Hyperscaler and VMware sovereign cloud solutions indicate that local partnerships are key to the offering

Listen to or download the associated podcast

Demand for public cloud solutions continues to grow rapidly because of the economic and scalability benefits that they offer to businesses. However, an increase in regulations related to data sovereignty could constrain the use of public cloud. This has led to a growing market for public cloud solutions with sovereignty controls.

Operators are well-placed to meet these demands, especially in their local markets where global hyperscalers may find it difficult to meet some local data sovereignty requirements. Some operators are partnering with public cloud providers (PCPs) to deliver public cloud solutions with sovereign controls, while an increasing number of operators are partnering with VMware for sovereign cloud solutions. These represent an opportunity for operators to play a larger role in the cloud market than they traditionally have with their standard cloud offerings.

There is a gap in the market for a public cloud with controls and assurances around data sovereignty

Demand for public cloud solutions (SaaS and IaaS/PaaS) has been strong in the past 5 years with retail revenue growing at a CAGR of 17% between 2017 and 2022. Analysys Mason expects this growth to continue at a CAGR of 12% until 2027.1 Much of this demand is served by three main hyperscalers: Amazon Web Services (AWS), Google Cloud Platform (GCP) and Microsoft Azure, Amazon Web Services (AWS) and Google Cloud Platform (GCP). Indeed, almost 90% of all partnerships between PCPs and operators to deliver cloud compute services to operators’ business customers are with these hyperscalers. Operators account for just 6% of the revenue market share for public cloud services, with many businesses buying direct from hyperscalers or from other service providers.

However, concerns around data sovereignty are increasing around the world. This is leading to new regulation relating to where data is stored and who can access it, often meaning data and access to it has to remain in the country where it was created. These regulations primarily apply to government departments and well-regulated industries at the moment but may extend to the wider market in time. The new regulations have created a gap in the market for a public cloud with controls and assurances around data sovereignty.

VMware and hyperscalers offer digital sovereignty solutions, but local partnerships are essential

Two operators are developing sovereign cloud solutions in partnership with hyperscalers: T-Systems with Google Cloud, and Orange Business has established a joint venture with Capgemini to create Bleu, will work with Azure as a technology partner to offer Azure and Microsoft 365 solutions. T-Systems launched services with ‘sovereign controls’ in mid-2022, which meet requirements for data residency, access controls and local support. It has two more tiers in its roadmap, each with more controls, that it plans to launch by 2024. Orange Business’s joint venture, announced in May 2021, finally received approval from the European Commission in June 2023, and its first services are expected to launch in 2024. Both solutions are aimed at the public sector, but could expand to serve the private sector.

As an alternative to partnering with PCPs, operators and other service providers are partnering with VMware for its sovereign cloud solution. Operators are seeking VMware’s Sovereign Cloud designation and can achieve it by being VMware Cloud Verified and by offering sovereign cloud services that are aligned with VMware’s framework. The principles of this framework include data sovereignty and jurisdictional control, data access and integrity, data security and compliance, and data independence and mobility.

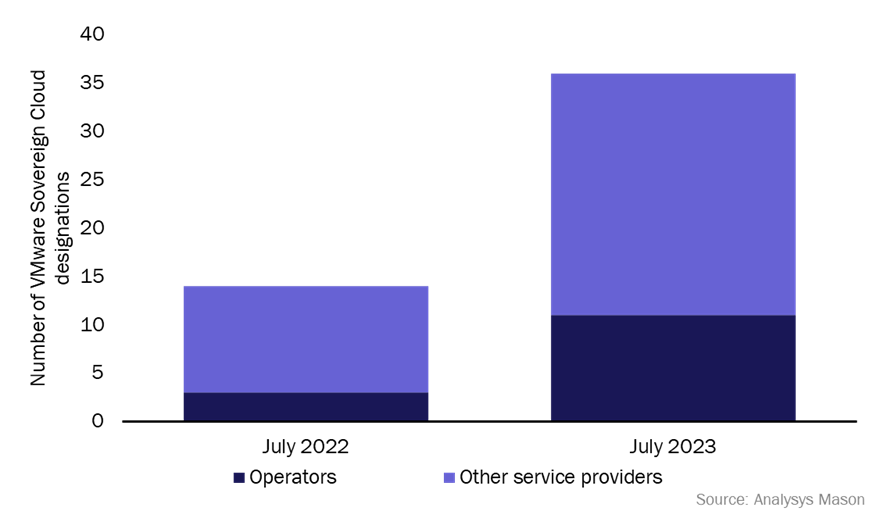

The number of service providers that have achieved this designation increased from 14 to 36 between July 2022 and July 2023, and the number of operators has increased from 3 to 11. This may indicate that operators and other service providers are expecting demand for public sovereign cloud services to grow.

Figure 1: VMware Sovereign Cloud designations, by service provider type, July 2022 and July 2023

The three main hyperscalers are also developing their own range of sovereign controls, which aim to provide similar solutions to their partnerships with operators.

- Microsoft’s Cloud for Sovereignty, which is still undergoing private previews, is aimed at giving public sector organisations greater control over their data and more operational transparency. Microsoft will work with in-country partners to tailor the solution for individual needs.

- GCP has sovereignty controls through its Assured Workloads for EU solution or through partnerships with local providers such as T-Systems and Thales.

- AWS announced its Digital Sovereignty Pledge in November 2022, but it appears less developed than the offerings from Google or Microsoft.

Hyperscalers will want to establish partnerships with local providers to deliver these solutions (yet to be fully released), which may help operators to play a bigger role and capture more revenue than they have done in the cloud market so far.

Operators have an opportunity to play a larger role in the sovereign cloud market than in other cloud services

The sovereign cloud market is still small and most cloud services that operators deliver are based on partnerships with PCPs. Indeed, we track 223 partnerships between operators and PCPs for cloud compute and cloud connectivity services but only 3 are for sovereign cloud. Providing these services, other than related professional services, tends to be low-margin and operators play a small part in the market. However, the sovereign cloud market is an opportunity for operators to play a larger role in the market because partnerships with local service providers appear to be crucial for the success of the offering.

Hyperscaler and VMware sovereign cloud solutions are both initially aimed at the public sector, but with expansion to regulated private sectors expected. Hyperscalers’ solutions will be in demand from businesses or public sector organisations that will want to access their SaaS solutions in a more secure way. Offerings where the hyperscaler is less-involved such as with Orange Business’s Bleu or T-Systems’ highest tier offering will also have a place in the market for the most regulated government departments or industries. VMware’s offering will also be a viable option for users that may want more flexibility, but the demand is less clear for this solution.

1 For more information, see Analysys Mason’s Operator business services for SMEs: worldwide forecast and Operator business services for large enterprises: worldwide forecast.

Article (PDF)

DownloadAuthor