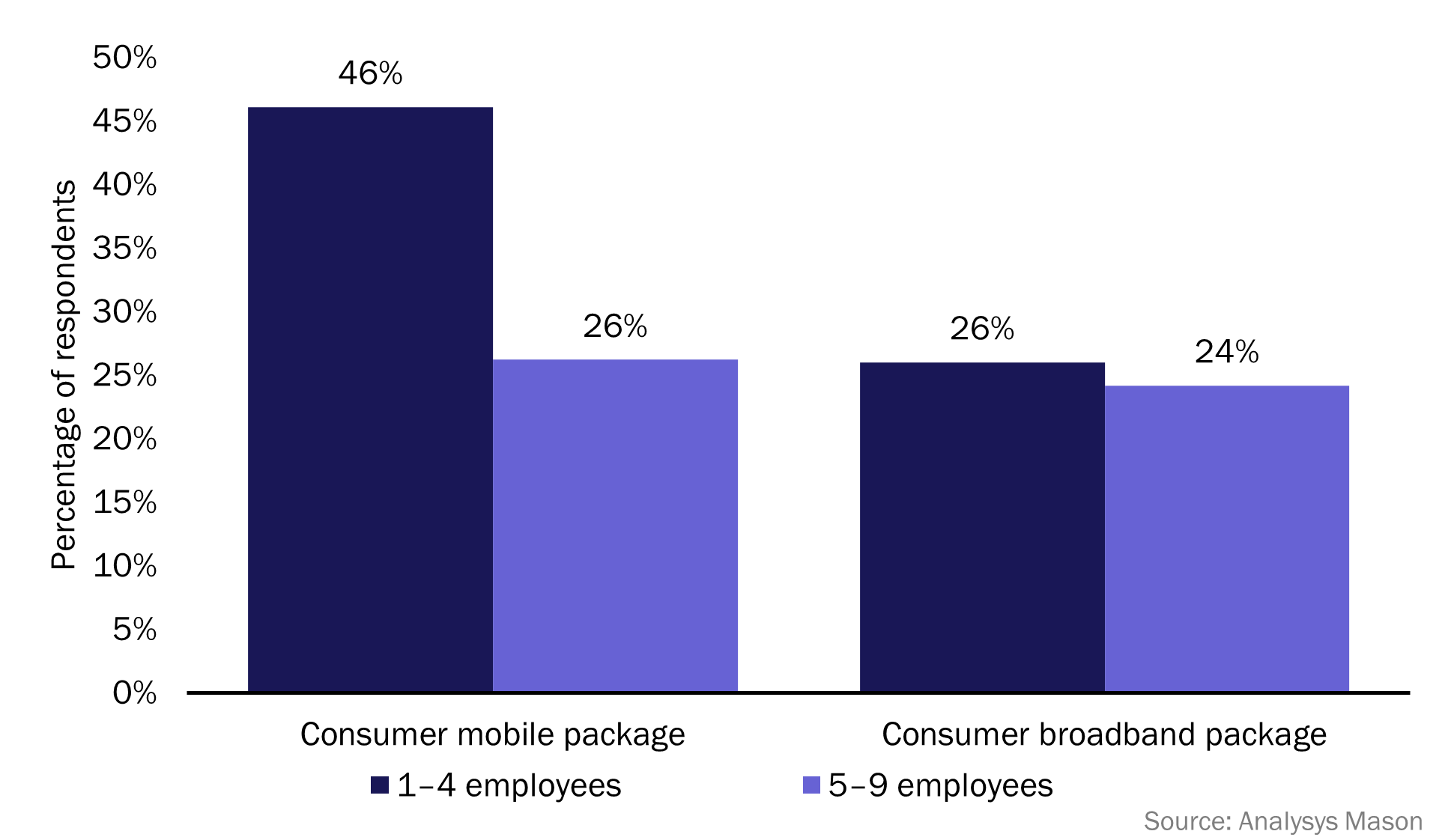

Very small businesses (with up to four employees) represent more than half of all businesses worldwide, and numbers are growing at an average CAGR of 2%. Our surveys indicate that in high-income markets, almost half of these very small businesses rely on consumer-grade mobile packages, and a quarter rely on consumer-grade broadband packages (Figure 1). This share tends to be even higher in middle-income markets, indicating a significant opportunity to upsell higher-value business services.

Figure 1: Percentage of very small businesses taking consumer packages, by business size, Germany, Singapore, UK and USA, 20211

Many SOHOs believe that business solutions are too expensive for their needs and offer little in terms of added benefits compared to consumer solutions. Operators have employed various tactics to address this misconception and several are reporting some success in upselling higher-value business propositions to SOHOs as a result.

These tactics include the following.

- Use of marketing collateral that is targeted explicitly at very small businesses. Some operators have created easy-to-understand explanations of how business-grade solutions can support a SOHO’s requirements. Telefónica Brazil for example has created a series of vertical-specific marketing brochures, written in simple language, that demonstrate typical business issues and how the operator’s business solutions can help to solve those problems. The operator reports that these brochures are resonating well with SOHOs.

- Supporting SOHO services with business-class service and support. Almost all operators offer enhanced service and support with their business propositions, including dedicated business helplines and faster turnaround times for repairs or installation services than for the equivalent consumer proposition. Some operators go further and also offer individual IT support, either bundled with the core proposition or offered as a value-added service. For example, Telefónica Spain has an ‘Access to Your Technology Expert service’, which provides support for breakdowns, maintenance and provisioning and comes free with particular business plans. Elisa charges a subscription fee for its corporate GURU service, which is an ‘IT specialist as-a-service’ product that provides technical help face to face or via a helpdesk or online meetings.

- Offering benefits with clear appeal for SOHOs. This might include preferential deals and discounts on relevant third-party services such as accounting software or web marketing services. It might also include access to benefits that are more commonly associated with consumer services, such as music or video streaming. Purchase decisions for SOHOs are often influenced not only by the benefits to their business but by the benefits to their personal lives as well.

Operators also need to convince SOHOs that they are valued as customers

Many SOHOs are concerned about whether operators see them as valued customers, or are interested only in serving higher-value, larger businesses. Again, operators have several tactics available to them to address this misconception.

- Providing tailored sales channels. Many operators serve SOHOs through their existing sales channels; either those that they use to serve consumers or those that they use to serve small and medium-sized enterprises (SMEs). However, some have a dedicated part of their website for very small businesses, which helps to position operators as being relevant to, and concerned about, SOHOs. Examples include Orange France’s ‘Orange Pro’ web pages which include propositions for start-ups and the self-employed segment, and Telefónica Brazil’s ‘Start-Up’ web pages. Some operators also employ dedicated small business specialists in their retail stores. This is a costly investment and may not be a suitable strategy for all operators, but some, such as Verizon, regard it as being a key differentiator in the small business segment.

- Providing a degree of personal service. SOHO customers are typically low value and most operators aim to serve them primarily through low-cost digital channels. However, small businesses often choose suppliers that are local or with whom they enjoy a strong relationship. Elisa has attempted to tap into this by providing a named contact for all its business customers; this may be linked to the growth that it reports in upselling IT solutions to SOHOs and other small businesses.

- Investing in helping SOHOs to improve their digital skills. Most SOHOs have limited IT skills and operators have an opportunity to position themselves as valued partners by providing advice, support and training. Several operators including BT (via its Small Business Support Scheme) and Vodafone (via its V-Hub) provide access to information about taking businesses online, deploying e-commerce, or learning about cybersecurity threats. Some also include access to phone-based, personalised support from advisers.

Operators that address these issues effectively have an opportunity to succeed in the relatively underserved SOHO market

Addressing these misconceptions is foundational to operators developing a strong brand in the SOHO market, becoming preferred suppliers, and upgrading SOHOs to business-grade services. Competition in the SME market has increased over the last couple of years as many operators look to sell cloud-based value-added services (previously the preserve of enterprise customers) to a wider base. However, the SOHO end of the market remains relatively underserved – as indicated by the large share of very small businesses that currently rely on consumer services. We believe there are substantial opportunities for operators with an appetite to meet demand from this segment.

1 Question: “What type of mobile package do you purchase?”; n = 689. Question: “What type of fixed data connections does your company purchase (e.g., fixed broadband, leased lines or dedicated internet access)?”; n = 870.

Article (PDF)

DownloadAuthor